|

|

Recent Articles

-

Phillips 66: A Huge Winner in 2022

Phillips 66: A Huge Winner in 2022

Nov 1, 2022

-

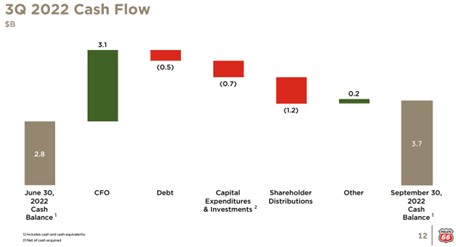

Image Source: Phillips 66.

Shares of Phillips 66 have soared more than 40% this year, and we believe there is still upside on the basis of the high end of our fair value estimate range ($140 per share). The company’s equity has been mighty volatile this year, however, sporting a 52-week range of ~$67-$111, so investors should continue to expect large swings. Right now, things in the energy markets are favorable, and we see no reason to sour on PSX shares at the moment. The company yields ~3.7% at the time of this writing.

-

Enterprise Products Partners Reports Strong 3Q, Impressive ~7.5% Distribution Yield

Enterprise Products Partners Reports Strong 3Q, Impressive ~7.5% Distribution Yield

Nov 1, 2022

-

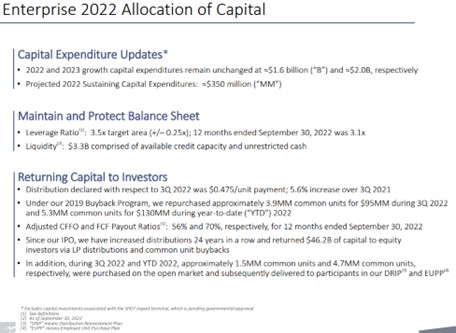

Image Source: Enterprise Products Partners.

The Alerian MLP ETF has faced considerable pressure during the past 10 years, generating a paltry annualized return, but shares of many constituents have improved during 2022 as energy resource prices have bounced back. Though we generally shy away from MLPs, more generally, Enterprise Products Partners is one of our favorites given the increased transparency it provides to investors when it comes to cash-flow metrics. Since its IPO, Enterprise Products Partners has raised its distribution 24 years in a row. Shares yield ~7.5% at this time.

-

Newmont Reports Challenging 3Q, But the Stock Is a Key Diversifier in the Dividend Growth Newsletter Portfolio

Newmont Reports Challenging 3Q, But the Stock Is a Key Diversifier in the Dividend Growth Newsletter Portfolio

Nov 1, 2022

-

Image Source: Newmont Mining.

Newmont’s performance in the third quarter of 2022 is not what we would be looking for in one of our best ideas. We prefer strong free cash flow generators and those with hefty net cash positions, but as one of the rare ideas in the metals and mining arena in the Dividend Growth Newsletter portfolio, we’re not rushing to remove it. Newmont boasts a solid investment-grade credit rating, and while the near term has been tough for shares, it offers a unique dividend policy that embraces a base annualized dividend of $1.00 per share, payable at $1,200/oz gold price, with an incremental dividend payment targeting 40%-60% of incremental attributable free cash flow above the base gold price assumption. Newmont’s free cash flow generation and dividend payment are heavily tied to the price of gold, and while costs have increased at the mining giant in this inflationary environment, the company remains one of the best dividend plays to gain exposure to potentially rising gold prices in an inflationary environment, in our view. We continue to like its diversification benefits in the simulated Dividend Growth Newsletter portfolio.

-

Recent Fair Value Estimate Changes

Recent Fair Value Estimate Changes

Oct 30, 2022

-

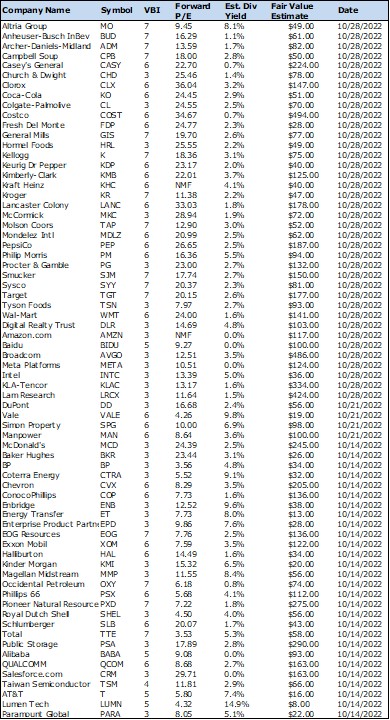

Let's have a look at recent fair value estimate changes across our coverage universe.

|