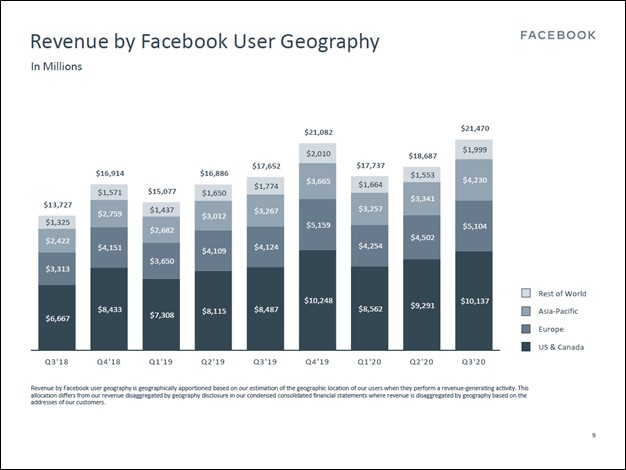

Image Shown: Facebook Inc has a large digital advertising business with global reach, but it does not have a monopoly on digital advertising or social media by any means. Image Source: Facebook Inc – Third Quarter of 2020 IR Earnings Presentation

Summary

Facebook is being sued by the FTC for allegedly engaging in monopolistic activities via its acquisition program. It’s important to note that the government is not seizing Facebook’s assets and that Facebook investors own the future free cash flow stream of the entire entity under any and every scenario–whether Facebook is retained in current form or whether it is broken into different parts through a potential IPO/spin-off of its Instagram and WhatsApp properties.

Under a status quo scenario, we believe Facebook’s shares are worth $413 each, an estimate that is backed by the company’s vast net cash position and future expected free cash flow stream. In such a scenario, the company would remain one of our favorite ideas, retain its material competitive advantages (i.e. the network effect) and continue to build upon its very healthy financial profile. Further, in light of the FTC news, we believe the market will look to price Facebook more and more on a sum-of-the-parts basis, which could help to accelerate price-to-estimated fair value convergence relative to our intrinsic value estimate.

In a highly improbable break-up scenario, Facebook investors could receive more than our status-quo intrinsic value estimate. The IPO market is very, very healthy at the moment, with investor interest in new issues at historic highs and many recent IPOs soaring on their first day of trading. If Facebook is forced to IPO Instagram or WhatsApp, the very, very healthy IPO market could generate proceeds for Facebook investors far in excess of what the implied value of Instagram and WhatsApp contribute to our current $413 per share fair value estimate of the combined company.

Further, the cash proceeds of an IPO of Instagram or WhatsApp would stuff the coffers of Facebook’s balance sheet with even more excess cash that could be used for material share buybacks or a vast one-time cash dividend–or for other value-generating opportunities. In an IPO or spin-off of Facebook’s Instagram or WhatsApp properties, please note that investors are merely capturing the present value of these properties’ future free cash flows sooner (not losing them)–and the market may price them at a substantial premium above our implied valuation within Facebook.

The FTC news, which was largely expected, will generate headline risk for Facebook’s shares, and it will undoubtedly be a source of continued share-price volatility and confusion for investors. In many respects, however, the FTC’s attack on Facebook may turn out to be a win-win for Facebook investors. At the very least, if investors start to look at Facebook more and more on a sum-of-the-parts basis (pricing Facebook, Instagram and WhatsApp separately with consideration of current market conditions/relative prices, which are undoubtedly healthy for new issues), it may only accelerate status-quo-scenario price-to-fair value convergence. Facebook remains a top-weighted holding in the Best Ideas Newsletter portfolio, and we will continue to follow developments related to the FTC news.

By Callum Turcan and Brian Nelson, CFA

On December 9, the US Federal Trade Commission (‘FTC’) sued Facebook Inc (FB), which was largely expected. The FTC is “alleging that the company is illegally maintaining its personal social networking monopoly through a years-long course of anticompetitive conduct” in breach of antitrust laws. Additionally, 46 US states, the District of Columbia, and Guam also sued Facebook, alleging the firm violated antitrust laws. The FTC lawsuit centers on Facebook allegedly pursuing acquisitions that stymied competition in the social media space and that Facebook supposedly “imposed anticompetitive conditions on third-party software developers’ access to valuable interconnections to its platform.” We continue to be big fans of Facebook and want to highlight why we still view the company’s capital appreciation outlook favorably, even when considering recent events (which could even be a catalyst for further upside).

For some background, Facebook acquired Instagram in 2012 for ~$1.0 billion and WhatsApp in 2014 for ~$19.0 billion, and these are the two main acquisitions the FTC cites as being anticompetitive. Note these acquisitions were completed and approved over a half-decade ago. However, the FTC is now seeking a permanent injunction in federal court that could force Facebook to divest certain operations (including Instagram and WhatsApp) while also forcing the company to file notice and seek approval first before pursuing any M&A activities in the future. Additionally, the FTC wants to force Facebook to stop engaging in actions that the commission believes faciliate anticompetitive conditions on its software developers. The permanent injunction could impose other measures on Facebook, but these are the main points.

Facebook’s Investors In a Great Position

We do not see the FTC’s actions as fundamentally weakening Facebook’s ability to generate sizable free cash flows in the future, and therefore we see no reason to alter our $413 fair value estimate of shares at this time. Our fair value estimate is backed by the company’s tremendous net cash position, and our expectations for it to generate strong and growing free cash flows long into the future.

If Facebook were to be broken up, which we view as quite unlikely at this point, a sum-of-the-parts relative price assessment by the market for these properties might even be greater than what we think shares of Facebook are worth as a combined entity. Note relative/comparable company valuation analysis and enterprise valuation (intrinsic valuation) analysis are two separate approaches, the former sometimes resulting in systematic overpricings disconnected from underlying future expected free cash flows.

In light of the hefty premium price/multiple that investors have been willing to pay for high-growth IPOs of late (e.g. the excitement over the recent DoorDash (DASH) and Snowflake (SNOW) IPOs, the general level of interest in Software-as-a-Service (‘SaaS’) companies, and shares of most entities in the realm of cloud computing), Facebook’s properties (Instagram and WhatsApp), if released as new issues to the market, could reap the company tremendous cash proceeds above their implied value within our intrinsic value calculation.

Social media companies that derive most of their sales from the digital advertising business generally are often asset-light, meaning their capital expenditure requirements to maintain a certain level of revenues are relatively low, allowing for those entities to (generally speaking) generate gobs of free cash flow. Instagram, the social media app, is likely a cash flow generating machine, and the company would be priced extremely favorably in today’s IPO market.

As its concerns WhatsApp, which is primarily a messaging-oriented app, while Facebook has not historically generated a significant amount of money from this operation, the goal is to build up an e-commerce and payment processing business leveraging the app’s large active user base. In light of the market capitalizations placed today on money-losing app-platforms such as Uber (UBER) and other speculative entities, today’s market would likely give WhatsApp a very attractive price tag as a new issue. Facebook’s namesake operations are immensely profitable, but as standalone entities, Instagram and WhatsApp are quite valuable, too (and the market may price them well above our current estimate of their implied values within our valuation construct of Facebook).

Counterintuitively, the antitrust lawsuits may, over time (keeping expected near-term turbulence in mind), act as the catalyst for shares of FB to converge toward our above-market fair value estimate, even in the event Facebook is forced to pursue an IPO of Instagram and WhatsApp to spin-off these operations to comply with regulatory concerns. In any scenario, however, the FTC suit will inevitably force the market to start to evaluate/price Facebook on a sum-of-the-parts basis–and given the high-growth and lucrative (particularly for Instagram) nature of these operations, investor enthusiasm for these IPOs would likely be simply ecstatic!

Facebook Operates in Competitive Markets

Pivoting to some of the complaints brought up by the FTC, let us first look at the commission’s allegations that the social media space is largely a monopoly run by Facebook. We disagree with that assessment.

For instance, Twitter Inc (TWTR) and Pinterest Inc (PINS) are two multibillion social media giants. In the third quarter of 2020, Twitter had an Average Monetizable Daily Active Usage (‘mDAU’), a proxy for active users, of 187 million (that was up 29% year-over-year). Pinterest had 442 million Global Monthly Active Users (‘MAUs’) in the third quarter of 2020, up 37% year-over-year. Additionally, the privately-held social media app Parler is a newcomer to the field (founded in 2018) and has already built up a sizable user base. ByteDance’s TikTok video sharing-oriented social media app is a global hit with an enormous active user base. The allegations that the social media space is dominated by Facebook is not consistent with the social media business landscape given the success seen at multiple new market entrants (including Parler and TikTok) and recent growth experienced at established firms (including Twitter and Pinterest).

As it concerns Facebook’s past acquisitions, the company took on tremendous risk in completing them, and by no means, were those acquisitions guaranteed to produce satisfactory shareholder returns. Look at how MySpace, at one time a social media giant, lost out to new competitive threats and ultimately became just another player in the space. When Facebook acquired Instagram, it was far from certain that the ~$1.0 billion price tag would yield favorable results. Looking now at WhatsApp and its goal to eventually generate meaningful revenues, this operation’s current business strategy is rooted in the e-commerce and payment processing space. In our view, it is a stretch (to say the least) to allege that Facebook’s acquisition of WhatsApp for ~$19.0 billon, a messaging-oriented app now focused on e-commerce, resulted in Facebook gaining a dominant position in the social media space.

Looking now at the digital advertising market, beyond newcomers in the social media space such as Parler and TikTok, Amazon Inc’s (AMZN) digital advertising business has been growing at a brisk pace of late. The WSJ cited data from market research firm eMarketer that noted Alphabet Inc (GOOG) (GOOGL), Amazon, and Facebook together represented almost two thirds of the dollars spent on digital advertising in the US this year. Considering that Facebook’s bread-and-butter business, its digital advertising operations, continues to operate in a competitive market with multiple large operators (along with many smaller players), it does not appear that Facebook’s prominent position in social media has translated into Facebook having a monopoly in the digital advertising market. There are many other oligopolistic industries out there, too, from the waste industry to the industrial gas business and beyond. We’re not seeing the FTC’s case.

Concluding Thoughts

In our view, the recent FTC suit against Facebook is potentially politically motivated, though we are going to let the courts make the final decision on this front. Facebook may be a very lucrative enterprise that is often grabbing headlines, but it is not running a monopoly in any market, in our view. In fact, Facebook faces rivals across its business lines, which is why the firm is constantly bulking up its workforce and investing in innovation (Facebook’s R&D expenses were up 36% year-over-year during the first nine months of 2020) so it can stay near the front of the pack.

Our base-case scenario is that Facebook’s shares will face near-term turbulence due to headline risk resulting from the news, but a break-up appears unlikely, with the more likely outcome being that it will be forced to pay a fine. The company’s long-term growth trajectory remains robust, in our view, and we continue to see ample capital appreciation upside potential under both the status-quo and break-up scenarios. We continue to like Facebook as a top-weighted holding in the Best Ideas Newsletter portfolio.

Facebook’s 16-page Stock Report (pdf) >>

—–

Also tickerized for holdings in the SOCL.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Facebook Inc (FB), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.