|

|

Recent Articles

-

Starbucks Posts Lower Than Expected Performance, Turnaround “Will Take Time”

Starbucks Posts Lower Than Expected Performance, Turnaround “Will Take Time”

Oct 23, 2024

-

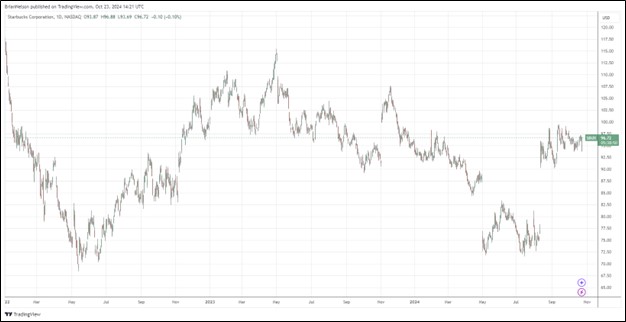

Image: Starbucks’ shares have been volatile the past couple years.

Starbucks suspended its guidance for the full year 2025, given new CEO Brian Niccol and “the current state of the business.” That said, the company increased its quarterly cash dividend to $0.61 per share from $0.57 per share, which equates to a 2.5% forward estimated dividend yield, pointing to optimism regarding the long term. We’re cautious on Starbucks’ shares, as even the executive team noted that a turnaround “will take time.” Our fair value estimate stands at $85 per share, below where shares are trading at the time of this writing.

-

Lockheed Martin Raises 2024 Guidance, F-35 Program in Focus

Lockheed Martin Raises 2024 Guidance, F-35 Program in Focus

Oct 23, 2024

-

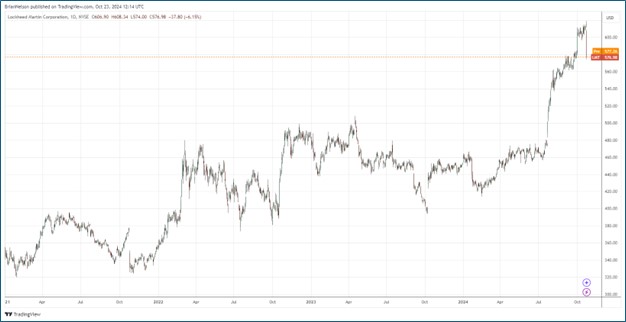

Image: Lockheed Martin’s shares have done well of late.

We liked Lockheed Martin’s guidance revisions for 2024, but we’re keeping a watchful eye on its F-35 program revenues, which experienced lower sales in the quarter due to delays in receiving additional contractual authorization and funding under its Lots 18-19 contract. The company’s Missiles and Fire Control (MFC) segment and Rotary and Mission Systems (RMS) segment experienced sales increases of 8% and 6%, respectively, in the quarter. Operating profit growth was most pronounced in its MFC division. The high end of our fair value estimate range stands at $649 per share, and we continue to like shares as an idea in the Dividend Growth Newsletter portfolio.

-

Philip Morris Raises 2024 Guidance, Shares Catapult to All-Time Highs

Philip Morris Raises 2024 Guidance, Shares Catapult to All-Time Highs

Oct 22, 2024

-

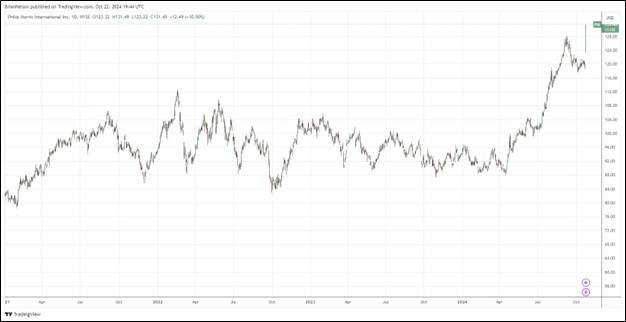

Image: Shares of Philip Morris catapult to all-time highs.

On the heels of strength witnessed in the third quarter, Philip Morris raised its outlook for adjusted diluted earnings per share, excluding currency, to $6.85-$6.91 (was $6.67-$6.79 per share), reflecting 14%-15% growth, up from prior expectations of 11%-13%. We like the earnings momentum behind Philip Morris’ business, and the company has a big winner on its hands with ZYN nicotine pouches. The high end of our fair value estimate range for Philip Morris stands at $134 per share. Shares yield 4.5%.

-

Procter & Gamble Maintains Outlook for Fiscal 2025

Procter & Gamble Maintains Outlook for Fiscal 2025

Oct 21, 2024

-

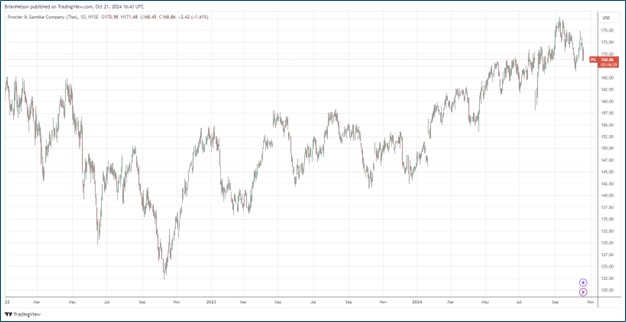

Image: P&G maintained its outlook for fiscal 2025, as shares flirt with all-time highs.

For fiscal 2025, P&G expects adjusted free cash flow productivity to be 90% and to pay roughly $10 billion in dividends while buying back $6-$7 billion in shares. P&G’s quarterly update revealed some top-line pressure and expectations for higher commodity prices, but the company maintained its all-in sales guidance, organic growth guidance, diluted net earnings per share growth guidance, and core earnings per share guidance for fiscal 2025. Shares of P&G yield 2.4% at the time of this writing.

|