Member LoginDividend CushionValue Trap |

Philip Morris International Issues Favorable Guidance

publication date: Feb 14, 2021

|

author/source: Callum Turcan

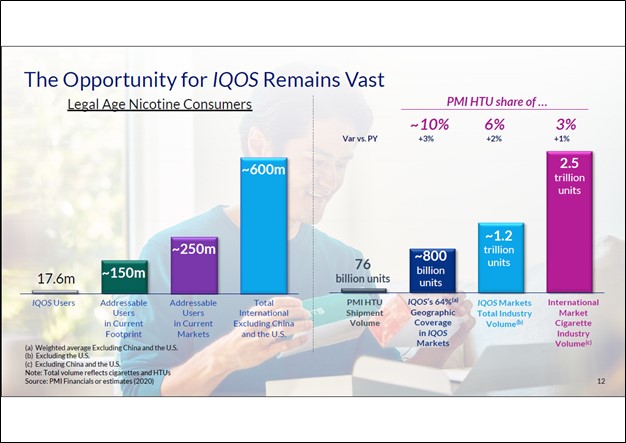

Image Shown: Philip Morris International Inc’s growth outlook rests heavily on its ability to grow its non-traditional cigarette sales volumes, and so far, the tobacco giant has put up tremendous performance on this front. Additionally, pricing power at its conventional cigarette business is also key, as that helps offset headwinds arising from secular declines in its annual cigarette shipment volumes. Image Source: Philip Morris International Inc – 2021 Investor Day Presentation By Callum Turcan During its 2021 Investor Day presentation held on February 10, tobacco giant Philip Morris International Inc (PM) reaffirmed its 2021 diluted EPS guidance and issued longer term guidance that was quite promising. The seller of Marlboro brand cigarettes in international markets (excluding the US and China) has historically offset headwinds that arise from secular declines in its annual cigarette shipment volumes through its impressive pricing power (made possible through the largely inelastic demand curve of tobacco products). However, more recently the company has been quite successful growing its unconventional tobacco product sales including its heated tobacco unit (‘HTU’) offerings. Its IQOS offerings (IQOS is not an abbreviation) is considered a HTU product and that offering has proven to be quite popular. We have covered Philip Morris International’s HTU growth ambitions extensively in the past including here and here. Rising HTU sales volumes and significant pricing power at its traditional cigarette offerings supports Philip Morris International’s outlook, and we continue to like the company as an idea in our High Yield Dividend Newsletter portfolio. Shares of PM yield ~5.6% as of this writing and the top end of our fair value estimate range sits at $91 per share. Philip Morris International has also been actively pursuing improvements in its cost structure. That strategy involves the firm focusing on generating manufacturing productivity gains and locating SG&A expense reductions, though digital investments and other endeavors are also important here. Unconventional Tobacco Product Sales Outlook The upcoming graphic down below highlights the enormous opportunity Philip Morris International is targeting via its IQOS and other HTU offerings. These unconventional tobacco offerings are targeted towards consumers seeking to quit smoking traditional cigarettes and attempt to replicate the conventional cigarette smoking experience. In 2020, Philip Morris International’s HTU shipment volumes were up roughly 28% year-over-year.

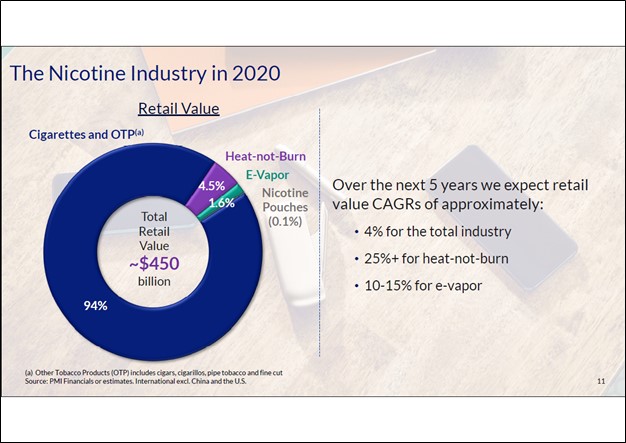

Image Shown: The market opportunity for Philip Morris International’s HTU offerings is enormous. Image Source: Philip Morris International – 2021 Investor Day Presentation In the upcoming graphic down below, Philip Morris International provides an overview of the retail value of the global tobacco market (excluding China and the US) as of 2020 and where the firm expects the industry to experience significant growth going forward. The growth rate in the retail value of HTU and e-vapor tobacco offerings are expected to significantly outpace broader growth in the retail value of tobacco products in the relevant markets over the next five years, according to Philip Morris International.

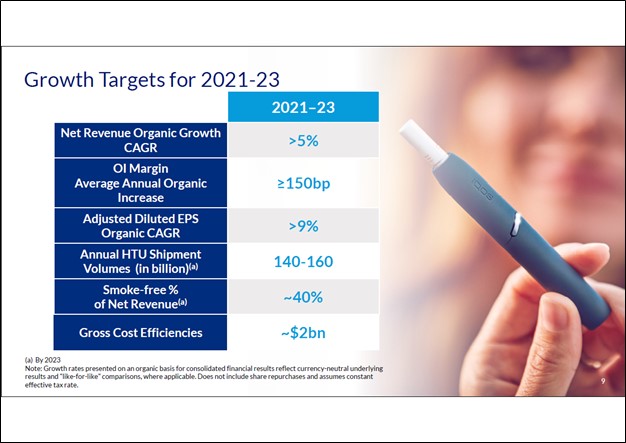

Image Shown: Traditional tobacco offerings, namely cigarettes, continue to dominate the industry in terms of market share though that will slowly change over time. Image Source: Philip Morris International – 2021 Investor Day Presentation Promising Guidance Philip Morris International reaffirmed its 2021 diluted EPS guidance of $5.90-$6.00 during its 2021 Investor Day presentation (based on currency exchange rates as of early-February 2021). That represents approximately 14%-16% growth over 2020 levels (the firm posted $5.16 in GAAP diluted EPS last year). Scale at its HTU business combined with broader corporate-level cost reductions is expected to provide a tailwind to Philip Morris International’s operating margins going forward. The tobacco giant aims to post net revenue growth north of 5% CAGR and diluted EPS growth north of 9% CAGR on an organic basis from 2021-2023. Management provides an overview of the firm’s 2021-2023 forecasts in the upcoming graphic down below. Additionally, management also noted during the company’s recent presentation that Philip Morris International expects to generate ~$35 billion in net operating cash flow from 2021-2023 at current exchange rates.

Image Shown: Philip Morris International’s medium-term guidance is quite promising, in our view. Image Source: Philip Morris International – 2021 Investor Day Presentation On February 4, Philip Morris International posted fourth quarter earnings for 2020 that beat both consensus top- and bottom-line estimates. The company generated $9.2 billion in free cash flow last year, broadly flat versus 2019 levels, while spending $7.4 billion covering its dividend obligations. Historically, Philip Morris International has not spent a significant amount (or any) towards buying back its stock. Given that the High Yield Dividend Newsletter portfolio focuses on locating high-quality ideas with juicy yields, we appreciate that Philip Morris International prioritizes its dividend obligations and key growth investments (though its capital expenditure requirements remain relatively modest) above another uses of capital (such as major acquisitions and share repurchases). At the end of 2020, the company had $7.3 billion in cash and cash equivalents on hand versus $3.4 billion in short-term debt and $28.2 billion in long-term debt. We view Philip Morris' net debt load as manageable given its ability to generate significant free cash flows in almost any environment and its impressive outlook. The firm has ample liquidity on hand and should be able to manage both its dividend obligations and refinancing needs going forward. Concluding Thoughts Philip Morris International did a solid job navigating major exogenous headwinds during 2020 and was still able to churn out gobs of free cash flow. We appreciate management’s promising guidance and continue to like exposure to Philip Morris International and its lofty yield in the High Yield Dividend Newsletter portfolio. To read more about the High Yield Dividend Newsletter portfolio, click here. PM's 16-page Stock Report (pdf) >> ----- Tickerized for PM, MO, BTI, IMBBY, GLLA, VAPE, JAPAY Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Philip Morris International Inc (PM) and Vanguard Consumer Staples ETF (VDC) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment