Member LoginDividend CushionValue Trap |

JPMorgan, Citigroup Third Quarters Not Terrible, But Still No Reason to Own Financials

publication date: Oct 13, 2020

|

author/source: Brian Nelson, CFA

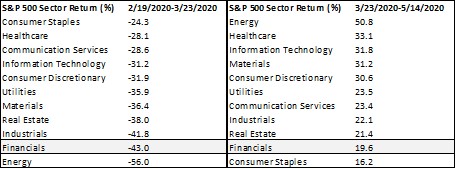

Image: Banks and financials were among the most aggressively beaten down groups during the COVID-19 crash, and the sector failed to participate meaningfully in the bounce back. The leveraged and arbitrary nature of banking business models makes them much less attractive than entities with strong net cash positions on the balance sheet and solid expected future free cash flows. Source: Kastner, David, Charles Schwab. “Schwab Sector Views: Changes Are Coming.” 18 June 2020. By Brian Nelson, CFA Better-than-feared third-quarter reports are not going to change our minds on the banking and financials sector. The group has been among the worst performing sectors amid the COVID-19 market crash and failed to bounce back meaningfully since the March bottom. Banks are being used as extensions of government fiscal intervention via myriad stimulus programs, while oversight puts a limit on just how much capital they can return to shareholders. Returns on equity remain subpar for many, and systemic risk remains present with most books opaque and intertwined within the global financial system. Cash flows for the group are largely arbitrary, and most remain leveraged by the very nature of their business models. We see no reason to own most banks and financials and point to fintech via PayPal (PYPL) and credit card processor Visa (V) as our favorite ideas for indirect exposure to the global financial system. Just how hard is it to manage a bank these days? Earlier this month, Citigroup (C) was hit with a $400 million civil penalty from the Office of the Comptroller of the Currency, and the Fed recently ordered Citigroup to improve its risk control measures citing ongoing deficiencies from years ago. It’s been over a decade since the worst of the Great Financial Crisis, and Citigroup is still working to get its house in order: We are disappointed that we have fallen short of our regulators’ expectations, and we are fully committed to thoroughly addressing the issues identified in the Consent Orders. Citi has significant remediation projects underway to strengthen our controls, infrastructure and governance. These projects are each multi-year and have received significant investment. However, while we have made progress in each of these areas, we recognize that substantial improvement is still required to meet the standards we have set for ourselves and that our regulators expect of us. Third quarter results released October 13 from Citigroup and JPMorgan (JPM) were not terrible, but the group will be facing a period of elevated loan losses and tighter net interest margins. The COVID-19 pandemic and the Fed’s response have put many of the money center banks in a bind, and while markets-related revenue may help offset some pressure, it’s hard to own a bank when one can instead gain exposure to transparent, net cash rich, strong free cash flow generating, moaty business models in the Best Ideas Newsletter portfolio. Revenue during the third quarter at Citigroup dropped 7% from the prior-year period, while net income fell 34% due to higher expenses and increased credit costs. Return on average common equity was paltry at 6.7% in the period even though it did migrate upward from the weak 2.4% showing during the second quarter of 2020. Citigroup’s tangible book value sits at $71.95 per share, but economic value destruction (ROE<COE) means the company should trade well below tangible book; shares are exchanging hands at $44.35 at the time of this writing. Celebrity JPMorgan CEO Jamie Dimon catches a lot of media attention these days, but JPMorgan’s stock is out of favor, down over 26% year-to-date, while a representative ETF for the Best Ideas Newsletter portfolio—generally large cap growth—has advanced more than 30% so far this year. Net revenue fell on a year-over-year basis during JPMorgan’s third quarter, but the bank still managed to generate net income expansion and a very respectable 15% ROE. Credit loss provisioning came in lower than expected at JPMorgan in the period. With so many other good ideas out there, we just don’t like exposure to the traditional banking industry in the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. This view has served many a member well, as the financials sector has performed terribly through the course of 2020; we don't expect this to change anytime soon, as we expect large cap growth, big cap tech, and the NASDAQ to continue to lead. That said, if we were forced to own a bank for diversification reasons (as we are often asked), JPMorgan would be one of our favorites (pdf) to consider >> Related: XLF, KBE, KRE ----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

---

Brian Nelson owns shares in SPY, SCHG, DIA, VOT, and QQQ. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment