Member LoginDividend CushionValue Trap |

PepsiCo Earnings Update

publication date: Oct 18, 2020

|

author/source: Callum Turcan

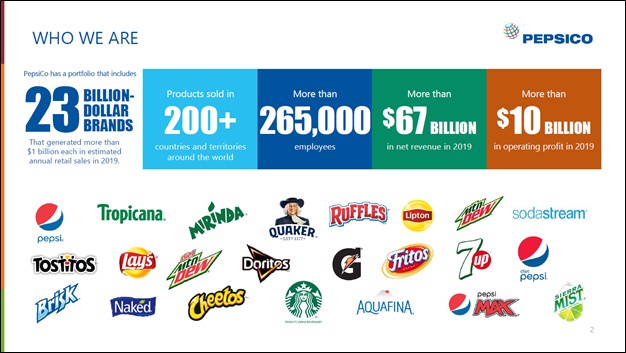

Image Shown: PepsiCo Inc’s expansive snacks and beverage portfolio is home to 23 brands that generated $1+ billion in annual retail sales in 2019. We are big fans of PepsiCo’s business model but caution that the firm’s net debt load needs to be closely monitored going forward, especially given management’s generous approach to dividends and share repurchases. Image Source: PepsiCo Inc – CAGNY 2020 IR Presentation By Callum Turcan Dividend aristocrat PepsiCo Inc (PEP) reported third-quarter fiscal 2020 earnings (period ended September 5, 2020) that beat both top- and bottom-line consensus estimates. PepsiCo’s organic revenue growth, a non-GAAP metric, stood out. During the fiscal third quarter and the first three quarters of fiscal 2020, PepsiCo’s organic revenue growth clocked in at 4.2% and 3.6%, respectively, on a year-over-year basis. For the full fiscal year, management is guiding for ~4% annual organic sales growth at PepsiCo. Quarterly Update Part of the reason why PepsiCo’s organic sales are growing is due to the pantry stocking trend in the wake of the ongoing coronavirus (‘COVID-19’) pandemic, with PepsiCo’s snacks business (Frito-Lay and Quaker Foods) performing quite well recently. Its beverage business has also performed well of late, with management citing its Pepsi Zero Sugar product as being in relatively high demand. PepsiCo has a great business model, and its cash flow profile is impressive, though we would prefer the company to pare down its large net debt load to improve its financial flexibility going forward. As of September 5, PepsiCo had $9.7 billion in cash, cash equivalents, and short-term investments on hand versus $6.7 billion in short-term debt and $37.9 billion in long-term debt. The firm remained very free cash flow positive during the first three quarters of fiscal 2020. Looking ahead, PepsiCo should be able to continue meeting its dividend obligations while managing its refinancing needs, in our view. PepsiCo expects it will generate ~$6 billion in free cash flow in fiscal 2020 while paying out ~$5.5 billion in dividends and spending ~$2 billion on share repurchases. In our view, management should take their foot of the gas pedal as it concerns share buybacks, especially as shares of PEP are generously valued as of this writing. Concluding Thoughts In May 2020, PepsiCo increased its quarterly dividend, and the firm was happy to announce that this marked its 48th consecutive year of annual dividend increases. PepsiCo has paid out quarterly dividends since 1965 and remains very committed to rewarding its shareholders. Organic sales growth will provide a tremendous amount of support to PepsiCo’s cash flows going forward. View its stock page here where you can download its 16-page stock report and supplemental dividend report. Recession Resistant: BUD, CL, CLX, CPB, COST, FDP, GIS, HRL, K, KDP, KHC, KMB, KO, KR, MDLZ, MKC, MO, PEP, PG, PM, SJM, TAP, TGT, TSN, WMT ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Vanguard Consumer Staples ETF (VDC) and Philip Morris (PM) are included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment