Member LoginDividend CushionValue Trap |

Public Storage Currently Has the Financial Strength to Support Its Payout

publication date: May 6, 2020

|

author/source: Callum Turcan

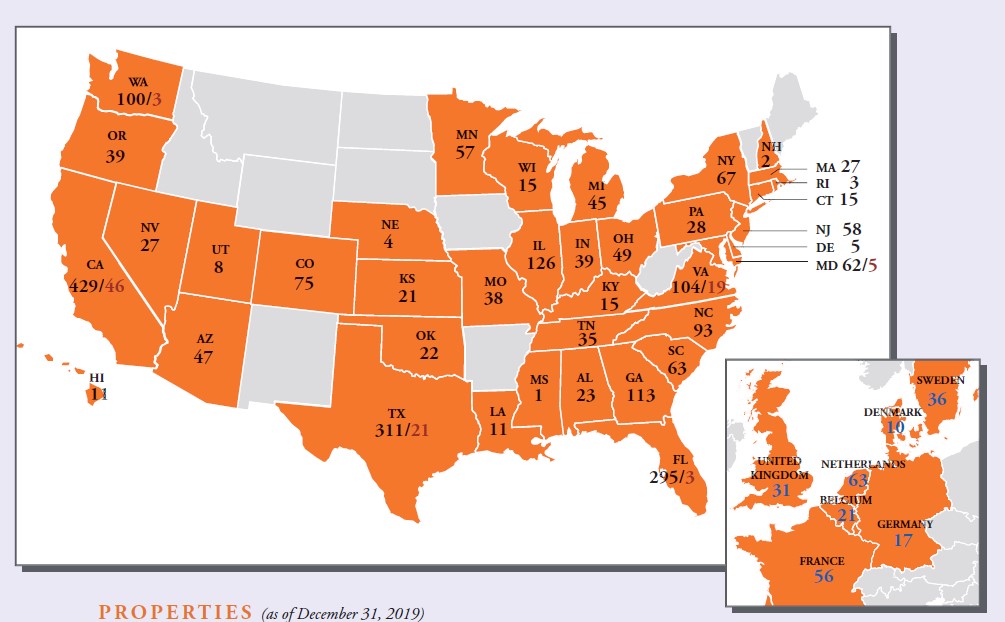

Image Source: Public Storage – 2019 Annual Report By Callum Turcan High Yield Dividend Newsletter portfolio holding Public Storage (PSA) reported its first quarter results for 2020 on May 1. The self-storage real estate investment trust’s (‘REIT’) core funds from operations (‘FFO’) per share grew by 2% year-over-year last quarter, hitting $2.58 per share, while its occupancy rate (as measured by its rentable square feet) grew by ~60 basis points year-over-year, reaching 93.1%. Public Storage was also able to push through marginal same-store rent increases, though rising operating costs (particularly property taxes, payroll expenses, and marketing expenses) chipped away at its margins last quarter. As of this writing, shares of PSA yield ~4.4%. Public Storage owns and operates self-storage facilities in the US and Western Europe, as one can see in the upcoming graphic down below. While Public Storage was contemplating moving into the Australian self-storage market, a process that included submitting a non-binding proposal to acquire all of National Storage REIT’s equity in February 2020, Public Storage announced it was no longer pursuing that potential acquisition as of March 2020 given rising exogenous headwinds. We think this reversal is prudent given the need for Public Storage to maintain its financial position to ride out the storm.

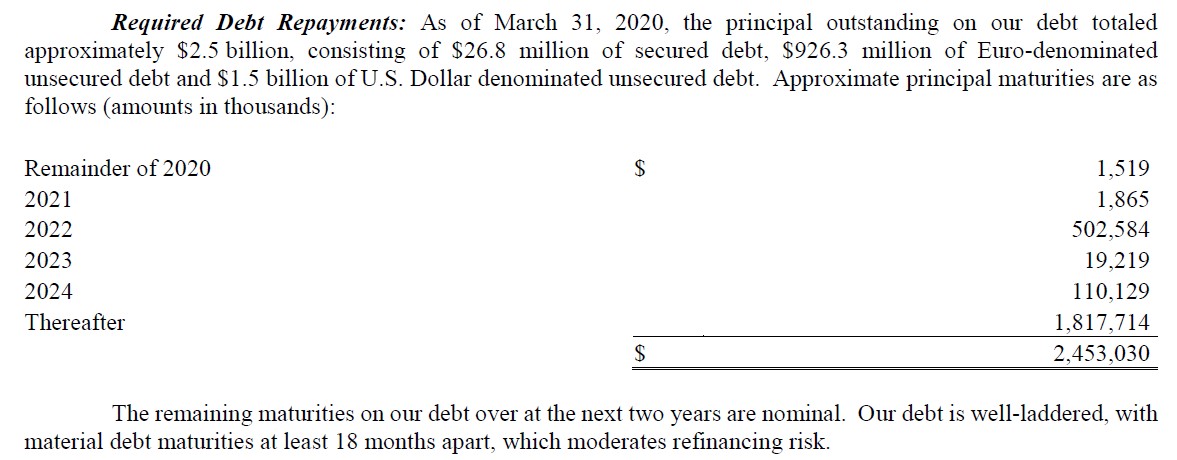

Image Shown: An overview of Public Storage’s asset base as of the end of 2019. Image Source: Public Storage – 2019 Annual Report Let’s start by covering the headwinds Public Storage has been facing before digging into its financial strength. First, Exogenous Headwinds Going forward, management expects that the ongoing coronavirus (‘COVID-19’) pandemic will depress Public Storage’s occupancy rates and same-store rental income this year, while pressures from operating expenses will remain. From April 1, 2020 to June 30, 2020, Public Storage has approved a temporary $3.00 per hour pay bump for its property manages given that self-storage units have been deemed an “essential” business and thus continue to operate during stay-at-home orders imposed in states across the US. Furthermore, management noted that bad debt expenses could exceed historical levels in the near-term in part due to surging unemployment rates across the country and in part due to the inability to auction off units that have been foreclosed on (which results in rental revenue recoveries). Public Storage noted that existing customers may have their rental contracts “roll[ed] down” which means that the new rental rates will be lower than the previous rates, which is what occurred during the Great Financial Crisis (‘GFC’) and remains a possibly (though this dynamic hasn’t played out in a material way yet according to managment). Getting new occupants will be tough given stay-at-home orders that are still in effect will limit the movement of these potential occupants for Public Storage and the industry as a whole. The REIT has also temporarily suspended its tenant revenue rate increases. In all, Public Storage expects its financial performance will deteriorate in 2020 in the face of exogenous headwinds. During the REIT’s latest quarterly conference call, management noted that Public Storage was seeing “a decline in new move-in volumes” yet its existing tenants were “performing well at this point” and that “collection have been solid in April” which we appreciate. The sky isn’t falling, but the kind of organic growth Public Storage has been able to churn out over the past several years (i.e. rental increases and high occupancy rates) won’t be possible in the short-term. Public Storage has scaled back its capital investment expectations to conserve cash and in light of delays in permitting and construction activity. Here’s a key excerpt from Public Storage’s first quarter earnings press release (emphasis added): Since late March 2020, we have seen significant reductions in demand for self-storage space, and as a result, our move-in volumes, despite lower move-in rental rates, have also declined significantly, offset partially by lower move-out volumes. The reduction in move-out volumes may be temporary or even reverse, to the extent they are driven by short-term factors such as stay at home orders and delays in our auction process. We have also temporarily curtailed our existing tenant rate increase program. Because existing tenant rate increases have contributed the majority of our increase in rental income in recent years, curtailment of these increases will have a material adverse impact on our revenue growth. These curtailments will impact our revenue subsequent to March 31, 2020. It is possible that the COVID Pandemic could change consumer behavior, either due to economic recession, uncertainty, or dislocation, as well as other factors, which could increase customer sensitivity and propensity to move-out in response to rate increases, either in the short or longer term. Please note that the US self-storage industry was already facing some industry-level problems heading into 2020, largely that supply growth in many US markets had gotten ahead of the expected demand growth (a dynamic that was expected to reverse by the end of 2020 or 2021 before the pandemic came into play). We covered this situation and the industry’s promising long-term growth trajectory in this article here. Considering that construction and renovation activity has slowed down to a crawl in most of the US due to the pandemic, that may help alleviate the oversupply problem over time when demand rebounds. With all of this in mind, there’s still plenty to like about the self-storage REIT. Financial Update and Opportunities In the first quarter of 2020, Public Storage generated $463 million in net operating cash flow and spent $105 million on capital expenditures, allowing for $358 million in free cash flow. While most REITs aren’t free cash flow positive given their large capital expenditure budgets, many players in the self-storage space are. Public Storage’s free cash flows didn’t fully cover $402 million in ‘distributions paid to preferred shareholders, common shareholders and restricted share unitholders’ in the first quarter as the REIT remains capital market dependent, meaning it must retain continuous access to debt and equity markets at attractive rates to make good on its payout obligations and growth ambitions. However, having positive free cash flows makes retaining access to capital markets a much easier task. Public Storage carries high quality investment grade credit ratings (A/A2) according to its 2019 Annual Report. In January 2020, Public Storage issued out €500 million (~$552 million US dollars) Euro denominated Senior Unsecured Notes with a 0.875% coupon that mature in January 2032, highlighting its ability to tap debt markets at attractive rates. Public Storage ended March 2020 with $718 million in cash and cash equivalents on hand. Having a large cash pile on hand is another key differentiator between Public Storage and the rest of the REIT world (which generally does not retain a meaningful amount of cash on hand), and we appreciate its liquidity position. The firm exited the first quarter of 2020 with $2.4 billion in total debt (inclusive of short-term debt), meaning it still carries a large net debt load. Public Storage’s capital structure is heavily weighted towards equity as its debt-to-capital ratio stood at ~21% at the end of the first quarter (defined as its interest-bearing debt, ‘senior unsecured notes’ plus ‘mortgage notes payable’, divided by total capital). Management is confident in Public Storage’s balance sheet strength (from the firm’s latest quarterly conference call): “[The] balance sheet is in great shape, as we’ve discussed on previous quarterly calls. And we’re sitting right now with debt to EBITDA just to touch over 1 times, fixed charge coverage around 8 times, and over $700 million in cash on the balance sheet. So, we feel very good about our financial and liquidity position to take advantage of potential opportunity, should it arise.” --- Tom Boyle, CFO of Public Storage Management thinks that the aforementioned self-storage oversupply problem in the US could represent an opportunity for Public Storage, particularly due to the REIT’s ability to acquire financially distressed self-storage properties at advantageous prices (made possible through Public Storage’s strong financial position). Here’s a lightly edited key excerpt from Public Storage’s latest quarterly conference call (emphasis added): “…A number of owners that have come into the sector, particularly over the last three or four years where we’ve seen an abundance of new supply coming into the market, particularly with owners and ownership structures that may not be well suited to deal with something like this [the ongoing pandemic]. There could be, again, a predictable fact, which would be more ability to capture assets, again, a price point that we think is very different and much more attractive than it’s been over the last, say, three or four years. We’re starting to hear, again, some rumblings around assets that I would say are underwater, where they’ve been funded through a certain level of debt. And the valuations are below that value… …the ability for us to in particular, take advantage of an environment that could create that additional level of transaction activity, the balance sheet is ready for it. And it’s ready in a meaningful way. So, we’ll see how that plays through.” --- Joseph Russel, CEO of Public Storage Bolt-on acquisitions could represent a good way to consolidate the self-storage space in the US and elsewhere without stressing Public Storage’s financial position; however, larger deals need to contend with Public Storage’s need to keep making good on its dividend obligations while also being in a financial position to refinance its debt load. One key consideration is when Public Storage’s debt comes due, as the REIT will need to refinance that burden given that all of its free cash flows (and then some) are going towards covering its dividend/distribution obligations. As one can see in the upcoming graphic down below, Public Storage doesn’t have any meaningful debt maturities until 2022 and furthermore, its maturities for the remainder of 2020 and in 2021 are negligible. Considering its sizable cash position, undrawn $500 million revolving credit line that matures in April 2024 (please note that Public Storage had a marginal amount of undrawn standby letters of credit posted against the credit facility at the end of the first quarter, which marginally reduces its borrowing capacity under the revolver), and apparent access to capital markets at attractive rates (with an eye towards its Euro denominated debt issuance in January 2020), we view Public Storage’s financial position as sound going forward.

Image Shown: Public Storage does not have any major debt maturities until 2022, as of the end of March 2020. Image Source: Public Storage – 10-Q filing covering the first quarter of 2020 Concluding Thoughts We continue to like Public Storage as an idea in our High Yield Dividend Newsletter portfolio, and additionally, we also like CubeSmart (CUBE) as an idea in that newsletter portfolio as well. Public Storage’s free cash flows, access to capital markets, and solid liquidity position should allow the self-storage REIT to emerge on the other side of the pandemic with its dividend intact. Once the storm passes, the self-storage industry (particularly in the US) should be able to recover quickly given that demand for these offerings are supported by secular growth tailwinds. Members interested in reading more about the self-storage space should considering checking out our latest commentary (link here) on Jernigan Capital Inc (JCAP), a self-storage REIT that’s undergoing a fundamental change in its business model. ----- Related: UHAL, CAR, PSA, R, URI, CUBE, EXR, JCAP, VNQ ---- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares of any of the securities mentioned above. CubeSmart (CUBE), Public Storage (PSA), and Vanguard Real Estate ETF (VNQ) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Vanguard Real Estate ETF is also included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

1 Comments Posted Leave a comment