|

|

Recent Articles

-

ESG Matters: KMB, ADM, CC

ESG Matters: KMB, ADM, CC

Mar 6, 2024

-

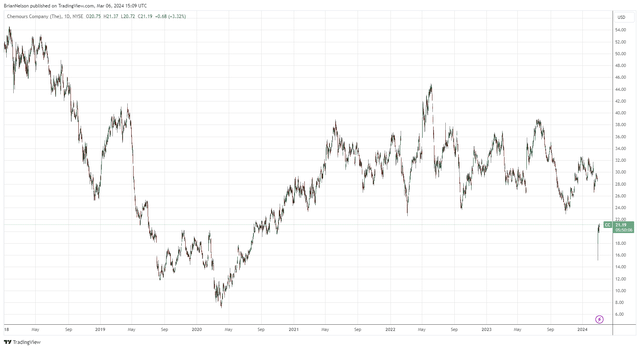

Image: Chemours stock has been pummeled recently over an accounting probe.

Kimberly-Clark is facing a new lawsuit that alleges it put dangerous "PFAS" chemicals into the environment, while ADM and Chemours face serious inquiries into their accounting practices.

-

Alphabet or Microsoft in Artificial Intelligence with Respect to Search? We Like Both

Alphabet or Microsoft in Artificial Intelligence with Respect to Search? We Like Both

Mar 5, 2024

-

Image Source: SEO.

It’s very likely that, if Google search is eventually disrupted, much of the disruption would come from Microsoft given its deep pockets and existing search engine Bing. We continue to include both Alphabet and Microsoft in the Best Ideas Newsletter portfolio as a hedge in this regard. If any share shifts do occur away from Google search, they’ll likely accrue to Microsoft, and with both Alphabet and Microsoft large components of big cap tech and the stylistic area of large cap growth, considering the Schwab Large Cap Growth ETF may be worthwhile. We like both Alphabet and Microsoft and view any share shifts as net neutral to our exposure in the Best Ideas Newsletter portfolio.

-

Merger Mania

Merger Mania

Mar 3, 2024

-

Image Source: Glenn Beltz.

Mergers and acquisition [M&A] activity continues as the market sets new highs. Elevated borrowing costs as a result of the Fed’s aggressive rate hiking cycle in 2022 are pushing many entities to pursue all-stock transactions.

-

Dividend Increases/Decreases for the Week of March 1

Dividend Increases/Decreases for the Week of March 1

Mar 1, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

|