|

|

Recent Articles

-

3 Catalysts for Apple’s Stock

3 Catalysts for Apple’s Stock

Feb 29, 2024

-

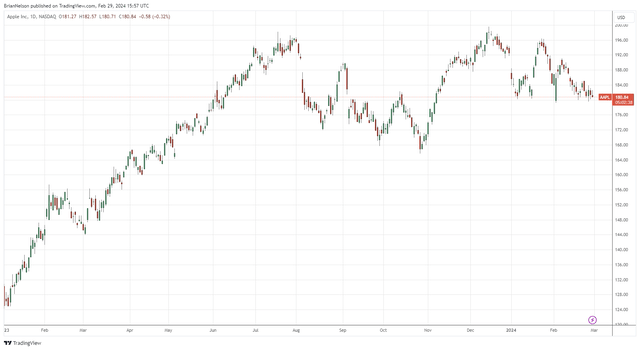

Image: Apple’s shares have done quite well since the beginning of 2023.

We see three positive catalysts on the horizon for Apple. First, Apple is now shifting resources from its electric car endeavor to work on generative artificial intelligence [AI]. Though an Apple Car would have been a nice deliverable later this decade, we like the move, as it relates to future iterations of the iPhone, which will likely have varying levels of AI features. This should drive a meaningful upgrade cycle across its installed base of iPhones. Second, we think Apple’s Vision Pro is another revenue driver, and recent reports indicate that demand has been higher than expected. Third, we think the Apple Watch X, the next iteration of its wearables line-up that will likely have features to measure blood pressure adn detect sleep apnea, will also drive a lot of upgrades across its installed base, in our view.

-

Republic Services Issues Solid Guidance for 2024

Republic Services Issues Solid Guidance for 2024

Feb 28, 2024

-

Image Source: Republic Services.

Republic Services is one of our favorite industrial entities. The company has valuable property in the form of disposal facilities, and its collection operations, while always facing a competitive environment, are essential services, making its business relatively recession-resistant. Republic Services is also a strong cash-flow generator. During 2023, for example, the garbage hauler generated cash flow from operations of ~$3.618 billion (was $3.19 billion in 2022) and adjusted free cash flow of ~$1.985 billion (was $1.742 billion in 2022). The company’s cash dividends paid were $638.1 million and $592.9 million in 2023 and 2022, respectively, so Republic Services is doing a great job covering its payout with traditional measures of free cash flow.

-

Berkshire Hathaway Caps Off Strong Year of Operating Earnings Growth

Berkshire Hathaway Caps Off Strong Year of Operating Earnings Growth

Feb 27, 2024

-

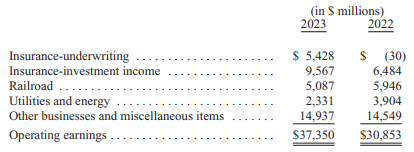

Image: Berkshire’s operating earnings experienced a strong advance during 2023 from last year’s levels.

On February 24, Berkshire Hathaway reported strong fourth-quarter results that capped off a year where operating earnings advanced 21% on a year-over-year basis. Warren Buffett tipped his hat to his long-time partner Charlie Munger, who passed away in November of last year, crediting him as the architect of Berkshire and himself merely in charge of the “construction crew.” There weren’t many surprises in the annual report, and Buffett made several references to areas that he has long talked about in the past, including pointing investors to operating earnings, as opposed to net income, which includes unrealized capital gains that can make reported results seem more volatile. All things considered, we liked Berkshire’s update, and we continue to like the firm as an idea in the Best Ideas Newsletter portfolio.

-

Domino’s Puts Up Strong Comp in Fourth Quarter, Approves Another $1 Billion in Buybacks, Raises Dividend

Domino’s Puts Up Strong Comp in Fourth Quarter, Approves Another $1 Billion in Buybacks, Raises Dividend

Feb 26, 2024

-

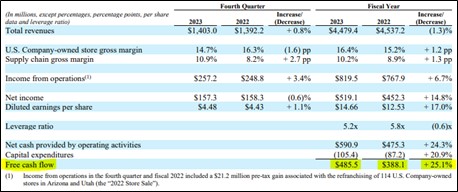

Image: Domino’s free cash flow increased meaningfully in fiscal 2023.

On February 26, Domino’s Pizza reported mixed fourth-quarter results, but comparable store sales came in better than expectations and the firm announced an additional $1 billion in buybacks, while it raised its dividend ~25%. We’re huge fans of Domino’s due in part to its heavily franchised business model, impressive digital initiatives, as well as its long-term unit growth prospects. The high end of our fair value estimate range of Domino’s stands at $569 per share, and we see meaningful upside from today’s price levels (~$465 per share) given the fundamental momentum at the firm.

|