|

|

Recent Articles

-

Investing's Odd Couple: Value and Momentum

Investing's Odd Couple: Value and Momentum

Feb 16, 2023

-

The American Association of Individual Investors highlighted the significant benefits of combining value and momentum strategies in the July 2013 edition of its Journal. This article previously appeared on our website.

-

PepsiCo's Pricing Actions Fantastic; Needs Better Free Cash Flow in 2023 to Cover 10% Dividend Hike

PepsiCo's Pricing Actions Fantastic; Needs Better Free Cash Flow in 2023 to Cover 10% Dividend Hike

Feb 13, 2023

-

Image Source: PepsiCo.

PepsiCo revealed tremendous product pricing power during its fourth quarter of 2022, but inflationary pressures were still present across its business operations. The beverage and snacks giant raised its dividend 10%, marking the 51st consecutive year the company has upped its payout. However, PepsiCo will have to step up its free cash flow generation during 2023 in order to cover the increased payout obligations. During 2022, for example, free cash flow came up short in covering cash dividends paid. PepsiCo also has a rather large net debt position, even as it plans to spend $1 billion in buybacks during 2023. We still like PepsiCo as an idea in the Best Ideas Newsletter portfolio, however, and peg its fair value estimate at $187 per share. Shares yield ~2.8% at the time of this writing.

-

The Dividend Cushion Ratio Warned of Risk to V.F. Corp’s Dividend

The Dividend Cushion Ratio Warned of Risk to V.F. Corp’s Dividend

Feb 13, 2023

-

Image: The Dividend Cushion ratio is one of the most powerful financial tools an income or dividend growth investor can use in conjunction with qualitative dividend analysis. The ratio is one-of-a-kind in that it is both free-cash-flow based and forward looking. Since its creation in 2012, the Dividend Cushion ratio has forewarned readers of approximately 50 dividend cuts. We estimate its efficacy at ~90%.

V.F. Corp cut its quarterly dividend by more than 40% on February 7, to a quarterly rate of $0.30 per share from $0.51 per share previously. The cut is yet further evidence of the importance of paying attention to the cash-based sources of intrinsic value--net cash on the balance sheet and future expected free cash flow--when it comes to evaluating dividend health. Please be sure to pay attention to the Dividend Cushion ratios of firms that you follow. Even if you are not a dividend growth or income investor, the Dividend Cushion ratio provides an assessment of the cash-based sources of intrinsic value relative to future potential outlays in the form of the dividend.

-

Albemarle Outlines Strong Lithium Demand Outlook

Albemarle Outlines Strong Lithium Demand Outlook

Feb 12, 2023

-

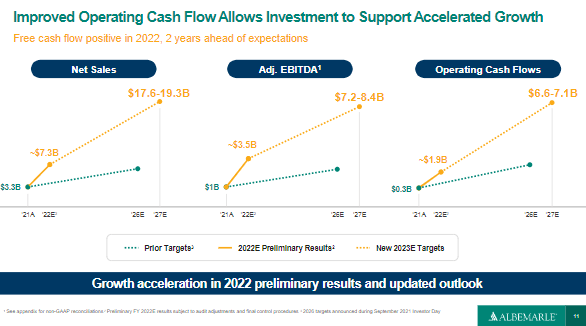

Image Source: Albemarle.

Albemarle released a very promising outlook in late January, one that implies a tremendous pace of top-line expansion, profitability growth, and free cash flow generation. We’re huge fans of the outlook and believe lithium demand will continue to be robust, even as new supply comes to market. The company has called its next five years a period of “transformational growth,” where expected net sales are targeted at 2.5x 2022 levels and adjusted EBITDA is targeted to more than double. Electric vehicle demand remains robust, and Albemarle has opportunities across the end markets of mobility, energy, connectivity, and health, too. We think Albemarle remains one of the best growth stories on the market today, and we like shares.

|