|

|

Recent Articles

-

Walmart Is Back on Track; Markets Looking Healthier

Walmart Is Back on Track; Markets Looking Healthier

Nov 15, 2022

-

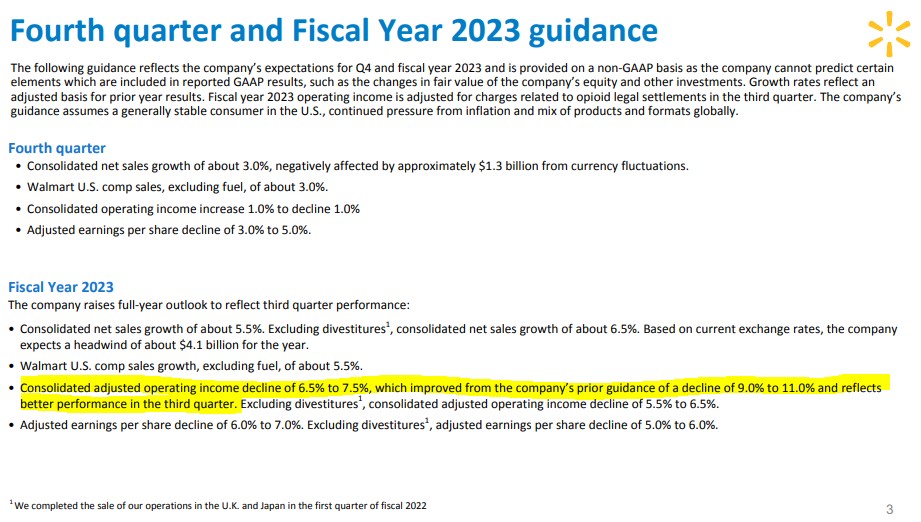

Image: Walmart’s operating income performance, while still under pressure, improved considerably during the third quarter. Image Source: Walmart.

Walmart Inc. was the canary in the coal mine earlier this year when the company reported its first-quarter 2022 results in May that showed spending on food staples and energy (gas) was cutting into discretionary general merchandise (hardline) spending. However, market sentiment seems to be improving these days, and the firm’s third-quarter results released November 15 showed the huge big box retailer is getting back on track. Though we’re not going to be adding Walmart to any newsletter portfolio, we like what we saw in the quarterly report.

-

ASML Launches Big Buyback; Lithography Systems Well Positioned for Demand Growth

ASML Launches Big Buyback; Lithography Systems Well Positioned for Demand Growth

Nov 13, 2022

-

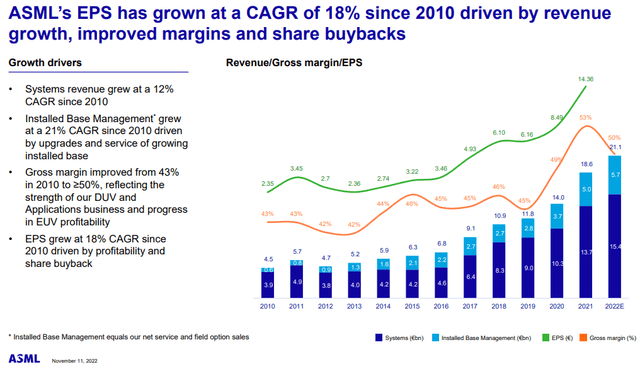

Image: ASML has been one of the most successful semiconductor companies thanks in part to the firm’s advanced lithography systems that continue to meet customer demands for size and cost efficiencies. Image Source: ASML.

We think ASML Holding is in a sweet spot in the semiconductor space as its lithography systems position the industry well along the path of Moore’s Law. Strong past investments have given it a leadership position, and we expect ASML to capture a significant amount of its addressable market from smartphones to personal computing and beyond, all the while it pays a dividend and buys back stock along the way. A continued focus on research & development and capital spending, while maintaining a strong and flexible balance sheet should be expected. The firm’s recent Investor Day was a positive catalyst for shares and eased the worst of the concerns regarding the intermediate-term impact of Sino-American tensions on the semiconductor space. We continue to like shares of ASML Holding.

-

Dividend Increases/Decreases for the Week of November 11

Dividend Increases/Decreases for the Week of November 11

Nov 11, 2022

-

Let's take a look at firms raising/lowering their dividends this week.

-

Market Whipsaw: Crypto Collapse and a Lower-than-Expected Inflation Print

Market Whipsaw: Crypto Collapse and a Lower-than-Expected Inflation Print

Nov 10, 2022

-

Image: Uncertainty in the cryptocurrency markets has surged with concerns over the liquidity of a key exchange. Investors are weighing the spillover effects of crypto with the view that the pace of inflation may have peaked.

The U.S. equity market continues to be highly volatile as it whipsaws between concerns over the health and sustainability of cryptocurrency and optimism over lower-than-feared inflation readings. We maintain our bearish/defensive stance on equities, but at the same time, we continue to be “fully-invested” across the simulated newsletter portfolios in part because we don’t want to miss out on days like today, November 10, when the markets are soaring ~2.5%-5.5% depending on which index you are monitoring. We’re also not ruling out a Santa Claus rally through the end of the year. Merry Dow Jones, as they say!

|