|

|

Recent Articles

-

Berkshire Hathaway Caps Off Strong Year of Operating Earnings Growth

Berkshire Hathaway Caps Off Strong Year of Operating Earnings Growth

Feb 27, 2024

-

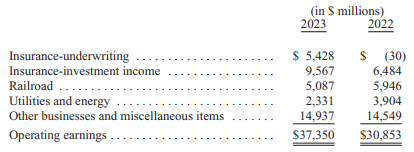

Image: Berkshire’s operating earnings experienced a strong advance during 2023 from last year’s levels.

On February 24, Berkshire Hathaway reported strong fourth-quarter results that capped off a year where operating earnings advanced 21% on a year-over-year basis. Warren Buffett tipped his hat to his long-time partner Charlie Munger, who passed away in November of last year, crediting him as the architect of Berkshire and himself merely in charge of the “construction crew.” There weren’t many surprises in the annual report, and Buffett made several references to areas that he has long talked about in the past, including pointing investors to operating earnings, as opposed to net income, which includes unrealized capital gains that can make reported results seem more volatile. All things considered, we liked Berkshire’s update, and we continue to like the firm as an idea in the Best Ideas Newsletter portfolio.

-

Domino’s Puts Up Strong Comp in Fourth Quarter, Approves Another $1 Billion in Buybacks, Raises Dividend

Domino’s Puts Up Strong Comp in Fourth Quarter, Approves Another $1 Billion in Buybacks, Raises Dividend

Feb 26, 2024

-

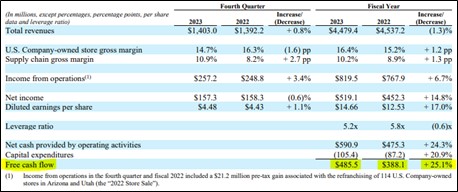

Image: Domino’s free cash flow increased meaningfully in fiscal 2023.

On February 26, Domino’s Pizza reported mixed fourth-quarter results, but comparable store sales came in better than expectations and the firm announced an additional $1 billion in buybacks, while it raised its dividend ~25%. We’re huge fans of Domino’s due in part to its heavily franchised business model, impressive digital initiatives, as well as its long-term unit growth prospects. The high end of our fair value estimate range of Domino’s stands at $569 per share, and we see meaningful upside from today’s price levels (~$465 per share) given the fundamental momentum at the firm.

-

Latest Report Updates

Latest Report Updates

Feb 26, 2024

-

Check out the latest report updates on the website.

-

We Remain Bullish; Is This 1995 – The Beginning of a Huge Stock Market Run?

We Remain Bullish; Is This 1995 – The Beginning of a Huge Stock Market Run?

Feb 25, 2024

-

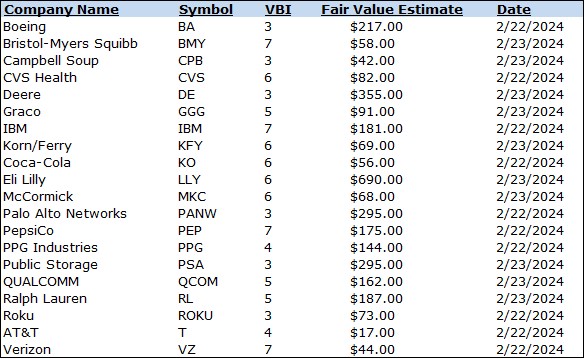

Image: Large cap growth stocks have trounced the performance of the S&P 500, REITs, and bonds since the beginning of 2023. We expect continued outperformance in this area of the market.

We’re now roughly four years past the depths of the COVID-19 meltdown, where equities collapsed in February and March of 2020. As the markets began to recover through 2020, our long-term conviction in equities only grew stronger. We think the biggest risk for long-term investors remains staying out of the market on the basis of what could be considered stretched valuation multiples. As we outlined heavily in the book Value Trap, valuation multiples hardly tell the complete story about a company and often omit key long-term earnings growth, cash flow dynamics, and balance sheet health considerations. We remain bullish on equities for the long haul, and we think the next couple years will be incredibly strong. Our best ideas can be found in the Best Ideas Newsletter portfolio, Dividend Growth Newsletter portfolio, High Yield Dividend Newsletter portfolio, ESG Newsletter portfolio, and via the Exclusive publication as well as options idea generation.

|