Image Source: Nvidia Corporation – Nvidia to Acquire Arm IR Presentation

By Callum Turcan

On September 13, Nvidia Corporation (NVDA) announced it would acquire Arm Limited (a semiconductor company with a heavy focus on smartphones and gaming devices) from SoftBank Group Bank Corp. (SFTBY) and SoftBank’s Vision Fund through a transaction valued at approximately $40 billion. That deal will see Nvidia pay SoftBank and the Vision Fund $12.0 billion in cash (including $2.0 billion payable at signing), $21.5 billion in Nvidia stock (equal to 44.3 million shares at the time of the announcement, though that figure could change as it depends on NVDA’s average closing price over the last 30 trading days), and the deal has an earn-out component that could see Nvidia pay an additional $5.0 billion in cash or stock if certain financial hurdles are met. Furthermore, Nvidia will issue $1.5 billion in equity to Arm’s employees if the deal closes.

Overview

Nvidia plans to fund the deal with cash on hand, and the deal does not include Arm’s ‘IoT Services Group’ with IoT standing for Internet of Things. This deal will face significant regulatory hurdles. Though the boards of Nvidia, Softbank, and SoftBank’s Vision Fund have approved the transaction, the group still needs approval from authorities in the US, the UK, China, and the European Union. That is likely why the group expects the transaction will take 18 months to close.

At the end of Nvidia’s second quarter of fiscal 2021 (period ended July 26, 2020), the firm had $11.0 billion in cash, cash equivalents, and marketable securities on hand while carrying no short-term debt and $7.0 billion in long-term debt on the books. Over time, Nvidia may allow additional cash to build up on its balance sheet by not embarking on meaningful share repurchases (Nvidia has not been repurchasing a significant amount of its stock of late to help fund its recent purchase of Mellanox), though there is a decent chance Nvidia will also turn to debt markets to help fund the cash portion of the deal.

For SoftBank, this move is all about unwinding several massive bets made by the firm and its Vision Fund during the past several years. SoftBank recently has been unloading several of its assets including selling down its equity stake in Chinese e-commerce giant Alibaba Group Holding Ltd (BABA), reducing its stake in T-Mobile US Inc (TMUS) after the telecom company acquired Sprint (which SoftBank had a large equity stake in), and now SoftBank is selling off Arm Limited. Once the deal closes, SoftBank is expected own just under 10% of Nvidia’s equity (it is not clear if that includes the equity stake SoftBank’s Vision Fund would also have in Nvidia). With its divestment proceeds, SoftBank intends to repurchase a lot of its stock and aggressively cut down its debt load.

Nvidia

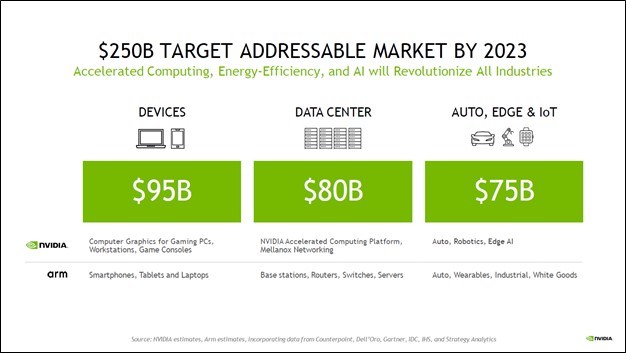

Pivoting to Nvidia, this acquisition is expected “is expected to be immediately accretive to NVIDIA’s non-GAAP gross margin and non-GAAP earnings per share.” By combining Arm’s central processing unit (‘CPU’) technology with Nvidia’s AI offerings, the goal is “to create the premier computing company for the age of artificial intelligence, accelerating innovation while expanding into large, high-growth markets.” In the upcoming graphic down below, Nvidia highlights several of the large markets the combined company would target once the deal closes.

Image Shown: Combined, Nvidia and Arm are targeting three key areas that are estimated to have a combined total addressable market (‘TAM’) value of $250 billion by 2023. Image Source: Nvidia – Nvidia to Acquire Arm IR Presentation

Nvidia intends to keep Arm’s open-licensing business model intact and will seek to grow its own licensing business as well (as noted in the press release announcing the deal). The company remains committed to Arm’s R&D presence in the UK, and Nvidia announced that it will create “a new global center of excellence in AI research at Arm’s Cambridge campus. NVIDIA will invest in a state-of-the-art, Arm-powered AI supercomputer, training facilities for developers and a startup incubator, which will attract world-class research talent and create a platform for innovation and industry partnerships in fields such as healthcare, robotics and self-driving cars.” Arm’s US headquarters are located in San Jose, California, while its global headquarters are located in Cambridge, UK.

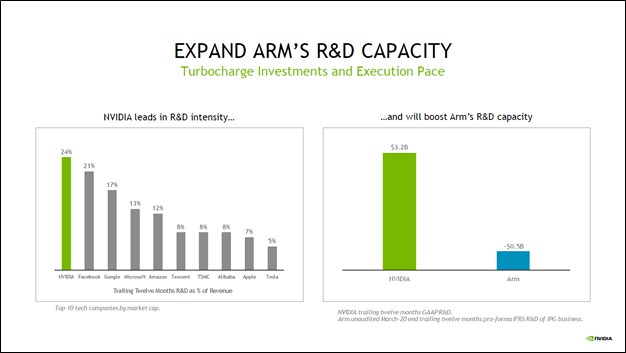

Another key consideration for this deal is that Nvidia expects its focus on innovation to enhance Arm’s R&D capabilities. In the upcoming graphic down below, Nvidia highlights its commitment to R&D which has played a leading role in enabling Nvidia’s success in the gaming and data center markets of late. Nvidia spent ~26% of its GAAP revenues on R&D expenses in fiscal 2020 (period ended January 26, 2020).

Image Shown: Nvidia spends a relatively large portion of its revenues on R&D. Image Source: Nvidia – Nvidia to Acquire Arm IR Presentation

Investors clearly liked the deal from Nvidia’s standpoint as shares of NVDA initially jumped higher on the news. There are anti-trust concerns as Nvidia would be a dominant player across the industry, with an incredibly strong position in semiconductors built for smartphones, automobiles, tablets, gaming devices, smart TVs, data centers, and graphics cards. We like the deal, though we caution that closing is still far off. In particular, winning approval from both authorities in the US and China might be a tough sell given ongoing geopolitical tensions.

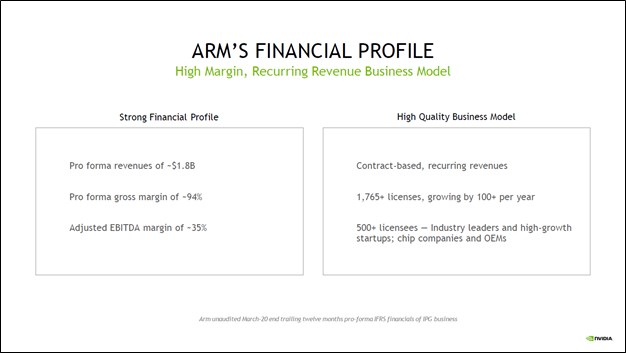

The upcoming graphic down below highlights Arm’s historical financial performance, which is impressive to say the least. Arm’s licensing business model allows for very generous margins, and when integrated into Nvidia’s company-wide operations, should provide a nice uplift to the combined company’s financial performance going forward.

Image Shown: Arm has historically performed very well financially. Image Source: Nvidia – Nvidia to Acquire Arm IR Presentation

On a final note, please keep in mind that Nvidia outsources the production of the chips it designs to third parties that operate semiconductor foundries, including firms like Taiwan Semiconductor Manufacturing Company Limited (TSM). Although Arm generally licenses its technology to firms that design chips, which in turn often utilize third-party foundries to manufacture semiconductors, there are many similarities between Nvidia and Arm’s business models (both are light on capital expenditures and both allow for generous margins, assuming the companies stay ahead of the innovation curve). This overlap should make integration efforts a bit easier, relatively speaking.

Concluding Thoughts

We see both Nvidia and SoftBank getting what they want out of this transaction. Though Nvidia will likely see its net cash position at the end of the second quarter of fiscal 2021 flip to a net debt position, depending on the firm’s capital allocation strategies over the coming fiscal quarters, the uplift from its pro forma dominant market position would more than justify such a move (and Nvidia could quickly rebuild its pristine balance sheet given its impressive free cash flows and relatively low dividend obligations). For SoftBank, the firm retains exposure to the upside Nvidia could generate from acquiring Arm while continuing to reduce its large debt load and outstanding share count.

—–

Broad Line Semiconductor Industry – AMD AVGO FSLR INTC TXN

Computer Hardware Industry – AAPL BB HPQ IBM TDC

Communication Equipment Industry – CIEN SATS LHX PLT QCOM VSAT

Communications Equipment Space – CSCO JNPR KN NOK SMCI

Internet Content & Services Industry – GOOG GOOGL BIDU FB JD TCEHY TWTR

Internet Content and Catalog Retail Industry – BABA AMZN BKNG EBAY EXPE GRPN IAC OSTK QRTEA STMP

Integrated Circuits Industry – ADI MCHP MRVL NVDA SWKS TSM XLNX

Semiconductor Equipment Industry – AMAT CREE IPGP KLAC LRCX MKSI SNPS TER

Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM

Telecom Services – CMCSA CTL DISH T TMUS VZ

Related: SFTBY, TSM, SNNLF, SCWX, SPY, VOD, CHA, CHL, CHUFF, ERIC, NLOK

Other: VLUE, SMH, FTXL, SOXX, TDIV, DEEP, JHMT

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO), Intel Corporation (INTC), and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Alphabet Inc (GOOG) Class C shares and Facebook Inc (FB) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. AT&T Inc (T) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.