|

|

Recent Articles

-

Dividend Increases/Decreases for the Week of January 12

Dividend Increases/Decreases for the Week of January 12

Jan 12, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

Dividend King Leggett & Platt’s Payout May Be Worth the Risk

Dividend King Leggett & Platt’s Payout May Be Worth the Risk

Jan 11, 2024

-

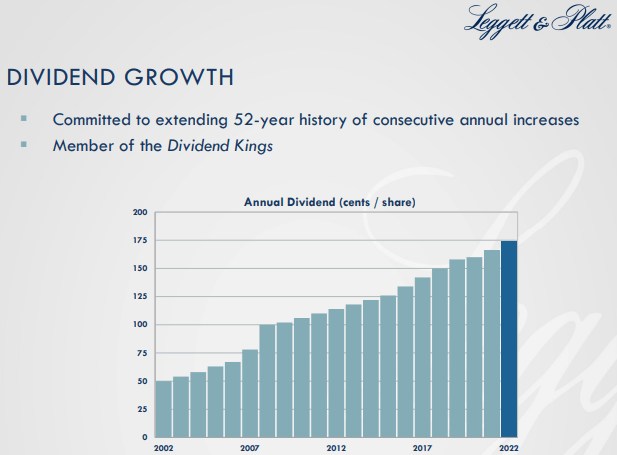

Image: Leggett & Platt has put together a long track record of consecutive annual dividend increases, but recent performance suggests that the dividend may be at risk in the longer run. Its 7.1% dividend yield may be worth the risk, however.

Leggett & Platt has raised its dividend for more than 50 consecutive years, putting it in the coveted category of being a Dividend King. However, the bedding, flooring and textile product maker has fallen on some difficult times. The company sports a Dividend Cushion ratio of -1.2 (negative 1.2), indicating that our future expectations of its dividend payments over the next five years coupled with its net debt position fall far below the cumulative free cash flow that we expect it to generate over the next five years. The company's 7.1% dividend yield may be worth the risk, however.

-

Best Ideas Visa, Alphabet Hit 52-Week Highs

Best Ideas Visa, Alphabet Hit 52-Week Highs

Jan 10, 2024

-

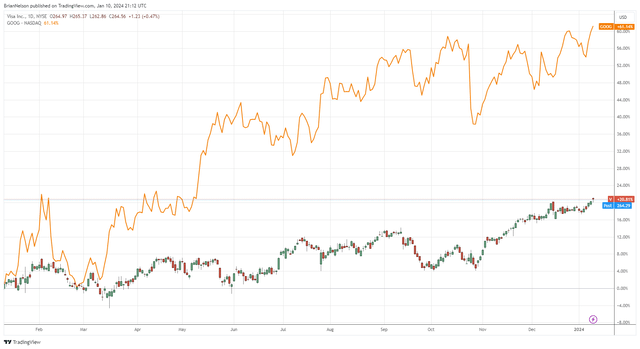

Image: The top weightings in Valuentum’s Best Ideas Newsletter portfolio just hit 52-week highs.

The first week of trading in 2024 gave investors some pause, as it was filled with profit taking from a strong 2023, but we think this bull market continues to have legs. We’ve outlined 12 reasons as to why we think investors should stay aggressive during 2024, and while key inflation data looms, we continue to like how the Best Ideas Newsletter portfolio is positioned heading into what could be another strong year in 2024. Visa and Alphabet remain two of our favorite ideas on the market today, and we point to the high end of their respective fair value estimate ranges as reasonable targets for optimistic, risk-seeking investors.

-

Boeing In Negative Headlines Again; Part of 737 Max Fuselage Blows Out During Commercial Flight

Boeing In Negative Headlines Again; Part of 737 Max Fuselage Blows Out During Commercial Flight

Jan 8, 2024

-

Image: Boeing's shares have been quite volatile the past couple years.

On January 6, Boeing received some more bad news. Part of a fuselage installed on one of its new eight-week old 737 Max 9 aircraft blew out on an Alaska Airlines flight. Boeing had been working hard to get back on track with customer perception of the safety of its 737 MAX line-up, and we view the incident as yet another hiccup in the firm’s relations with the public.

|