|

|

Recent Articles

-

ASML Holding Lowers 2025 Outlook

ASML Holding Lowers 2025 Outlook

Oct 16, 2024

-

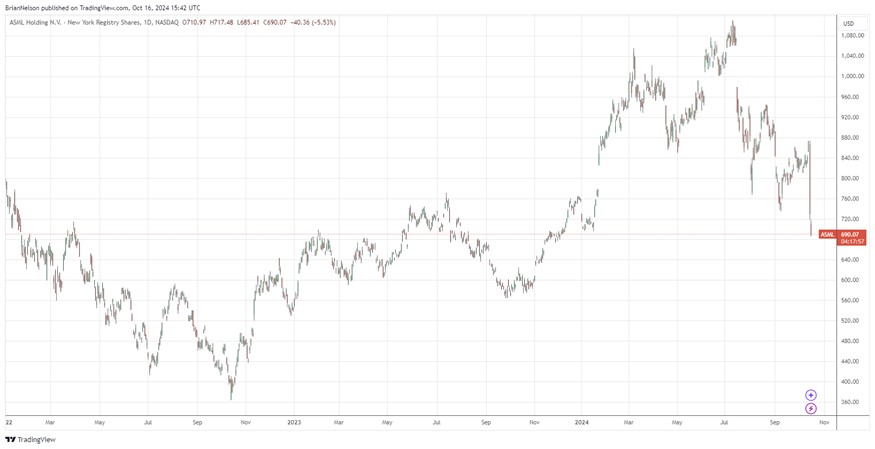

Image: ASML Holding is falling from recent highs as its third quarter report and outlook disappointed investors.

ASML’s guidance for 2025 came in below what consensus had been looking for. 2025 net sales are now expected in the range of €30 billion and €35 billion, which compares to guidance of €30 billion to €40 billion previously and the consensus estimate of €35.94 billion. The company’s updated gross margin outlook for 2025 in the range of 51%-53% is below the 54%-56% it had previously forecast and below the consensus estimate of 53.9%. The bookings number in the third quarter coupled with lowered 2025 guidance is weighing on the stock. Though the news isn’t great, we continue to like ASML Holding as a long-term idea in the ESG Newsletter portfolio.

-

Goldman Sachs Beats Third Quarter Estimates, Puts Up Strong Economic Returns

Goldman Sachs Beats Third Quarter Estimates, Puts Up Strong Economic Returns

Oct 16, 2024

-

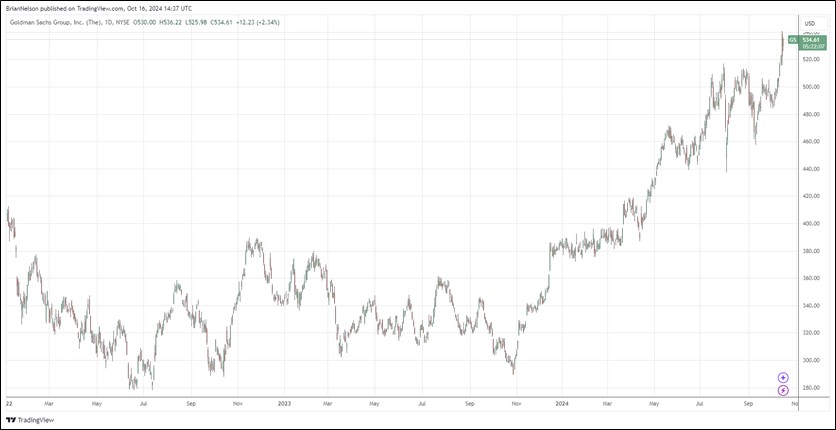

Image: Goldman Sachs’ shares have done well the past couple years.

Goldman Sachs continues to generate value for shareholders. Annualized return on average common shareholder equity [ROE] was 10.4% for the third quarter of 2024 and 12.0% for the first nine months of 2024. We liked Goldman’s revenue growth in the quarter, and the company continues to put up double-digit economic returns. Shares trade at 1.6x book value, so we’re not viewing them as cheap at this time. Shares yield 2.3%.

-

Johnson & Johnson's Shares Look Fairly Valued

Johnson & Johnson's Shares Look Fairly Valued

Oct 16, 2024

-

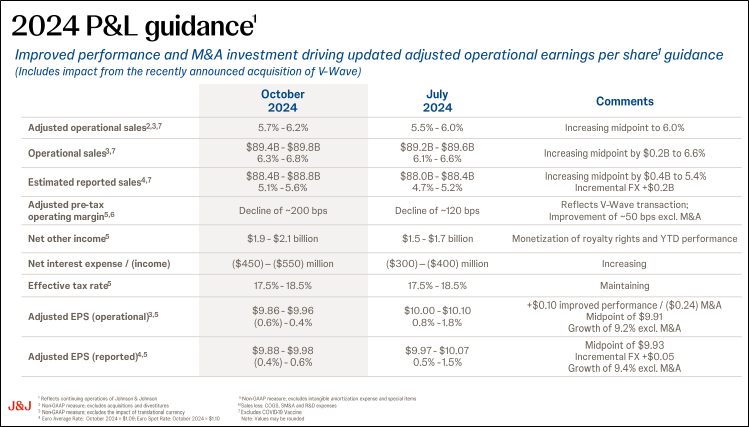

Image: Johnson & Johnson’s 2024 P&L guidance.

Looking to all of 2024, Johnson & Johnson expects the midpoint of adjusted operational sales growth of 6%, up from its prior expectation of 5.8%. At the midpoint, diluted adjusted operational earning per share expansion is targeted at $9.91 per share down from $10.05 per share due to a negative impact from its recent acquisition of V-Wave. Our fair value estimate stands at $165 per share, about in-line with where shares are currently trading. Shares yield ~3%.

-

UnitedHealth Remains a Free Cash Flow Generating Powerhouse

UnitedHealth Remains a Free Cash Flow Generating Powerhouse

Oct 15, 2024

-

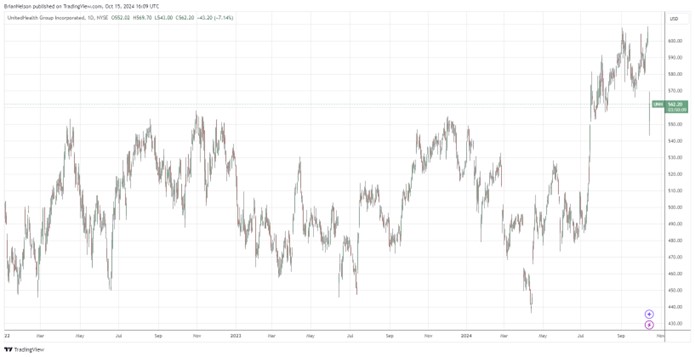

Image: UnitedHealth’s shares have done well the past few years, but a gloomy outlook for 2025 has prompted a selloff.

Looking to 2024, UnitedHealth Group lowered the high end of its guidance to the range of $27.50-$27.75 compared to $27.50-$28.00 previously due in part to higher than expected business disruption impacts for the affected Change Healthcare services. On the conference call, the company noted that its “2025 adjusted profit could be $30 per share (Seeking Alpha),” which was below consensus of $31.17 per share for the year. Though its medical care ratio advanced in the quarter and it continues to navigate the impact of cyberattack and direct response costs, we’re huge fans of UnitedHealth’s robust free cash flow generation, and we still like shares in the Best Ideas Newsletter portfolio.

|