It May Be Too Little Too Late

publication date: Feb 1, 2021

With the ability to stop it before it started now behind us, in my view, enterprise valuation and a focus on net cash and future expected free cash flow within companies with strong competitive advantages that are tied to secular growth trends is still the best way to combat this type of environment. But investors need to keep their guard up. We could be headed for some crazy market action in the coming months.

Subscribe Now to Gain Access!

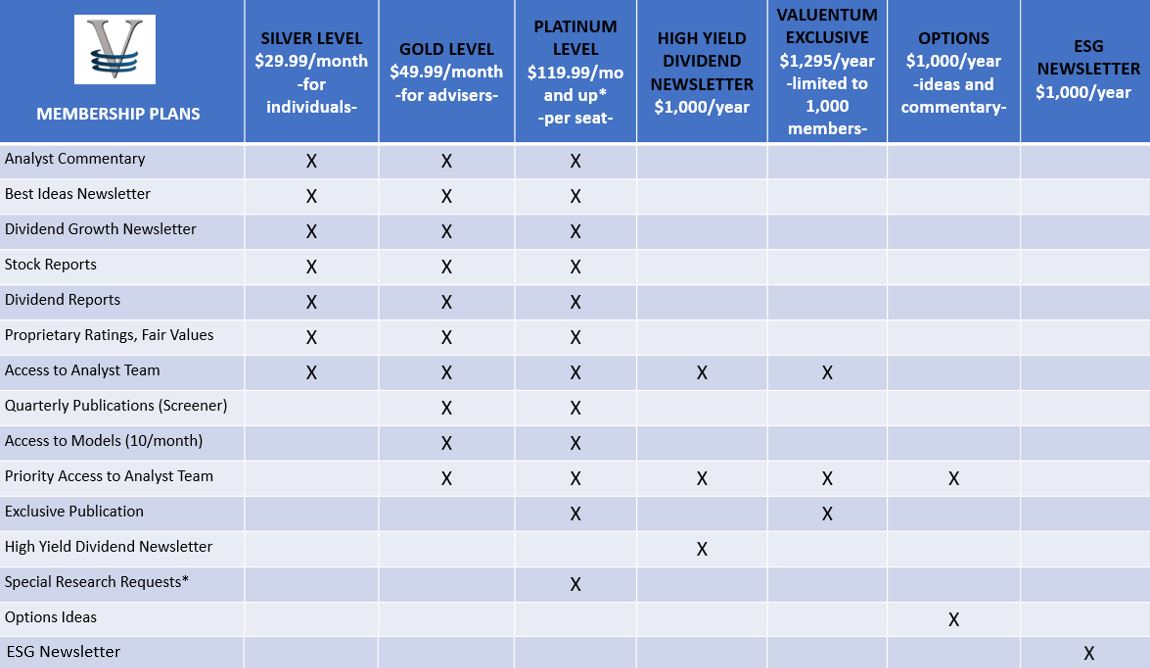

This page is available to subscribers only. To gain access to members only content (including this research piece), click here to subscribe. With a subscription, you'll have access to all of our premium commentary, equity reports, dividend reports and Best Ideas Newsletter and Dividend Growth Newsletter, as well as receive discounts on all of our modeling tools and products. Financial advisers and institutional investors have even more to choose from!

Click to Learn More about Valuentum

If you are already a subscriber, please login.

If you believe you should be able to view this area then please contact us and we will try to rectify this issue as soon as possible.

To gain access to the members only content, click here to subscribe. You will be given immediate access to premium content on the site.