Image Source: Honeywell International Inc – Fourth Quarter of 2020 IR Earnings Presentation

By Callum Turcan

Two industrial bellwethers reported fourth quarter earnings for 2020 recently, Caterpillar (CAT) and Honeywell (HON). Industrial companies were hit extremely hard by the coronavirus (‘COVID-19’) pandemic last year due to a myriad of factors from production lines getting shut down to deteriorating end-user demand, though things are starting to improve as global health authorities steadily work towards putting an end to the public health crisis now that vaccine distribution activities are underway. Both industrial firms covered in this note mentioned that they expect their financial and operational performance to improve going forward.

Caterpillar (CAT)

When Caterpillar Inc reported fourth quarter earnings for 2020 on January 29, the earthmoving-equipment maker missed consensus top-line estimates but beat consensus bottom-line estimates. The company’s business took a big hit from the COVID-19 pandemic, with its full-year GAAP revenues and GAAP operating income falling 22% and 45% year-over-year, respectively. However, Caterpillar expects its financial performance to improve in the first quarter of this year as it is seeing signs of improving end-user demand and the need for dealers to restock their inventories (after dealer inventories declined in the final quarter of 2020, according to Caterpillar, keeping in mind these dealers are independent entities).

Last year, Caterpillar’s ‘Machinery, Energy & Transportation’ industrial segment generated ~$3.1 billion in free cash flow (please note Caterpillar also has a large ‘Financial Products’ financing segment as well). We are impressed with Caterpillar’s free cash flow generating abilities, though we caution the construction equipment maker has a meaningful debt load. At the end of 2020, its Machinery, Energy & Transportation segment had a net debt load of $2.4 billion (inclusive of short-term debt) while its Financial Products segment had a total debt load of $27.0 billion (inclusive of short-term debt and borrowings with consolidated companies), which was modestly offset by $0.5 billion in cash and cash equivalents on hand (though this segment has material short- and long-term receivables on the books).

Management expects Caterpillar’s adjusted (non-GAAP) operating profit will improve sequentially in the first quarter of 2021 as the firm begins to recover from the COVID-19 pandemic. The company did not provide full-year guidance for 2021 as serious near-term headwinds remain. Looking ahead, Caterpillar aims to expand its offerings with an eye towards growing its services sales. During the firm’s latest earnings call management noted that (moderately edited, emphasis added):

“As you know we have a target of doubling our services revenue from 2012 to 2026. Our annual services revenue declined 13% to $16 billion in 2020 versus the prior year. As we expected, services were less cyclical than original equipment and rose as a percentage of sales representing 41% of ME&T sales in 2020.

Year-over-year services declines reflected the reduction in machine hours related to the pandemicand customer decisions to delay planned maintenance and rebuilds as they sought to conserve cash. However, we did see an increase in customer value agreements… with over 1 million connected assets we feel we have critical mass from our connectivity perspective which will leverage to increase services sales over time. In the coming year we expect to return to growth in services, we did see positive momentum from the third to the fourth quarter of 2020.” — Jim Umpleby, CEO of Caterpillar

Bigger picture, Caterpillar had this to say regarding its outlook for end-user demand during its latest earnings call (emphasis added):

“Market conditions remain fluid due to the pandemic. However, I’ll provide some thoughts based on what we see today. In construction industries we see construction in North America benefiting from increased residential demand. We expect a strong selling season in China including demand for our new GX excavator line.

We expect continued recovery in the rest of Asia-Pacific. The current shutdown in some regions of EMEA may constrain construction activity in Europe in the short term. However, we expect improved market conditions due to favorable expansionary policies as well as benefits from higher commodity prices in Africa, the middle east and Eurasia. In Latin America we see Brazil’s construction sector supportive of machine demand while weakness outside Brazil is expected to continue at least in the short term.

Turning to resource industries. The improvement in mining fundamentals is expected to continue. We anticipate most mined sites to continue operating with limited disruptions and high levels of truck activity.” — CEO of Caterpillar

It appears that the industrial rebound is widespread, though there are pockets of weakness, according to Caterpillar’s CEO. As of this writing, shares of Caterpillar are trading in the upper end of our fair value estimate range. We view the company’s forward-looking dividend coverage favorably as the firm has a Dividend Cushion ratio of 1.9, earning Caterpillar a “GOOD” Dividend Safety rating. Please note these metrics incorporate our assumptions that Caterpillar will steadily grow its per share payout going forward. Shares of CAT yield ~2.3% as of this writing.

Honeywell (HON)

On January 29, Honeywell International Inc reported fourth-quarter earnings for 2020 that beat consensus top-line estimates and on a non-GAAP basis, beat consensus bottom-line estimates as well. The industrial conglomerate faced meaningful headwinds last year at most of its business operating segments including at its ‘Aerospace’ and ‘Performance Materials and Technologies’ divisions, though Honeywell’s ‘Safety and Productivity Solutions’ [‘SPS’] division performed quite well as the pandemic drove up demand for personal protective equipment (‘PPE’).

Last year, Honeywell’s GAAP revenues and GAAP diluted EPS were down 11% and 20% year-over-year, respectively, though the company noted it reported meaningful sequential improvement in its financial performance last quarter. Honeywell expects its financial performance will rebound in 2021 with management guiding for both organic sales growth and margin expansion this year. During Honeywell’s latest earnings call, management noted the firm expects to post stronger financial performance in 2021 due to widespread strength across its various business segments, with its SPS business leading the way. Cost structure improvements, particularly those embarked on during the COVID-19 pandemic, are also key. Honeywell’s management team had this to say on the issue during the firm’s latest earnings call (emphasis added):

“On the cost side, we responded fast and early to the crisis by identifying and delivering on a two-phase cost program, which achieved $1.5 billion in year-over-year fixed cost savings as we had committed. Approximately 70% of these savings or about $1 billion represent a permanent reduction to our fixed cost base.

To achieve this, we curtailed discretionary expenses, took temporary actions to reduce costs, including reducing Executive and Board pay, and remove significant structural costs through our repositioning programs. Our streamlined cost base positions us well for 2021 recovery and will drive margin expansion across all four of our segments, as well as capacity for investment as sales recover in 2021 and beyond.” — Greg Lewis, CFO of Honeywell

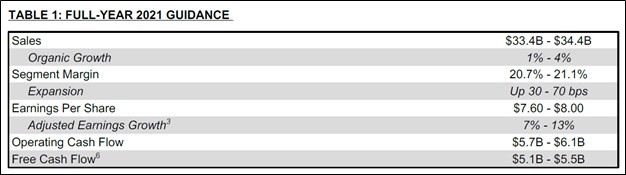

Honeywell’s guidance for 2021 can be viewed in the upcoming graphic down below. Please note the firm expects to generate $5.1-$5.5 billion in free cash flow this year.

Image Shown: Honeywell expects its financial performance will rebound in 2021 after a harrowing 2020. Image Source: Honeywell – Fourth Quarter of 2020 Earnings Press Release

Management had the following to say during Honeywell’s latest earnings call as it concerns the firm’s SPS business (moderately edited, emphasis added):

“In SPS, organic sales were up 27% year-over-year [in the fourth quarter of 2020], a very strong result to end the year in which the SPS team stepped up to meet unprecedented demand for critical safety products. Intelligrated and personal protective equipment led the way with another quarter of double-digit organic growth, followed by high single digit growth in productivity solutions and services. We are encouraged by the turnaround in 2020 that team has orchestrated in 2020.

SPS exited 2020 with a backlog of approximately $4 billion, which was nearly double our backlog at the end of 2019, placing the business in a very strong position to start 2021, where we expect to see a robust first half in particular…

…in SPS, we expect continued strength [this year] in warehouse automation and personal protective equipment, as we execute the delivery of our robust backlog. We also expect productivity solutions and services to grow, as the strategic turnaround of the business drives market share gains, and we expect gas sensing to recover in line with the market. In total, we expect SPS to grow double digits in ’21 with comps getting tough in the back half as we lap strong growth from the back half of 2020.” — CFO of Honeywell

We continue to like exposure to Honeywell in our Dividend Growth Newsletter portfolio given its improving outlook and strong free cash flow generating abilities. In 2020, Honeywell generated $5.3 billion in free cash flow even when faced with serious exogenous headwinds, while spending $2.6 billion covering its dividend obligations and another $3.7 billion buying back its stock.

Honeywell had a net debt load of $7.2 billion (inclusive of short-term debt and not including ‘investments and long-term receivables’) at the end of 2020, though we view that burden as manageable given its stellar cash flow profile. In our view, it would be prudent for Honeywell to take advantage of expected improvements in its financial performance this year to pare that burden down.

Shares of HON yield ~1.9% as of this writing, and we view its forward-looking dividend coverage quite favorably. Honeywell has a Divided Cushion ratio of 2.3, earning the firm a “GOOD” Dividend Safety rating, and please note these metrics incorporate our expectations that its per-share dividend will grow at a brisk pace going forward. As of this writing, shares of Honeywell are trading in the bottom half of our fair value estimate range.

Concluding Thoughts

2020 was a tough year for the industrial sector, and the world at large, though things are starting to improve with both Caterpillar and Honeywell communicating to investors that 2021 will likely be a year of recovery. We continue to be big fans of Honeywell and would like to note that when the aerospace industry starts to recover in earnest, particularly as it concerns commercial airplane production, that will go a long way in improving Honeywell’s financial and operational performance going forward.

Members interested in reading more about Honeywell are encouraged to check out this article here.

—–

Related: CAT, HON

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Honeywell International Inc (HON) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.