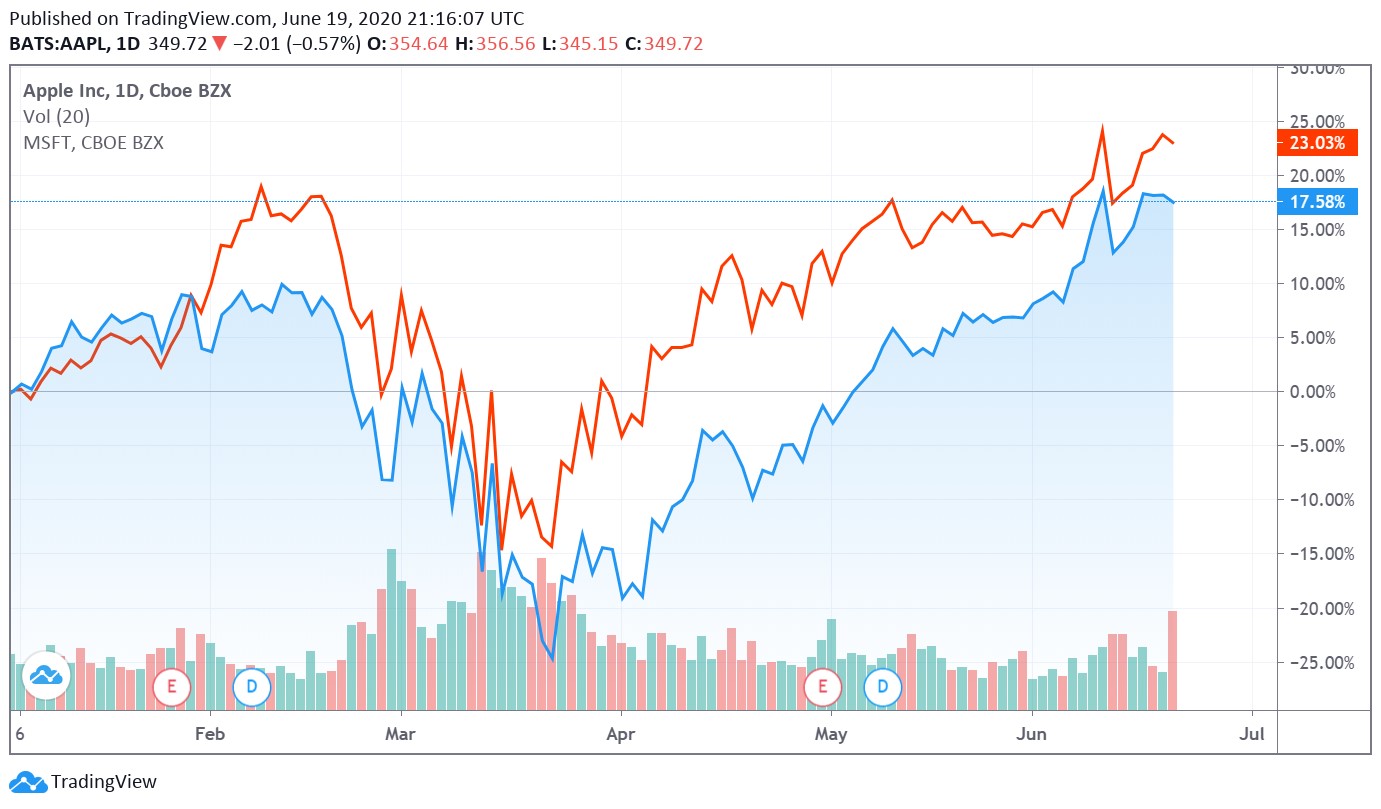

Image Shown: Shares of Apple Inc (blue line) and Microsoft Corporation (red line) are up significantly year-to-date as of the market close on June 19, and we see room for both shares of AAPL and MSFT to continue marching higher after recently revising our fair value estimates for both companies.

By Callum Turcan

On June 12, we added back shares of Apple Inc (AAPL) and Microsoft Corporation (MSFT) to both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio (link here). We added Apple and Microsoft back to the newsletter portfolios using the cash position generated by removing the Vanguard Real Estate ETF (VNQ) and the SPDR S&P Aerospace and Defense ETF (XAR) from the Best Ideas Newsletter portfolio and Cracker Barrel Old Country Store Inc (CBRL) and Bank of America Corporation (BAC) from the Dividend Growth Newsletter portfolio on June 11 (link here). The Best Ideas Newsletter portfolio (link here) and Dividend Growth Newsletter portfolio (link here), as of June 15, 2020, can be viewed on our website.

There are a lot of reasons to like Apple and Microsoft, especially during these turbulent times. Both firms have massive net cash positions, better positioning the tech giants to ride out the storm created by the ongoing coronavirus (‘COVID-19’) pandemic. Both companies are free cash flow cows and their growth trajectories are underpinned by secular growth tailwinds (particularly on the cloud computing and digitally-provided services side of things), further bolstering their cash flow profiles.

Apple

As of the end of Apple’s second quarter of fiscal 2020 (period ended March 28, 2020), the firm had a net cash position of $83.3 billion (defined as its cash and cash equivalents plus its short-term marketable securities plus its long-term marketable securities less its short-term term debt less its outstanding commercial paper and repurchase agreement balance less its long-term term debt). Please note Apple has been utilizing its hefty net cash position to repurchase a material amount of its stock. In the second quarter of fiscal 2020, Apple’s outstanding diluted share count fell by more than 6% year-over-year.

From fiscal 2017 to fiscal 2019 (period ended September 28, 2019), Apple generated $58.3 billion in annual free cash flow on average which easily covered $13.5 billion in annual dividend obligations on average. The company’s annual share repurchases averaged $57.5 billion during this period, and those buybacks really started to pick up pace in fiscal 2018 and fiscal 2019. As mentioned previously, a chunk of Apple’s share repurchases were funded by its balance sheet.

We rate both Apple’s Dividend Safety and Dividend Growth ratings as “EXCELLENT” and give the firm a Dividend Cushion ratio of 5.7. Please note our forward-looking Dividend Cushion ratio factors in our expectations that Apple will push through double-digit annual per share dividend increases over the coming years. Apple’s dividend coverage strength is a product of its sizable net cash balance, stellar cash flow profile, and its growing ‘Services’ segment, which in our view underpins Apple’s long-term growth trajectory.

While the potential launch of Apple’s first 5G-capable iPhone this calendar year will get most of the market’s attention in the short term, we are looking out past the firm’s upcoming new iPhone cycle. Apple’s Services segment includes sales generated through its digitally-oriented App Store, Apple Arcade, Apple Pay, Apple Music, Apple TV+, and iCloud services along with its more physically-oriented Apple Care services (fee-based services that includes hardware repairs among other things, and under certain programs, coverage for accidental damage to iPhones among other things).

From fiscal 2017 to fiscal 2019 (all of the upcoming figures are on a GAAP basis and are derived from the firm’s income statement), Apple’s Services segment saw its net sales grow by 42%. During this period, Apple’s Services segment’s gross margin expanded by over 870 basis points, hitting 63.7% in fiscal 2019. For reference, Apple’s ‘Products’ segment posted a gross margin of 32.2% in fiscal 2019 and saw its sales grow by 9% from fiscal 2017 to fiscal 2019. For now, Apple’s Products segment is still far larger in terms of revenue and gross profit than its Services segment but please keep in mind that its Services segment has grown tremendously (in terms of revenue and gross profit) over the past few fiscal years.

Due to rising confirmed cases of COVID-19 and the related increase in hospitalizations in parts of the US, Apple announced that as of Saturday June 20, the company would temporarily close 11 stores across four states (Arizona, Florida, North Carolina, and South Carolina). It is possible that additional stores may get shut down temporarily if the situation continues to worsen. While this news highlights why there are growing fears of a second wave of COVID-19 infections in the US (and elsewhere), this news does not change Apple’s long-term growth trajectory and is more representative of the short-term headwinds global economies will face when attempting to resume “normal” activities during the pandemic. Please note we added a hedge to both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios on June 11 by adding SPDR S&P 500 ETF Trust (SPY) put options to each newsletter portfolio.

Our recently revised fair value estimate for shares of AAPL sits at $344 and the top end of our fair value estimate range sits at $413 per share of Apple. We remain very optimistic on the tech giant’s growth runway and see the firm as well-positioned to ride out near-term headwinds, especially as its Services segment continues to grow both in absolute terms and as a percent of Apple’s overall business. Apple’s goal is to double its Services revenue in fiscal 2020 over fiscal 2016 levels, and the company had this to say during its latest quarterly conference call:

“Turning to Services. We set an all-time revenue record of $13.3 billion [in the second quarter of fiscal 2020] with strong performance across the board with all-time revenue records in the App Store, Apple Music, Video, cloud services, and our App Store search ad business. And we also set a March quarter record for AppleCare. Our new services, Apple TV Plus, Apple Arcade, Apple News Plus and Apple Card continue to add users, content and features while contributing to overall Services growth.

As [CEO] Tim [Cook] mentioned, we’re well on our way to accomplishing our goal of doubling our fiscal ‘16 Services revenue during 2020.

App Store revenue grew by strong double digits, thanks to robust customer demand for both in-app purchases and subscriptions. Our third-party subscription business grew across multiple categories and increased over 30% year-over-year, reaching a new all-time high. Our first party subscription services also continued to perform very well. Apple Music and cloud services, both set all-time revenue record and AppleCare set a March quarter record. Paid subscriptions for all three of these services were up strong double-digits.

Customer engagement in our ecosystem continues to grow strongly, and the number of both transacting and paid accounts on our digital content stores reached a new all-time high during the March quarter. In particular, the number of paid accounts increased double digits in all of our geographic segments. We now have over 515 million paid subscriptions across the services on our platform, up 125 million from a year ago. On a sequential basis, paid subscriptions grew by over 35 million. This is the highest sequential growth we have ever experienced. With this momentum, we’re confident we will reach our increased target of 600 million paid subscriptions before the end of calendar 2020.” — Luca Maestri, CFO of Apple

We appreciate that Apple’s Services segment hit an all-time record in terms of revenue in the fiscal second quarter. Going forward, while the ongoing pandemic will create plenty of volatility in Apple’s financial and operational performance, we appreciate the strong momentum Apple’s Services segment has seen of late.

As it relates to Apple’s Hardware segment and its near- to medium-term growth trajectory, some analysts see its first 5G-capable iPhone potentially getting announced in September 2020 for an October 2020 rollout. We will keep our members informed on all related updates as its concerns Apple and its various growth initiatives. On a final note, please keep in mind Apple intends to reach “a net cash neutral position over time” indicating material share repurchases and per share dividend increases will continue over the coming years.

Microsoft

At the end of Microsoft’s third quarter of fiscal 2020 (period ended March 31, 2020), the firm carried a net cash position of $71.0 billion (defined as total cash, cash equivalents, and short-term investments less current portion of long-term debt less long-term debt). Additionally, please note Microsoft had $2.7 billion in equity investments at the end of this period, which could be considered cash-like assets. As with Apple, Microsoft has also been repurchasing its stock though at a much more moderate pace. In the third quarter of fiscal 2020, Microsoft’s weighted average outstanding diluted share count fell by roughly 1% year-over-year.

From fiscal 2017 to fiscal 2019 (period ended June 30, 2019), Microsoft generated $34.0 billion in annual free cash flows on average which fully covered $12.8 billion in average annual dividend obligations during this period. Microsoft’s annual share repurchases averaged $14.0 billion during this period, which were also fully covered by its average annual free cash flows. Microsoft’s cash flow profile is stellar.

As with Apple, we give Microsoft “EXCELLENT” Dividend Safety and Dividend Growth ratings which are supported by its Dividend Cushion ratio of 3.9. We model in double-digit annual per share dividend increases in Microsoft’s Dividend Cushion ratio, made possible through its high-quality cash flow profile, pristine balance sheet, and strong growth outlook that is underpinned by its growing cloud-computing and intelligent business applications businesses.

Microsoft’s ‘Intelligent Cloud’ segment posted 27% year-over-year revenue growth in the fiscal third quarter (up 29% on a constant-currency basis) which was made possible in part by its Azure revenues growing by 59% year-over-year during this period (up 61% on a constant-currency basis). Azure is Microsoft’s cloud computing service provider. Pivoting to Microsoft’s ‘Productivity and Business Processes’ segment, which posted 15% year-over-year revenue growth in the fiscal third quarter (up 16% on a constant-currency basis), that was made possible in part by its Dynamics 365 revenues growing by 47% year-over-year (up 49% on a constant-currency basis). For reference, Dynamics 365 provides customers a set of intelligent business applications that utilize data analytics and artificial intelligence (‘AI’) to help Microsoft’s clients to better understand and ultimately improve their operations and financial performance.

Our recently revised fair value estimate for shares of MSFT sits at $195 per share and the top end of our fair value estimate range sits at $234 per share of Microsoft. The firm’s long-term growth trajectory is impressive and secular growth tailwinds are providing an immense amount of support during these challenging times. While Microsoft’s Azure operations started off to a relatively slow start compared to some of its peers, namely Amazon Inc (AMZN), Microsoft is really starting to gain ground in the cloud computing arena. Here is what Microsoft’s management team had to say during the firm’s latest quarterly conference call:

“Now on to Azure. Now more than ever, organizations are relying on Azure to stay up and running, driving increased usage. We have more data center regions than any other cloud provider. And this quarter, we announced new regions in Mexico as well as in Spain. We are the only cloud that extends to the edge, with consistency across operating models, development environments and infrastructure stack. Now Azure Edge Zones extends Azure to the network edge, connecting directly with the carriers’ 5G network to enable immersive real-time experiences that require ultralow latency. And our acquisition of Affirmed Networks will help operators deploy and maintain 5G networks and services cost effectively and securely.

From BlackRock (BLK) to Coca-Cola (KO) to Genesys, leading companies in every industry are choosing Azure. The NBA is using Azure and our AI capabilities to build their own direct-to-consumer experiences, and the world’s largest companies like AB InBev (BUD) and Mars continue to migrate their SAP (SAP) workloads to our cloud. In AI, customers are applying a comprehensive portfolio of tools and services and infrastructure to address unique challenges, including those created by COVID-19. In health care, we are seeing compute data and AI come together to help speed up response from testing to therapeutics and vaccine development. Health care providers have created more than 1,400 bots using our Healthcare Bot service, helping more than 27 million people access critical health care information.” — Satya Nadella, CEO of Microsoft

Microsoft announced on June 18 it had acquired ADRM Software which is billed as “a leading provider of large-scale industry data models.” We like the deal as it allows for Microsoft to provide more targeted and nuanced intelligent business services and offerings to its existing and potential clients. Financial terms of the deal were not disclosed. Due to the ongoing pandemic, there will be volatility in Microsoft’s short-term financial and operational performance going forward, but we remain optimistic on its long-term growth trajectory.

Concluding Thoughts

We strongly encourage our members to check out our recently updated 16-page Stock Reports and two-page Dividend Reports covering Apple (I, II) and Microsoft (I, II) that can be accessed through our website. Companies with pristine balance sheets and high quality cash flow profiles that are also supported by secular growth tailwinds offer investors some of the best ways to navigate the current market environment. Apple and Microsoft offer a combination of capital appreciation and dividend growth upside to investors that we find very appealing. As of this writing, shares of AAPL and MSFT yield ~0.9% and ~1.1%, respectively.

—–

Computer Hardware Industry – AAPL BB HPQ IBM TDC

Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM

Internet Content & Services Industry – GOOG GOOGL BIDU FB JD TCEHY TWTR