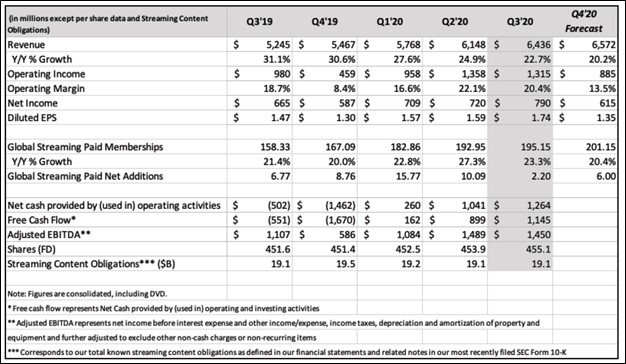

Image Shown: An overview of Netflix Inc’s historical financial and operational performance and a snapshot of its outlook for the fourth quarter of 2020. Image Source: Netflix Inc – Letter to shareholders covering the third quarter of 2020.

By Callum Turcan

On October 20, the video streaming giant Netflix Inc (NFLX) reported third quarter 2020 earnings after the market close that underwhelmed lofty investor expectations and saw shares of NFLX move lower the next day. We recently updated our cash flow models for the Discretionary Spending industry, and our current fair value estimate for NFLX sits at $488 per share, near where Netflix is trading as of this writing (Netflix’s latest 16-page Stock Report can be viewed here). The recent selloff in Netflix’s stock price is largely about investors scaling back their expectations for Netflix’s net paid subscriber growth figures, in our view, and is not a sign of underlying weakness in the company’s business model.

Quarterly Update

In the first and second quarters of 2020, Netflix added 15.8 million and 10.1 million net paid streaming memberships to its operations, respectively. The ongoing coronavirus (‘COVID-19’) pandemic prompted households worldwide to stay indoors to socially distance, and in many regions mandatory quarantines were imposed for a time. Effectively, this dynamic pulled forward demand for Netflix’s offerings, in our view. During the third quarter of 2020, Netflix added only 2.2 million net paid streaming memberships to its operations.

Looking ahead, management expects Netflix will add 6.0 million net paid streaming memberships to its operations during the fourth quarter of 2020 (down from the 8.8 million net paid streaming memberships Netflix added to its operations in the fourth quarter of 2019). We continue to view Netflix’s long-term growth trajectory quite favorably, but the company’s stellar performance during the first half of 2020 was largely an anomaly. As investors recalibrated their growth forecasts for Netflix, that sent shares of NFLX lower. With that in mind, we are pleased with Netflix’s financial performance of late.

Financial Update

During the first three quarters of 2020, Netflix generated ~$2.55 billion in net operating cash flow and spent ~$0.35 billion on its capital expenditures, allowing for roughly $2.2 billion in free cash flows. Please keep in mind that during this same period last year, Netflix generated -$1.4 billion (negative $1.4 billion) in net operating cash flow which resulted in the firm sizable negative free cash flows. We view 2020 as a pivotal point for Netflix and if its performance on this front can be maintained, the company should increasingly become very free cash flow positive going forward.

Image Shown: Netflix was free cash flow positive during the first nine months of 2020. Image Source: Netflix – Letter to shareholders covering the third quarter of 2020

At the end of September 2020, Netflix had $8.4 billion in cash and cash equivalents on hand versus $0.5 billion in short-term debt and $15.5 billion in long-term debt. Netflix’s net debt load appears manageable given its sizable cash position, nascent ability to generate free cash flows and its ongoing access to capital markets. In April 2020, Netflix issued $0.5 billion in 3.625% senior notes due June 2025 and €470 million in 3.000% senior notes due June 2025, highlighting its ability to tap debt markets at attractive rates. Additionally, its strong stock price performance this year indicates Netflix could issue equity at attractive prices, though Netflix does not appear to need to tap capital markets at this juncture.

Management Commentary

During Netflix’s latest earnings call, management noted that Netflix had been able to resume production activities in earnest. In response to an analyst’s question regarding Netflix’s strong free cash flow performance of late, Theodore Sarandos, CEO of Netflix, noted that “since the COVID shutdowns, we’ve completed production on over 50 productions and we expect another 150 before the year is over” indicating the company is quickly getting back on track. Original content is essential to maintaining the interest of Netflix’s membership base in its video streaming service and is the main way such companies differentiate themselves from the competition.

Though it was not directly addressed by management, Netflix seemed to indicate during its latest earnings call that there was a good chance its cash flow outlays would increase to complete the remaining productions by year’s end. For instance, Netflix saw a cash flow outlay of $10.0 billion on ‘additions to content assets’ during the first nine months of 2019. That dropped down to $8.5 billion during the first nine months of 2020, though to reach Netflix’s production completion goal by year’s end, that figure might increase substantially in the fourth quarter of 2020 (in other words, Netflix’s content investment spend is back-loaded due to the pandemic).

Netflix’s additions to content assets has been steadily rising for years as the company prioritized investments in original content, which turns out to have been the right call. As an aside, Quibi, the new video streaming service, is reportedly shutting down in large part because consumers were simply just not that interested in its short-form videos (in other words, content is king).

Concluding Thoughts

We are keeping a close eye on Netflix as a bellwether in the video streaming space, though we would like to stress here that the slowdown in the growth rate of Netflix’s net paid streaming memberships of late is largely because its growth was front-loaded in 2020. As earnings season gets underway, we will continue to update our members on the state of the video streaming wars. On a final note, we applaud Netflix’s new-found ability to generate free cash flows.

—–

Discretionary Spending Industry – ATVI BBY CBRL CMG DIS DG DLTR DPZ DNKN EL F GM HAS HD LOW MCD NFLX NKE SBUX TSLA YUM

Telecom Services Industry – CMCSA CTL DISH T TMUS VZ

Related: SPY, ROKU, FOXA, OMC, VIAC, AMCX, DISCA, IPG

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Dollar General Corporation (DG) and The Walt Disney Company (DIS) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. AT&T Inc (T) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.