Image Source: Dick’s Sporting Goods

By Brian Nelson, CFA

On November 21, Dick’s Sporting Goods (DKS) reported solid third-quarter results with sales up 2.8% on a year-over-year basis thanks to comparable store sales growth of 1.7% that lapped an impressive 6.5% increase in the same period a year ago. Non-GAAP earnings per share came in at $2.85 in the quarter, up from $2.60 in last year’s period. The company also raised its 2023 comparable store sales growth guidance range to 0.5%-2% from flat to 2% previously, and it raised its 2023 non-GAAP earnings per share outlook to $12.00-$12.60 from its previous range of $11.50-$12.30. We liked the news and continue to believe that shares of Dick’s Sporting Goods are mispriced. Our fair value estimate stands at $160 per share, well above where shares are trading at the moment.

The athlete today has never been better equipped. Youth sports are hardly anything like they were 20-30 years ago when baseball teams used to share a couple old bats and a few hand-me-down helmets that were 5-10 years old. Today, youth baseball players have their own bats, their own helmets, and some even have two bats. This isn’t only 15-18 year-old high school players with such personal equipment, but rather 8-14 year old kids, too. Dick’s Sporting Goods has benefited from trends such as these across all sports, and parents are all-too willing to keep spending on the latest and greatest gear and equipment (and instruction) for their kids. Even as some sports face declining participation rates, those that stay in the sport are spending more and more each and every year, and Dick’s Sporting Goods is meeting their demands.

Across footwear, apparel and hardlines, we’re looking at roughly a $140 billion total addressable market for Dick’s Sporting Goods, and it only has an estimated high-single-digit percentage share at this time. We expect the company to continue to drive share gains, perhaps a percentage point or two every few years or so (with the biggest gains in the ‘outdoor’ category), and by our estimates, we think it could command as much as 15% of this market in the long run. It all comes back to its differentiated product assortment, brand engagement and growth (e.g. Yeti, adidas, Columbia, Nike, Marucci and the like), and how it offers an appealing athletic experience from visual presentation to enhanced service and in-store technology and beyond. For one, those looking to try out a new baseball bat can go into The Cage and take some hacks to find exactly the feel they want for their swing.

The company’s ‘GameChanger’ app continues to put its brand in front of youngsters, too, building brand awareness. We view ‘GameChanger’ as the Brownie camera of our day: “Plant the Brownie acorn and the Kodak oak will grow.” In the coming decades, those kids that were hooked on watching ‘GameChanger’ for updates will have Dick’s Sporting Goods top of mind when looking for some new gear or equipment, and the company is delivering in ways that they want either via in-person at its stores, curbside pick-up, or traditional delivery. The company estimates that omni-channel athletes represented more than 65% of sales and were twice as valuable as single-channel athletes. Dick’s Sporting Goods has found a unique way to connect with today’s athlete, and its economic moat will only grow stronger as today’s younger generation become the adult volunteers of tomorrow’s sporting events.

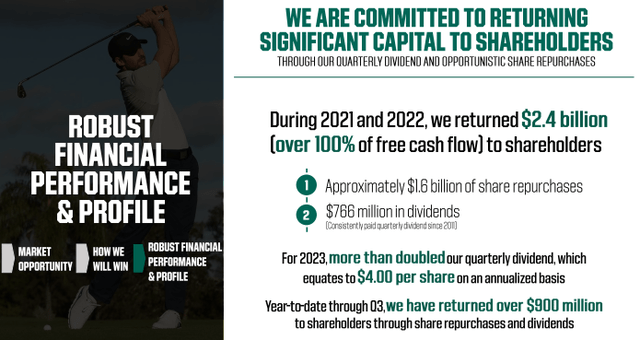

For the 39 weeks ended October 28, 2023, net cash from operations came in at $764.7 million, up significantly from $35.6 million in the same period a year ago, as the firm benefited greatly from improved inventory management. Capital expenditures came in at $409.5 million over this time period, up from $274.3 million in the year-ago period, and the company has turned the corner nicely with respect to free cash flow, generating a robust $355.2 million so far in its fiscal year. Though Dick’s Sporting Goods has material operating lease liabilities, it is running roughly a net-neutral balance sheet, ending its quarter with $1.4 billion in total cash and $1.48 billion in total debt. Shares continue to look cheap, trading at less than 10x this year’s earnings guidance at the high end of the range. We continue to like the idea as a holding in the Dividend Growth Newsletter portfolio.

———-

Tickerized for holdings in the DKS, HIBB, NKE, YETI, ASO, FL, ADDYY, UA, UAA, GOLF, MODG, BGFV, SPWH, HBI, PMMAF, FIGS, LULU, BFIT, PTON, COLM.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, QQQ, and SCHG. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and range.