Image: Leggett & Platt has put together a long track record of consecutive annual dividend increases, but recent performance suggests that the dividend may be at risk in the longer run. Its 7.1% dividend yield may be worth the risk, however.

By Brian Nelson, CFA

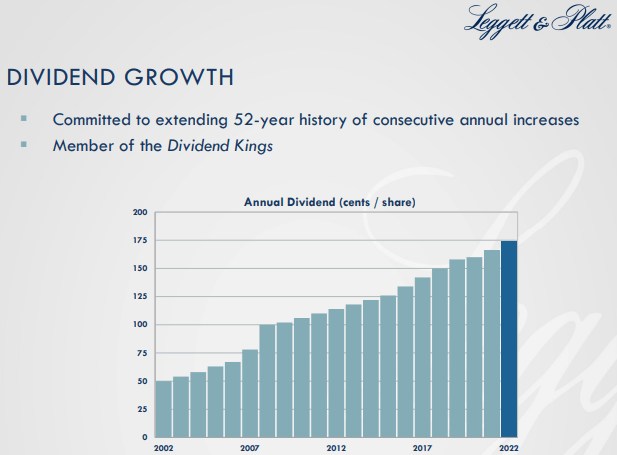

Leggett & Platt (LEG) has raised its dividend for more than 50 consecutive years, putting it in the coveted category of being a Dividend King. However, the bedding, flooring and textile product maker has fallen on some difficult times. The company sports a Dividend Cushion ratio of -1.2 (negative 1.2), indicating that our future expectations of its dividend payments over the next five years coupled with its net debt position fall far below the cumulative free cash flow that we expect it to generate over the next five years. The company’s 7.1% dividend yield may be worth the risk, however.

When Leggett & Platt reported third-quarter results on October 30, the performance wasn’t pretty. Sales fell 9% on a year-over-year basis due to weak demand in residential end markets, while adjusted earnings per share dropped $0.16, to $0.36. The company also lowered its sales guidance for 2023 to the range of $4.7-$4.75 billion (down high single digits) and its adjusted earnings per share guidance to the range of $1.35-$1.45 per share from $1.45-$1.65 previously. Here is what management had to say about the weakness that is expected to persist:

Ongoing weak demand impacted our Bedding Products and Furniture, Flooring, & Textile Products segments but was partially offset by continued demand strength in our Specialized Products segment. We are lowering our full year guidance to reflect continued volatility in the macroeconomic environment, continued low consumer demand in residential end markets, and the modest impact we have experienced so far from the UAW strike on several North American automakers.

We tend to like dividend payers that have a strong net cash position on the balance sheet and generate significant free cash flow in excess of cash dividends paid. Leggett & Platt’s net debt stood at ~$1.7 billion at the end of the third quarter, resulting in a net debt/12-month adjusted EBITDA ratio of 3.15x, up materially from the 2.63x it posted at the end of the year-ago period. Though the firm’s net debt has fallen from the year-ago period, adjusted EBITDA continues to be under pressure.

Leggett & Platt’s free cash flow coverage of the dividend has also been inconsistent. Though free cash flow generation was in excess of cash dividends paid during 2022, the measure fell below its dividend obligations in 2021. Through the first nine months of 2023, cash flow from operations came in at ~$351.1 million, while capital expenditures were $90.4 million, resulting in free cash flow of ~$260.7 million, which was better than the $178.1 million in cash dividends paid over the same time period.

For 2023, operating cash flow is targeted in the range of $450-$500 million and capital spending in the range of $110-$130 million, resulting in expectations of free cash flow of $355 million at the midpoint, higher than dividend payment expectations of $240 million on the year. Leggett & Platt can make good on its dividend payments with free cash flow for the time being, but if fundamental performance continues to move in the wrong direction, we would not be surprised to find the payout eventually on the chopping block. Depending on one’s risk tolerance, however, a lofty 7.1% dividend yield may be worth the risk.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, QQQ, SCHG, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.