Image Source: Oracle Corporation – September 2019 IR Presentation

By Callum Turcan

On December 10, Oracle Corp (ORCL) reported second-quarter earnings for fiscal 2021 (period ended November 30, 2020) that beat both consensus top- and bottom-line estimates. In the fiscal second quarter, Oracle’s GAAP revenues advanced 2% year-over-year on the back of its ‘Cloud services and license support’ segment posting 4% sales growth. The company’s GAAP operating income rose 13% year-over-year last fiscal quarter, as operating expenses shifted lower 3% thanks to the efforts of Oracle’s management team to make cost containment efforts a priority.

The firm’s diluted GAAP EPS came in at $0.80 during the second quarter of fiscal 2021, up 16% year-over-year thanks in part to its weighted-average outstanding diluted share count falling almost 9% during this period. We are maintaining our $67 per share fair value estimate for Oracle and continue to include shares of ORCL in the Dividend Growth Newsletter portfolio. Shares of ORCL yield ~1.6% as of this writing with room for ample payout growth going forward, in our view.

Favorable Guidance

Most importantly, Oracle provided decent guidance for the current fiscal quarter that indicated its revenue growth trajectory remains resilient. During Oracle’s latest earnings call, management noted that the firm’s revenues would grow by 2%-4% in US dollar terms while its non-GAAP EPS is expected to grow by 13%-17% in US dollar terms during the third quarter of fiscal 2021 on a year-over-year basis. These expected growth rates are modestly lower on a constant-currency basis, but the trajectory remains the same.

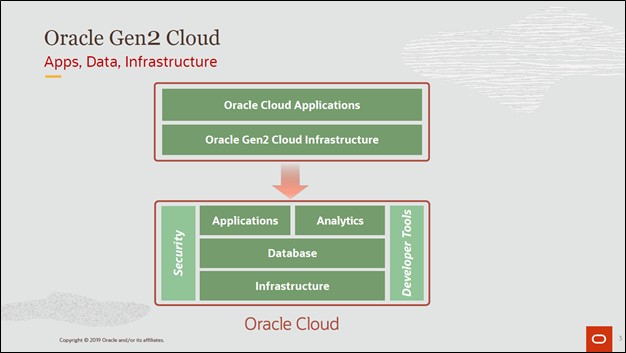

One of Oracle’s biggest hurdles is growing its cloud-oriented business at a fast enough pace to offset declines at its legacy IT business. Part of that process involves building out the data centers that enable its Infrastructure-as-a-Service (‘IaaS’) platform Oracle Cloud Infrastructure (‘OCI’) to meet rising demand. The company’s ‘Autonomous Database’ offering “runs natively on Oracle Cloud Infrastructure while providing workload-optimized cloud services for transaction processing and data warehousing” and has played a key role in supporting Oracle’s revenue growth of late. During Oracle’s latest earnings call, management noted that the company’s revenues would have grown at a faster rate if not for capacity constraints (emphasis added, lightly edited):

“We just completed a great quarter, but the quarter would have been even better if we would have had more — and we would have had more revenue growth if we had not been capacity constrained in OCI during Q2. There was more demand than we have supply. To remedy this capacity shortfall, we are adding OCI capacity and building new OCI data centers as fast as we can. We are now up to 29 regional data centers around the world… OCI added customers and grew revenue at a rate well in excess of 100% year-over-year in Q2. The Oracle Autonomous Database was up over 60%.” — Larry Ellison, co-founder, executive chairman, and chief technology officer of Oracle

The launch of new services will help keep the momentum going in the right direction as it concerns Oracle’s revenue growth trajectory, in our view. Management specifically mentioned that Heat Wave, a “massively parallel query accelerator” which is used on the open-source relational database management system MySQL, represented an exciting new opportunity for Oracle. During Oracle’s latest earnings call, management noted that “MySQL plus Heat Wave processes queries hundreds of times faster than the current version of MySQL by itself and other MySQL-compatible databases.” Heat Wave is optimized for OCI and allows for real-time analytics. Oracle sees the service being more cost-effective than its peers.

For reference, enterprise resource planning (‘ERP’) software is used by businesses for day-to-day operations (from accounting to supply chain operations). Oracle’s Fusion Cloud ERP and NetSuite Cloud ERP offerings posted 33% and 21% revenue growth, respectively, on a year-over-year basis last fiscal quarter. A growing customer base supported sales growth at both segments. Looking ahead, Oracle appears confident that these offerings will be able to continue winning over new customers.

Looking ahead, Oracle aims to have “38 Cloud regions live by [what appears to be calendar year] mid-2021” after recently opening new commercial cloud regions in Chile, Dubai in the UAE, and the UK. These cloud regions refer to areas where Oracle has data centers and interconnection operations in place, enabling the firm to offer high-quality cloud-computing services including “zero-data-loss architectures for applications like Oracle Database.” So far, Oracle has opened 13 new regional data centers to broaden its geographical reach in calendar year 2020. Expanding its geographical reach will go a long way tp supporting and extending Oracle’s growth runway on this front.

Financial Update

During the first half of fiscal 2021, Oracle generated $6.3 billion in free cash flow. One of the things we appreciate about Oracle is its free cash flow conversion ratio (free cash flow as a percent of net income), which has consistently been above 110% on a trailing twelve-month basis during the past several fiscal quarters. The upcoming graphic down below highlights this strong performance, which signals high earnings quality.

Image Shown: Oracle does a tremendous job converting net income into free cash flow. Image Source: Oracle – Second Quarter of Fiscal 2021 Earnings Press Release

The company spent $1.4 billion covering its dividend obligations and $9.0 billion buying back its stock during the first half of fiscal 2021, activities that were partially funded by the balance sheet. As of November 30, Oracle had $38.6 billion in cash, cash equivalents, and marketable securities on hand versus $7.3 billion in short-term debt and $63.5 billion in long-term debt. Though we would prefer Oracle to pare down its debt load over time, we view its net debt load as manageable given the company’s ability to consistently generate sizable free cash flows.

Concluding Thoughts

We continue to view Oracle’s dividend growth trajectory favorably. Modest revenue growth and operating expense containment efforts will support Oracle’s cash flow profile going forward. Shares of Oracle were up modestly during normal trading hours on December 11 while equity markets were broadly lower, indicating investors appreciated management’s favorable forward-looking guidance.

On a final note, Oracle reportedly plans to move its headquarters from the heart of Silicon Valley in Redwood City, California, over to Austin, Texas. In our view, this move could help Oracle keep a lid on operating expenses without losing access to top tier talent. The company reportedly plans to allow for more flexible work arrangements over the long-term, particularly as it concerns where employees work (with an eye towards greater amounts of its employees working from home), and Oracle will maintain its workforce hubs in key IT regions across the US.

Oracle’s 16-page Stock Report >>

Tickerized for ORCL, NOW, CRM, HUBS, MSFT, WDAY, WORK, DDOG

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Facebook Inc (FB), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.