|

|

Recent Articles

-

Dividend Increases/Decreases for the Week of November 18

Dividend Increases/Decreases for the Week of November 18

Nov 18, 2022

-

Let's take a look at firms raising/lowering their dividends this week.

-

Cisco Raises Fiscal 2023 Guidance But Orders Face Difficult Comps

Cisco Raises Fiscal 2023 Guidance But Orders Face Difficult Comps

Nov 17, 2022

-

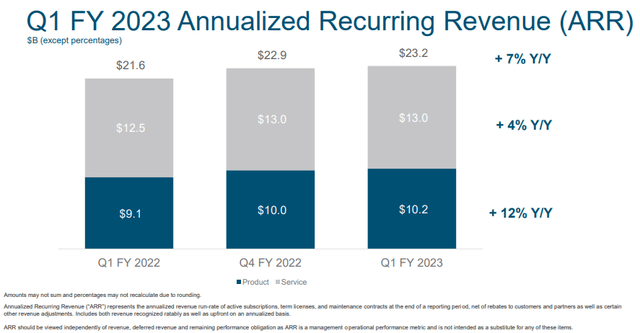

Image: Cisco’s annualized recurring revenue (ARR) continues to advance nicely. Image Source: Cisco.

Cisco’s first-quarter results for fiscal 2023, released November 16, were solid, and the firm’s pace of annualized recurring revenue continues to advance nicely, giving it nice visibility into future performance. The networking giant raised its guidance for fiscal 2023 for both the top- and bottom-lines, though we note that product orders did fall meaningfully in the quarter on a year-over-year basis (but this was largely due to a tough comparison from last year's period). Its free cash flow generation was solid in the quarter, and we continue to like the company’s net cash position. Cisco continues to buy back its own undervalued stock and yields an attractive ~3.4% at this time.

-

Efficacy of the Dividend Cushion Ratio

Efficacy of the Dividend Cushion Ratio

Nov 16, 2022

-

The Dividend Cushion ratio is one of the most powerful financial tools an income or dividend growth investor can use in conjunction with qualitative dividend analysis. The ratio is one-of-a-kind in that it is both free-cash-flow based and forward looking. Since its creation in 2012, the Dividend Cushion ratio has forewarned readers of approximately 50 dividend cuts. We estimate its efficacy at ~90%.

-

Home Depot Says Customers Remain “Resilient and Engaged”

Home Depot Says Customers Remain “Resilient and Engaged”

Nov 16, 2022

-

Image: Home Depot's third-quarter performance wasn't bad. Inventories expanded, but management reiterated that its core customer remains resilient and engaged. Image Source: Home Depot.

Home Depot’s third-quarter report was solid, all things considered. The firm offset weaker transactions with a higher average ticket to driven solid comp performance. Management noted that its core customer remains resilient, and while inventories have ballooned on a year-over-year basis, we’re less concerned about the inventory build as most of Home Depot’s inventory is of the non-perishable variety. We like the firm as an idea in the simulated Dividend Growth Newsletter portfolio, though we continue to pay attention to the health of its balance sheet, which includes a considerable net debt position.

|