Member LoginDividend CushionValue Trap |

Korn Ferry’s Stock Helps Diversify Best Ideas Newsletter Portfolio

publication date: Sep 7, 2022

|

author/source: Callum Turcan

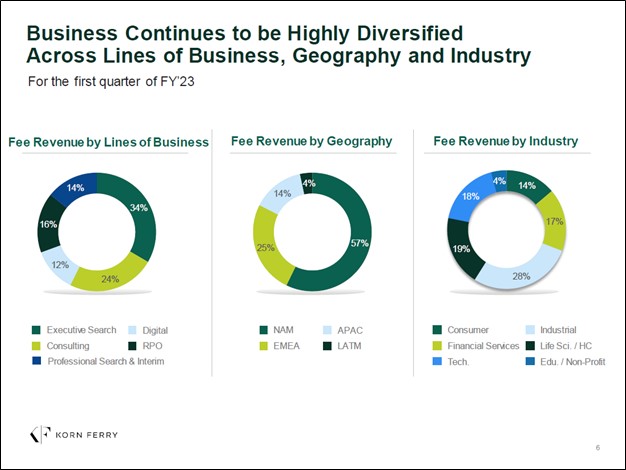

Image Shown: Within the realm of the global consulting industry, Korn Ferry’s revenues are well-diversified in terms of both the geographic markets and industries it caters to. We like shares of Korn Ferry as an idea in our Best Ideas Newsletter portfolio. Image Source: Korn Ferry – First Quarter of Fiscal 2023 IR Earnings Presentation By Callum Turcan On September 7, the global consulting firm Korn Ferry (KFY) reported first quarter earnings for fiscal 2023 (period ended July 31, 2022) that beat consensus top-line estimates but missed consensus bottom-line estimates. Korn Ferry has been steadily shifting towards a model of digitally delivering its services, when feasible, to its client base as a way to boost its revenue generating potential per consultant while driving growth in its earnings. We include shares of Korn Ferry as an idea in the Best Ideas Newsletter portfolio and our fair value estimate sits at $85 per share, well above where shares of KFY are sitting at as of this writing. In addition to Korn Ferry’s capital appreciation upside potential, the firm’s dividend growth potential offers incremental upside, though management has not historically prioritized Korn Ferry’s payout and instead prefers to invest in the business, pursue M&A activities, and buy back stock. Shares of KFY yield ~1.0% as of this writing. Earnings Update Korn Ferry’s GAAP revenues were up 20% year-over-year in the fiscal first quarter to reach $703 million, aided by double-digit growth at its ‘Professional Search & Interim,’ ‘RPO [recruitment process outsourcing],’ and ‘Consulting’ offerings. Please note that Korn Ferry, as with all US corporates with major international sales, has been contending with sizable foreign currency headwinds of late due to the strong US dollar. Korn Ferry was still able to put up double-digit revenue growth in the face of those headwinds last fiscal quarter, which we appreciate. The company’s operating expenses increased significantly last fiscal quarter which offset its revenue growth to a degree. Korn Ferry’s GAAP operating income rose 10% year-over-year in the fiscal first quarter to reach $112 million. Its GAAP diluted EPS rose by 6% year-over-year to reach $1.45. GAAP diluted EPS growth was aided by a reduction in Korn Ferry’s outstanding diluted share count and operating income growth offsetting higher interest expenses, reductions in its non-operating income, and increases in its provision for corporate income taxes. Korn Ferry exited July 2022 with a nice net cash position of $501 million (inclusive of long-term marketable securities) and no short-term debt on the books. However, please note that a sizable chunk of Korn Ferry’s cash-like assets is pledged towards employee compensation. Even on an adjusted basis, Korn Ferry’s $396 million in long-term debt on the books at the end of the fiscal first quarter would be fully covered by its adjusted ~$614 million in cash-like assets on hand.

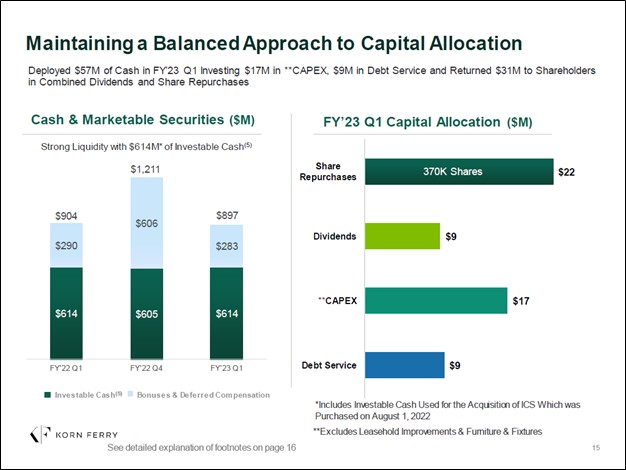

Image Shown: Korn Ferry had a pristine balance sheet with a nice net cash position on hand at the end of July 2022, one of the reasons why we are big fans of the name. Image Source: Korn Ferry – First Quarter of Fiscal 2023 IR Earnings Presentation Looking ahead, Korn Ferry forecasts that it will generate $678-$708 million in fee revenue (represents the lion’s share of total revenue) and $1.34-$1.50 in adjusted non-GAAP EPS in the current fiscal quarter. Those forecasts were issued in conjunction with its latest earnings update. On a year-over-year basis, its fee revenue guidance at the midpoint represents 18% growth and its adjusted EPS guidance at the midpoint represents 4% growth for fiscal second quarter, if realized. Concluding Thoughts We continue to be big fans of Korn Ferry and view its growth outlook quite favorably. The company’s pivot towards digitally providing its services combined with its pristine balance sheet has resulted in a rock-solid business model that can withstand the various exogenous shocks seen of late, from inflationary pressures to supply chain hurdles to labor shortages to rising geopolitical tensions across the globe. Korn Ferry’s capital appreciation upside potential remains substantial, and while the stock is facing pressure following the report, we still like shares as an important diversifying presence in the simulated Best Ideas Newsletter portfolio. ----- Technology Giants Industry - META, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, TXN, EBAY, ADP, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI Tickerized for KFY, ADP, DLX, EFX, JOBS, MAN, NSP, PAYX, RHI, HURN Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan owns shares of DIS, META, GOOG, VRTX, and XLE. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Meta Platforms Inc (META), Korn Ferry (KFY), and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. ASML Holding NV (ASML), Meta Platforms, Oracle, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment