|

|

Recent Articles

-

Constellation Brands’ Beer Business Continues to Propel Results

Constellation Brands’ Beer Business Continues to Propel Results

Oct 4, 2024

-

Image Source: Constellation Brands.

Looking to fiscal 2025 guidance, Constellation Brands expects net sales growth of 4%-6% led by Beer net sales growth of 6%-8%, offset in part by net sales declines of 4%-6% for Wine and Spirits. Operating cash flow is targeted at $2.8-$3 billion, while capital spending is expected in the range of $1.4-$1.5 billion, including major investments in its Mexico beer operations. Free cash flow is expected at $1.4-$1.5 billion. On a comparable basis, management is targeting earnings per share at $13.60-$13.80 for the fiscal year versus $12.38 in fiscal 2024.

-

Dividend Increases/Decreases for the Week of October 4

Dividend Increases/Decreases for the Week of October 4

Oct 4, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

Nike In the Midst of a CEO Transition, Withdraws Full Year Guidance

Nike In the Midst of a CEO Transition, Withdraws Full Year Guidance

Oct 2, 2024

-

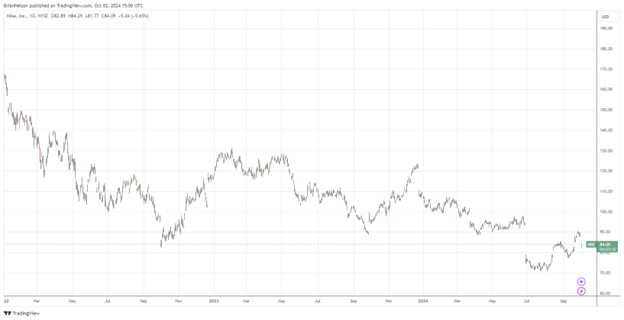

Image: Nike’s shares have been under pressure as the firm continues to underperform.

Nike is in the midst of a management transition with Elliott Hill returning to the company in the capacity of President and CEO effective October 14. Looking to the second quarter of fiscal 2025, Nike expects revenue to be down in the 8%-10% range and gross margins to be down roughly 150 basis points, pointing to higher promotions and channel mix headwinds. Though Nike has a storied brand, unmatched by rivals, it has fallen on difficult times, and we’re staying on the sidelines with respect to shares. Shares yield 1.7% at the time of this writing.

-

Carnival Corp. Experiencing Strong Demand

Carnival Corp. Experiencing Strong Demand

Sep 30, 2024

-

Image: Carnival’s shares have traded sideways since the beginning of 2024.

We like the demand momentum behind Carnival’s business, but its balance sheet keeps us on the sidelines. The company ended the quarter with $1.5 billion in cash and $28.9 billion in long-term debt. Fitch rates the company’s debt as non-investment grade with a BB credit rating. S&P rates its debt at BB and Moody’s B1. The company’s economic returns aren’t that much greater than its cost of capital either, even during good times. Carnival’s shares have been roughly flat year-to-date.

|