|

|

Recent Articles

-

IBM’s Generative AI Book of Business Doing Well

IBM’s Generative AI Book of Business Doing Well

Feb 1, 2025

-

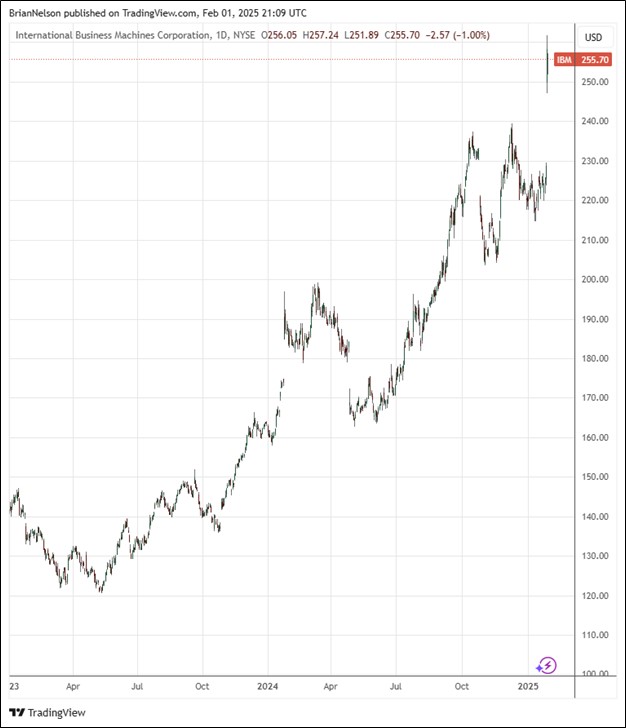

Image Source: TradingView.

For the full year 2024, IBM generated net cash from operating activities, excluding IBM financing receivables, of $13.9 billion and hauled in $12.7 billion in free cash flow for the year, up $1.5 billion, and exceeding dividends paid of $6.1 billion. IBM ended the fourth quarter with $14.8 billion in cash and marketable securities, and debt, including IBM Financing debt of $12.1 billion, totaled $55 billion, down $1.6 billion from the end of 2023. For full year 2025, IBM expects full-year constant currency revenue growth of at least 5% and free cash flow of $13.5 billion for the full year, both measures exceeding the consensus forecast. Shares of IBM yield 2.6% at the time of this writing.

-

Apple Reports Best Quarter Ever Despite Declining iPhone, China Sales

Apple Reports Best Quarter Ever Despite Declining iPhone, China Sales

Jan 31, 2025

-

Image Source: TradingView.

During the quarter, Apple returned to shareholders $3.9 billion in dividends and equivalents and $23.3 billion in share repurchases. Looking to the March quarter, management expects total company revenue to grow low to mid-single-digits year-over-year, with Services revenue to grow low double-digits year-over-year. It expects its gross margin to be between 46.5%-47.5%, about in line with the December quarter. We continue to be fans of Apple’s large installed base (2.35 billion active devices) and growing, high-margin Services business, and the company remains a key holding in the newsletter portfolios.

-

Visa’s Free Cash Flow Margins Are Incredible

Visa’s Free Cash Flow Margins Are Incredible

Jan 31, 2025

-

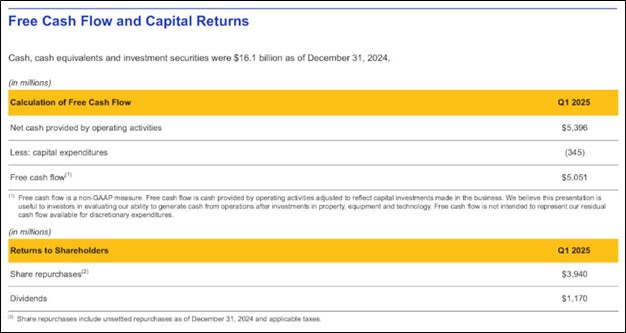

Image Source: Visa.

Visa’s cash and investment securities were $16.1 billion at the end of the calendar year versus short-and long-term debt of $20.6 billion. For the three months ended December 31, operating cash flow was $5.4 billion, up from $3.6 billion in the year ago period. Capital spending came in at $345 million in the quarter, with the firm hauling in free cash flow of $5.05 billion, revealing a free cash flow margin of 53%. Looking to full year 2025, management is targeting low double-digit growth in net revenue and low-teens earnings per share growth. We continue to like Visa as a top weighting in the Best Ideas Newsletter portfolio. The high end of our fair value estimate range stands at $365 per share.

-

Dividend Increases/Decreases for the Week of January 31

Dividend Increases/Decreases for the Week of January 31

Jan 31, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

|