Image: Deere put up excellent fiscal fourth-quarter results for the period ending October 30, 2022. The company’s pricing power is phenomenal. Image Source: Deere

By Brian Nelson, CFA

On November 23, Deere & Company (DE) reported results for its fourth quarter of fiscal 2022 for the period ending October 30, 2022. We pay close attention to Deere for insights across the industrial equipment and agricultural supply chain, and things are looking resilient, despite evident pressures across the consumer discretionary arena, as revealed by Target’s (TGT) holiday outlook. Shares of Deere have soared more than 26% year-to-date during 2022, and while we like the company, we think its equity price has run too far too fast. We like our existing ideas in the Dividend Growth Newsletter portfolio and High Yield Dividend Newsletter portfolio as Deere’s dividend yield of ~1% is a little light for our taste.

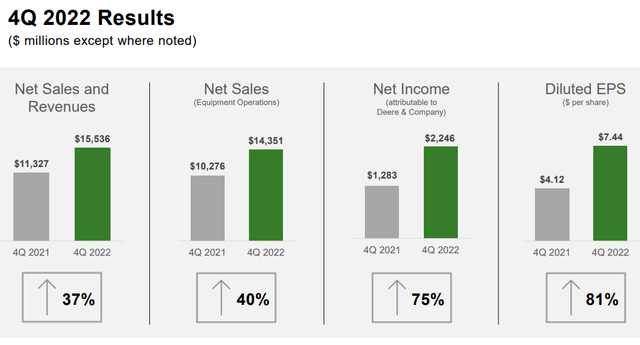

The industrial and agricultural equipment markets are highly cyclical, but things remain healthy for the likes of Caterpillar (CAT) and Deere (DE) at the moment. During the latter’s fiscal fourth-quarter report, worldwide revenue advanced an impressive 37% as the firm’s dealer network and higher factory production effectively overcame supply-chain issues that have been plaguing many sectors as a result of an overhang from the COVID-19 lockdowns. Net income at Deere during the period came in at $7.44, up from $4.12 per share in the same period a year ago thanks to tremendous pricing strength, something management expects will continue into the new fiscal year. Both sales and net income in the quarter topped consensus expectations, and we liked the operating leverage inherent in Deere’s model during good times.

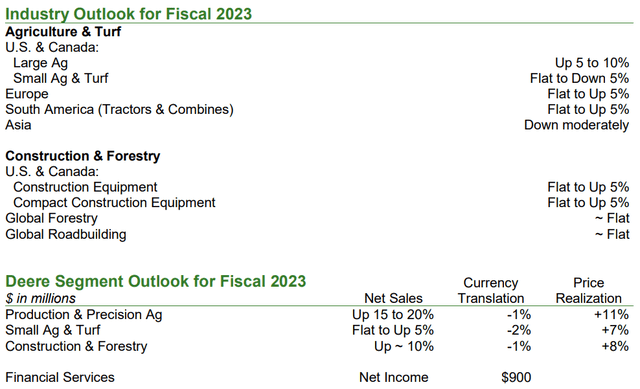

During fiscal 2022 (ends October 30, 2022), Deere reported net income of ~$7.13 billion, and we were pleased to hear that management expects net income to be in the range of $8-$8.5 billion for fiscal 2023. This implies a top-line growth rate of ~15.7% at the midpoint of the range, and given the firm’s operating leverage, we’re expecting a strong showing on the bottom line for fiscal 2023, too, particularly if the company experiences strong pricing strength, as it did during the fiscal fourth quarter (and as outlined in its outlook in the image below). Management’s commentary in the quarterly press release pointed to “positive farm fundamentals and fleet dynamics as well as increased investment in infrastructure” as key reasons to be optimistic in the new fiscal year.

Image: Deere’s outlook for fiscal 2023 is fantastic, revealing more than 15% top-line growth, while better pricing realization could drive tremendous operating earnings expansion in the fiscal year. Agricultural and construction markets remain healthy. Image Source: Deere

We think Deere’s pricing strength is worth emphasizing. Excluding its captive financial services arm, the company operates three primary segments, “Production & Precision Agriculture,” “Small Agriculture & Turf,” and “Construction and Forestry,” and all three operating divisions revealed the company’s incredible pricing power. In its “Production & Precision Agriculture” division, price accounted for $873 million of the firm’s $1.74 billion quarterly operating profit in that division. In its “Small Agriculture & Turf” segment, price accounted for $350 million of the division’s $506 million in quarterly operating income, while price accounted for nearly all (approximately 86%) of the “Construction & Forestry” division’s operating profit during the fiscal fourth quarter. Deere may be one of the best ways to play an inflationary environment, but its share price already reflects that view.

Concluding Thoughts

Deere & Company put up excellent fiscal fourth quarter results November 23, and the highlight of the quarter was the firm’s tremendous pricing power. Its outlook for fiscal 2023 was solid, too, and we expect considerable operating income expansion on the back of strong double-digit top-line growth as supply chain issues fall to the wayside in the coming quarters as economic conditions normalize.

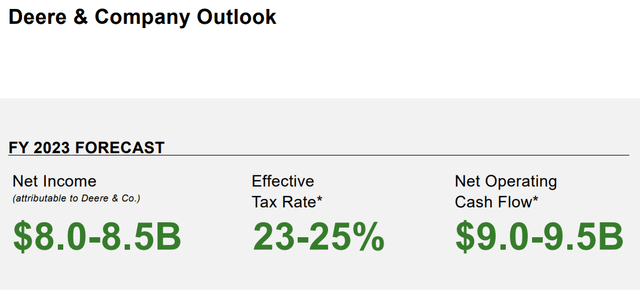

Image: Deere expects operating cash flow to get back on track during fiscal 2023 after a sizable decline in fiscal 2022. Image Source: Deere

Deere has a sizable net debt position and traditional free cash flow faced pressure on a year-over-year basis during fiscal 2022, but the company may be one of the best ways to combat inflation through equities. Management also expects operating cash flow to bounce back to the range of $9-$9.5 billion in fiscal 2023 from $4.7 billion in the recently completed fiscal 2022.

For us, however, Deere isn’t a great fit for the simulated newsletter portfolios given its pricey stock and comparatively small dividend yield of ~1%, but its outlook bodes well for the agricultural supply chain for fiscal 2023. The high end of our fair value estimate for Deere still resides below its current price of $440 per share, meaning investors are paying up to own Deere at the moment.

Tickerized for DE, CAT, MTW, AGCO, CNHI, CORN, SOYB, WEAT, and for various other in the holdings VEGI.

———————————————

About Our Name

But how, you will ask, does one decide what [stocks are] “attractive”? Most analysts feel they must choose between two approaches customarily thought to be in opposition: “value” and “growth,”…We view that as fuzzy thinking…Growth is always a component of value [and] the very term “value investing” is redundant.

— Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett’s thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn’t be more representative of what our analysts do here; hence, we’re called Valuentum.

———————————————

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.