|

|

Recent Articles

-

Dividend Increases/Decreases for the Week of August 1

Dividend Increases/Decreases for the Week of August 1

Aug 1, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

-

Microsoft Puts Up Awesome Fiscal Fourth Quarter Results

Microsoft Puts Up Awesome Fiscal Fourth Quarter Results

Jul 31, 2025

-

Image Source: TradingView.

Looking to fiscal 2026, Microsoft expects to deliver another year of double-digit revenue and operating income growth. Management noted that it “will continue to invest against the expansive opportunity ahead across both capital expenditures and operating expenses given (its) leadership position in commercial cloud, strong demand signals for (its) cloud and AI offerings, and significant contracted backlog.” Capital expenditures are expected to be over $30 billion in the first quarter of fiscal 2026. Microsoft is firing on all cylinders, and we continue to like the idea in the newsletter portfolios.

-

Visa’s Fiscal Third Quarter Results Reveal Consumer Remains Resilient

Visa’s Fiscal Third Quarter Results Reveal Consumer Remains Resilient

Jul 30, 2025

-

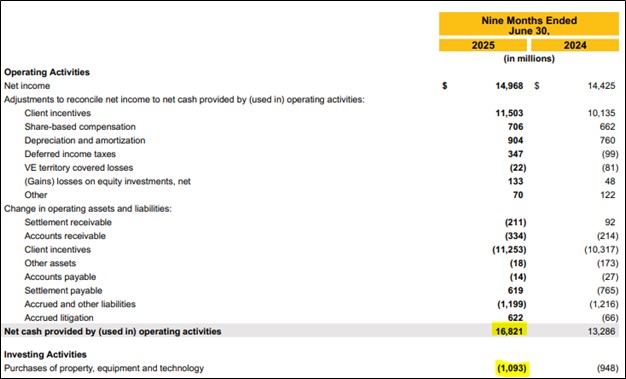

Image: Visa’s free cash flow generation remains phenomenal.

Visa’s fiscal third quarter results showed that the consumer continues to be resilient, with healthy spending trends continuing into July. During the quarter, payments volume increased 8%, while total cross-border volume increased 12%. Processed transactions increased 10% in the quarter. Cash and investment securities were $20.4 billion at the end of the quarter versus $25.1 billion in short- and long-term debt. For the nine months ended June 30, cash flow from operations increased to $16.8 billion, up from $13.3 billion in the same period a year ago. For the nine months ended June 30, free cash flow totaled $15.7 billion, or 53.7% of revenue. We continue to like Visa as a top weighting in the Best Ideas Newsletter portfolio.

-

Enterprise Products Partners’ DCF Coverage of Its Distribution Is Healthy

Enterprise Products Partners’ DCF Coverage of Its Distribution Is Healthy

Jul 30, 2025

-

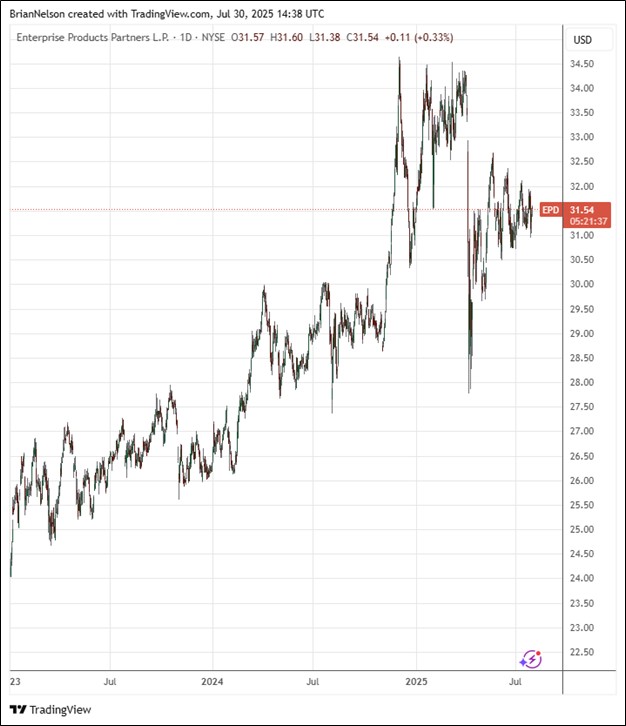

Image Source: TradingView.

In the second quarter, Enterprise Products Partners’ adjusted cash flow from operations was $2.1 billion, and it was $8.6 billion for the twelve months ended June 30. The pipeline giant bought back roughly $110 million of its common units on the open market in the second quarter of 2025. Enterprise paid out 57% of its adjusted cash flow from operations as distributions and common unit buybacks for the twelve months ended June 30. Total capital investments were $1.3 billion in the second quarter of 2025, while total debt principal outstanding was $33.1 billion at the end of the quarter. Enterprise had consolidated liquidity of $5.1 billion as of June 30. Enterprise remains a holding in the High Yield Dividend Newsletter portfolio, and we continue to like its DCF coverage of the distribution. Shares yield 6.9% at the time of this writing.

|