|

|

Recent Articles

-

Johnson & Johnson Narrows 2024 Outlook, Raises Dividend

Johnson & Johnson Narrows 2024 Outlook, Raises Dividend

Apr 16, 2024

-

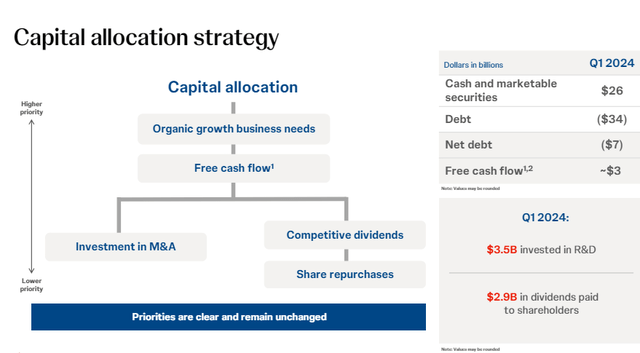

Image Source: J&J.

Looking to 2024, J&J expects adjusted operational sales growth in the range of 5.5%-6%, the midpoint of which is up from the prior range of 5%-6%. Adjusted operational diluted earnings per share is targeted in the range of $10.60-$10.75 per share, the midpoint also up from the range of $10.55-$10.75 previously. Management also upped its dividend 4.2%, to a quarterly payout of $1.24 per share, implying a forward estimated dividend yield of 3.4%. We like J&J, but we won’t be adding it back to any newsletter portfolio anytime soon.

-

UnitedHealth Group Reiterates 2024 Adjusted Net Earnings Outlook

UnitedHealth Group Reiterates 2024 Adjusted Net Earnings Outlook

Apr 16, 2024

-

Image: UnitedHealth Group’s shares have been choppy during the past couple years.

UnitedHealth Group’s shares have seen better days as the firm works to recover from a cyberattack, while the industry’s medical costs are on the rise as patients begin to pursue procedures that were deferred during the peak of the COVID-19 crisis. Though it may be some time for UnitedHealth Group’s performance to normalize given the cyberattack and pent-up demand, we liked that it maintained its adjusted net earnings outlook for 2024 amid concerns of rising costs. UnitedHealth remains a key idea in the Best Ideas Newsletter portfolio.

-

Goldman Sachs Delivers in First Quarter

Goldman Sachs Delivers in First Quarter

Apr 15, 2024

-

Image Source: Goldman Sachs.

Goldman Sachs put up solid first-quarter 2024 results across all lines of its business, revealing that capital markets activity remains very healthy, even in the face of elevated interest rates. Goldman Sachs' book value per share was $321.10 at the end of the first quarter, revealing that shares are trading at 1.25x book at the time of this writing.

-

Vertex Pharma to Acquire Alpine Immune Services

Vertex Pharma to Acquire Alpine Immune Services

Apr 13, 2024

-

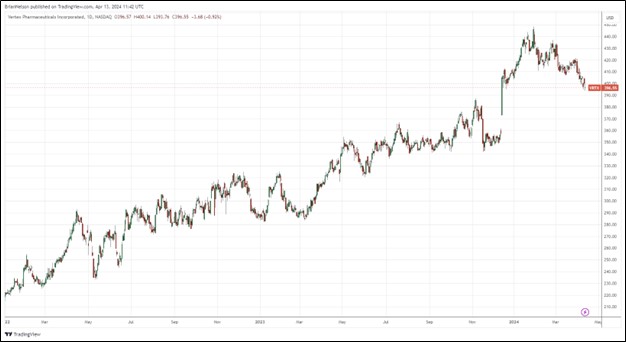

Image: Vertex Pharma’s shares have had a nice run the past couple years.

On April 10, Vertex Pharma announced that it had entered into an agreement where Vertex will acquire Alpine Immune Services for $65 per share or ~$4.9 billion in cash. We have no qualms with the deal for Alpine, and we expect Vertex Pharma to continue to deliver for shareholders.

|