Member LoginDividend CushionValue Trap |

Serious Question: What Are You Looking At?

publication date: Oct 12, 2022

|

author/source: Brian Nelson, CFA

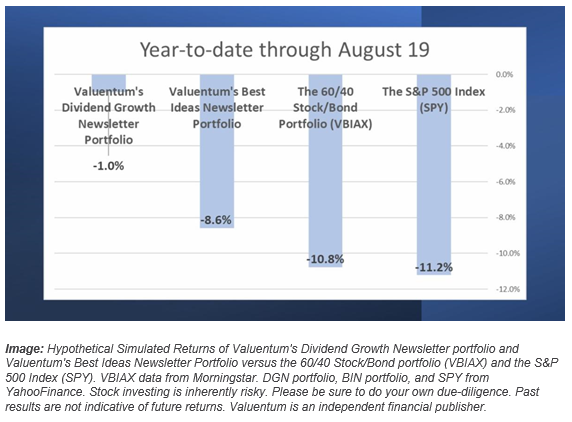

Image: Stocks with the largest 52-week losses, according to YahooFinance. By Brian Nelson, CFA Thank goodness that you're subscribed to a service that didn't include any of the above as top ideas in their simulated newsletter portfolios. Many were chasing returns in 2021 and are now left holding the bag this year, but we stuck to our methodology and processes, and we didn't expose members to tremendous risks. That's what it's all about. With that said, let's talk about how we successfully navigated a number of these terrible ideas in the Exclusive publication, a monthly resource that includes an income idea, a capital appreciation idea, and a short idea consideration, released to members each month on the 8th. Exclusive Long Ideas We highlighted Square (SQ), now Block, in the December 2017 edition of the Exclusive and closed it for a 90% hypothetical "gain" in October 2018. We highlighted Teladoc Health (TDOC) in the May 2019 edition of the Exclusive publication and closed it for a 11.8% hypothetical "gain" in July 2019. We highlighted Shopify (SHOP) as an idea in the Exclusive publication in November 2019 and closed it for a hypothetical 24% "gain" in December of that year. We highlighted Okta Inc. (OKTA) in the September 2020 edition of the Exclusive publication and closed it the next month for a 11.5% hypothetical "gain." We highlighted Farfetch (FTCH) in the October 2020 edition of the Exclusive and closed it for a 7.1% hypothetical "gain." Exclusive Short Ideas We highlighted Snap, Inc. (SNAP) as a short idea consideration in May 2017 and closed it out in shortly thereafter for a 25.9% hypothetical "gain." We highlighted Peloton (PTON) as a short idea consideration in the October 2019 edition of the Exclusive publication and closed it for a modest 4.5% hypothetical "gain" in March 2020. We highlighted AMC Entertainment (AMC) in the October 2020 edition of the Exclusive publication and closed it out shortly thereafter for a nice 26.9% hypothetical "gain." We highlighted DoorDash (DASH) in the January 2021 edition of the Exclusive publication and closed it for a modest hypothetical 3% "gain" in March 2021. We highlighted Twilio (TWLO) in the October 2021 edition of the Exclusive publication and closed it for an 8.8% hypothetical "gain" that month. Success Rates in the Exclusive We currently have Okta Inc. open as a short idea consideration in the Exclusive publication, and it is materially lower since its September 2022 highlight. We currently have Sea Limited (SE) as an open capital appreciation idea consideration, and it is the only stock on this list that we have been "wrong" on. Now that's a track record! Today, the stocks mentioned above have become some of the worst-performing stocks in the past 52 weeks, and their year-to-date performance has been nothing short of atrocious. To be successful as an investor, one has to have not only a strong consider buying discipline but also a strong consider selling discipline, and that's what we did with flying colors when it came to some of the most speculative stocks on the marketplace that were highlighted in the Exclusive publication. Though we may have let companies such as Meta Platforms (META) and PayPal (PYPL) run too long in the simulated Best Ideas Newsletter portfolio, we made some great moves in the Exclusive publication on some of the riskiest stocks. Remember -- the simulated Best Ideas Newsletter portfolio targets capital appreciation on the portfolio level over the long haul, while the Exclusive publication targets success rates on each individual idea. These are two different approaches, and we can never tell you what to do. The success rate for capital appreciation ideas in the Exclusive publication is 82.7% (62 out of 75), while the success rate for short idea considerations is 92% (69 out of 75). We define the success rate as the percentage of ideas highlighted in the Exclusive that have moved in the direction of our thesis (i.e. up for capital appreciation ideas and down for short idea considerations) through the current price or closed price, with consideration of cash and stock dividends. Success rates do not consider trading costs or tax implications. In a market of the worst of the worst stocks, we did fabulous. The High Yield Dividend Newsletter Portfolio You look at other resources on the web, and many of them have no shame. The Vanguard Real Estate ETF (VNQ) is down 33% so far this year on a price-only basis, and if you didn't know any better, you might think their stocks are up 50% or more! Things don't get better on a five-year look-back period for the REITs either. On a price-only basis, the VNQ is down more than 9%, and this compares to areas such as large cap growth (SCHG), for example, that is up nearly 65% over the same time period. The iShares Mortgage Real Estate Capped ETF (REM) is down more than 40% year-to-date, and it is off nearly 56% during the past five years, both measures on a price-only basis! We last updated the "performance" of the High Yield Dividend Newsletter through June 22, and the simulated portfolio, which was down 7.26% at the time, was doing better than the ProShares High Yield ETF (-8.9%), the SPDR S&P 500 Dividend ETF (-9.61%), the Vanguard Real Estate ETF (-21.8%), the SPDR Portfolio S&P 500 High Dividend ETF (-7.34%), and most every major market index, including the S&P 500, the Dow Jones Industrial Average and the NASDAQ 100 -- all data retrieved from Seeking Alpha. The simulated newsletter portfolio currently offers a nice estimated forward dividend yield of ~5.6%, too, and we like the diversified array of ideas held within. It begs a serious question: What are you looking at? The Dividend Growth Newsletter Portfolio and Best Ideas Newsletter Portfolio We last updated the "performance" of the simulated Dividend Growth Newsletter portfolio on August 19, and it was down only modestly on the year, and we're huge fans of the selection of names included within. The simulated Best Ideas Newsletter was also "outperforming" not only the S&P 500 at that time, but also the 60/40 stock bond portfolio.

So What Are You Looking At? I've been serving individual investors, financial advisors and institutional investors for more than a decade at Valuentum -- and longer throughout my career -- and the answer is that everyone is looking at something different. You're never going to truly know what's going inside everyone's heads. For example, instead of closing out some of the big winners in the Exclusive, some investors may have held on and are suffering through 2022. Instead of building a diversified portfolio as in the High Yield Dividend Newsletter portfolio, Dividend Growth Newsletter portfolio, Best Ideas Newsletter portfolio, and ESG Newsletter portfolio, some investors may have only picked one or two of the stocks included within. Some investors may only be interested in the pace of a company's dividend growth and may not care that they burned through years' worth of yield by being exposed exclusively to REITs, as those held in the VNQ or REM, for example. Not paying attention to the prices of your stocks in a strategy is nothing to be proud of -- it's irresponsible! In hindsight now, many investors perhaps wanted us to call the top earlier this year, but that was near-impossible at the time. Inflation was still very much a positive to equity returns, and inflation didn't start weakening consumer spending until this year. Quite frankly, we had to let things evolve a bit during 2022, and when the facts changed, we changed our minds, too. We went bearish on August 19, and the markets have fallen considerably since then. Every investor is looking at something different. The Bad News Keeps Pouring In We've written many a note these past couple months on the swift change in the health of the broader global economy. FedEx (FDX) continues to warn about the economy, we're seeing some stiff inventory builds across the consumer discretionary sector, consumer staples entities such as Mondelez (MDLZ) and Pepsi (PEP) continue to exhibit pricing power that will weigh on consumer discretionary spending, and the list of negatives has continued. We've talked about Apple reducing its plans to suppliers to increase production of the iPhone 14, we saw the warning from AMD (AMD), and we wouldn't be surprised if Meta issues a very troubling outlook due to advertising weakness, the rise of TikTok, and criticism over its latest VR/AR headset. Intel (INTC) is now laying off thousands of workers, and warnings from the likes of PPG Industries (PPG), Leggett and Platt (LEG), and Levi Strauss (LEVI) have all but soured the mood. Concluding Thoughts We've handled the worst performers of 2022 quite handily, and the simulated newsletter portfolios are showcasing the importance of our methodology and processes. We expect things to get worse in the economy before they get better, but we maintain our view that there may be nothing better out there than a subscription to Valuentum to navigate these tumultuous times. So what are you looking at? ----------

Video: Valuentum's President of Investment Research, Brian Nelson, CFA, explains the importance of diversification, how to think about firm-specific and systematic risk, how many stocks one should own to achieve 90% of the diversification benefits, how to think about active asset allocation versus active equity management, and why diversification is a means to achieve goals, not the goal itself. A content-packed 14-minute video. Don't miss it! ----- Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. |

0 Comments Posted Leave a comment