|

|

Recent Articles

-

JPMorgan Continues to Generate Value for Shareholders

JPMorgan Continues to Generate Value for Shareholders

Oct 15, 2024

-

Image Source: Hakan Dahlstrom.

During the third quarter, JPMorgan's book value per share was up 15%, to $115.15, while tangible book value per share grew 18%, to $96.42. Shares of JPMorgan aren’t cheap trading at north of 1.9x book value. JPMorgan is an important bellwether for the global economy, and its third quarter results spoke of continued strength and high returns on capital. We include Financial Select SPDR in the Best Ideas Newsletter portfolio to capture diversification benefits from the largest financial institutions. Shares of JPM yield approximately 2.3% at the time of this writing.

-

Dividend Increases/Decreases for the Week of October 11

Dividend Increases/Decreases for the Week of October 11

Oct 11, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

Domino’s Pizza Remains an Attractive Long-Term Story

Domino’s Pizza Remains an Attractive Long-Term Story

Oct 10, 2024

-

Image: Domino’s core values.

Looking to 2024, Domino’s expects approximately 6% annual global retail sales growth and approximately 8% annual income from operations growth as it seeks to expand global net store count by 800 to 850. For 2025, Domino’s expects a similar pace of expansion for annual global retail sales growth and annual income from operations growth. Its long-term guidance (2026-2028) calls for 7%+ annual global retail sales growth and 8%+ annual income from operations growth. The company ended the quarter with $4.98 billion in total debt and $189.1 million in cash and cash equivalents. Though Domino’s has a lofty net debt position, we like its long-term growth story, and the company remains a core idea in the portfolio of the Best Ideas Newsletter.

-

PepsiCo Experiencing Subdued Growth, Business Disruptions Due to Geopolitical Tensions

PepsiCo Experiencing Subdued Growth, Business Disruptions Due to Geopolitical Tensions

Oct 8, 2024

-

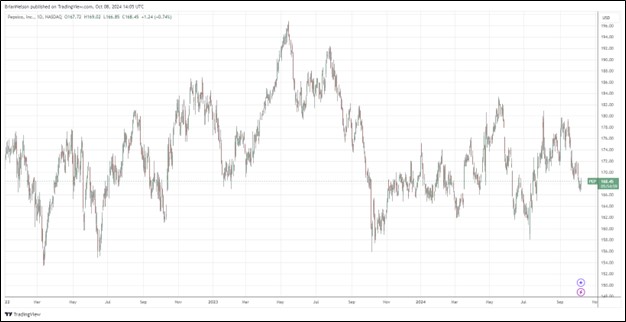

Image: PepsiCo has traded sideways for most of the past couple years.

For 2024, PepsiCo expects a low-single-digit increase in organic revenue (was previously approximately 4% in organic revenue growth) and at least an 8% increase in core constant currency earnings per share. PepsiCo is targeting total cash returns to shareholders of $8.2 billion for the year, comprising $7.2 billion in dividends and the balance in share repurchases. As it relates to core earnings per share, management is targeting at least $8.15, a 7% increase compared to 2023 core earnings per share of $7.62. Though PepsiCo’s results weren’t great with subdued category trends in North America and business disruptions from geopolitical tensions, we still like shares as a key diversifier in the portfolio of the Best Ideas Newsletter.

|