Image Source: Exxon Mobil Corporation – November 2019 Guyana IR Presentation

By Callum Turcan

Near-term oil prices and most importantly, the oil price futures curve, have improved materially since just a couple of months ago when it looked like the sky was falling. For the first time ever, WTI turned negative in April 2020 for physical deliveries due May 2020 of light sweet oil to Cushing, Oklahoma, as storage options were limited (and arguably, many speculators had jumped into the market not fully aware of the risks they were taking on). Exxon Mobil Corporation (XOM) has seen its share price recover considerably since the drop, though we caution that management’s commitment to the dividend will prove a hard task if things do not improve materially in the short-term. As of this writing, near-term futures for WTI and its international counterpart Brent are trading near $40 per barrel.

In the face of COVID-19, low raw energy resource prices (Exxon Mobil’s upstream operations form its largest single business segment), and subdued demand for refined petroleum and petrochemical products (from gasoline to plastics) have significantly weakened Exxon Mobil’s cash flow profile. The ongoing coronavirus (‘COVID-19’) pandemic has shaken energy markets to their core in ways we have not seen ever before. Shares of XOM yield ~7.4% as of this writing.

We give Exxon Mobil a Dividend Cushion ratio at 0.2, though its Dividend Safety rating is “GOOD” given the company’s ability to tap capital markets, especially debt markets as the oil giant carries high quality “A-rated” investment grade credit ratings. There is a limit to how much debt Exxon Mobil can take on to cover its dividend obligations, however, which we will cover in greater detail in this article.

Overview

At the end of the first quarter of 2020, Exxon Mobil had $11.4 billion in cash and cash equivalents on hand versus $27.8 billion in short-term debt and $31.9 billion in long-term debt. The oil giant’s net debt load grew by $4.4 billion from the end of 2019 to the end of March 2020 as the firm’s cash flow profile deteriorated. Exxon Mobil tapped credit markets to bulk up its liquidity position in the face of a major downturn in raw energy resource prices. Exxon Mobil generated only a minor amount of free cash flow last quarter (relatively speaking). Defining free cash flow as net operating cash flows less capital expenditures, Exxon Mobil generated just $0.3 billion in free cash flow last quarter which did not fully cover $3.7 billion in dividend payouts to its common shareholders.

Historically speaking, Exxon Mobil’s downstream businesses (gas stations, refineries, and petrochemical complexes) acted like a natural hedge against downturns in raw energy resource prices. This was particularly true during the previous downturn in raw energy resource prices from late-2014 to early-2017, as rising demand for refined petroleum products and petrochemical products (including synthetic rubber and various plastic products) helped offset weakness at its massive upstream business (the segment that produces raw energy resources). Though financial strength of its downstream business did not offset all of the decline in the financial performance of its upstream business, it helped keep Exxon Mobil afloat until things improved, aided by OPEC+ announcing a global oil supply curtailment agreement at the end of 2016.

Looking Ahead

Going forward, the second quarter will likely be brutal for Exxon Mobil. Not only is the firm facing a very weak pricing environment for raw energy resources (prices have since rebounded from their April-May lows but remain heavily subdued), but demand for refined petroleum products and petrochemical products fell off a cliff due to the pandemic. That is on top of Exxon Mobil and the energy market at-large having just emerged from a vicious downturn.

Exxon Mobil has enough cash on hand to make good on its near-term obligations (debt, dividend, and capital expenditures), but that cash balance will be drained quickly if energy markets do not experience a “V-shaped” rebound. Now that the Fed is actively intervening in corporate credit markets that will make future debt issuances an easier task, though there are limits to this strategy particularly given Exxon Mobil’s hefty dividend obligations.

Exxon Mobil maintains high-quality investment grade credit ratings, though Moody’s Corporation (MCO) and S&P Global Inc (SPGI) recently cut the firm’s credit rating (from Aaa to Aa1 at Moody’s and from AA+ to AA at S&P Global) and maintain negative outlooks. We do not think Exxon Mobil will get locked out of credit markets anytime soon, but should its net debt load grow continuously due to the lack of a sustained recovery in energy markets, that could force management’s hand and prompt a dividend cut. It is likely that Exxon Mobil will tap credit markets again going forward to raise funds to meet its near-term capital expenditure needs and dividend obligations.

As demand for refined petroleum products (namely gasoline and diesel as households start hitting the road again, kerosene is a different story given pressures facing the airline industry) picks up as lockdown measures ease, that should benefit Exxon Mobil’s vast downstream business as well as its midstream business (pipelines, storage facilities). Plastics demand will recover alongside the global economy, which may take time. Most importantly, Exxon Mobil needs raw energy resources prices to move higher. That could become possible through a combination of rising refinery runs meaning rising crude throughput volumes (due to gasoline and diesel demand returning in earnest post-lockdown), “voluntary” OPEC+ supply cuts (via coordinated reductions led by Saudi Arabia, Kuwait, the UAE, Iraq, and Russia), and “involuntary” supply cuts from non-OPEC+ nations (via well shut-ins, capital expenditure reductions, and natural declines).

Recently, OPEC+ decided to extend the largest part of the agreed-upon global oil supply reductions and boost compliance (with an eye towards Iraq). The curtailment program has several stages with the planned supply reduction being significantly larger in the short term before tapering off somewhat, though the program is slated to last through April 2022. Given that the program is set to run for a couple years, that should go a long way in eventually alleviating the global glut in storage. Should OPEC+ continue to curtail supply in a meaningful way through 2022 (far from certain), the medium-term outlook for raw energy resource pricing would be a lot brighter (relatively speaking) than things appear today.

In the short- to medium-term, should the global economy begin growing in earnest by the third or fourth quarters of 2020 on a sequential basis, Exxon Mobil could have the financial capacity to ride out the worst of the storm with its dividend policy intact. If a recovery takes longer to materialize, Exxon Mobil will have to contend with the reality that a dividend cut may become impossible to avoid. Here is what Exxon Mobil’s CEO, Darren Woods, had to say during the firm’s Annual Meeting of Shareholders held in late-May (emphasis added):

“Let me start by just talking about our capital allocation priorities. First and foremost, we want to invest in advantaged projects. That’s a priority, because it maintains the foundation for a healthy and long-term business. We want to pay reliable and growing dividend, it’s our way of rewarding long-term shareholders and it shares our success over the years. And when you maintain a strong balance sheet to rise through the ups and downs of the market and commodity markets that we have historically seen and particularly relevant in today’s environment. So those capital allocation priorities have been in place for many, many years. We continue to honor those priorities and actually balance across those. When the environment gets challenging, we adjust to make sure that we’re optimizing across the whole and for the long-term.

As you look at the short-term environment, we have given a priority to the dividends and so have not reduced that. And instead move to cut our operating expenses and to reduce capital, while preserving the value of that capital over the long-term. And we’ll continue to assess that as we move forward, balancing across those three priorities that we have. The board looks at that every quarter and assesses it, and continues to put a priority on those three priorities and in maintaining a dividend. So I think we’ll have to see how the environment continues to grow but it’s an important priority that the board wants to maintain.”

For now, Exxon Mobil is holding the line, though management did mention that the firm would adjust as needed in order to balance out its three major priorities (investing in “advantaged projects” like its upstream oil producing Guyanese operations while “maintaining a dividend” and keeping “a strong balance sheet”). We appreciate management providing in-depth commentary on how the firm views its capital allocation priorities going forward during these very harrowing times.

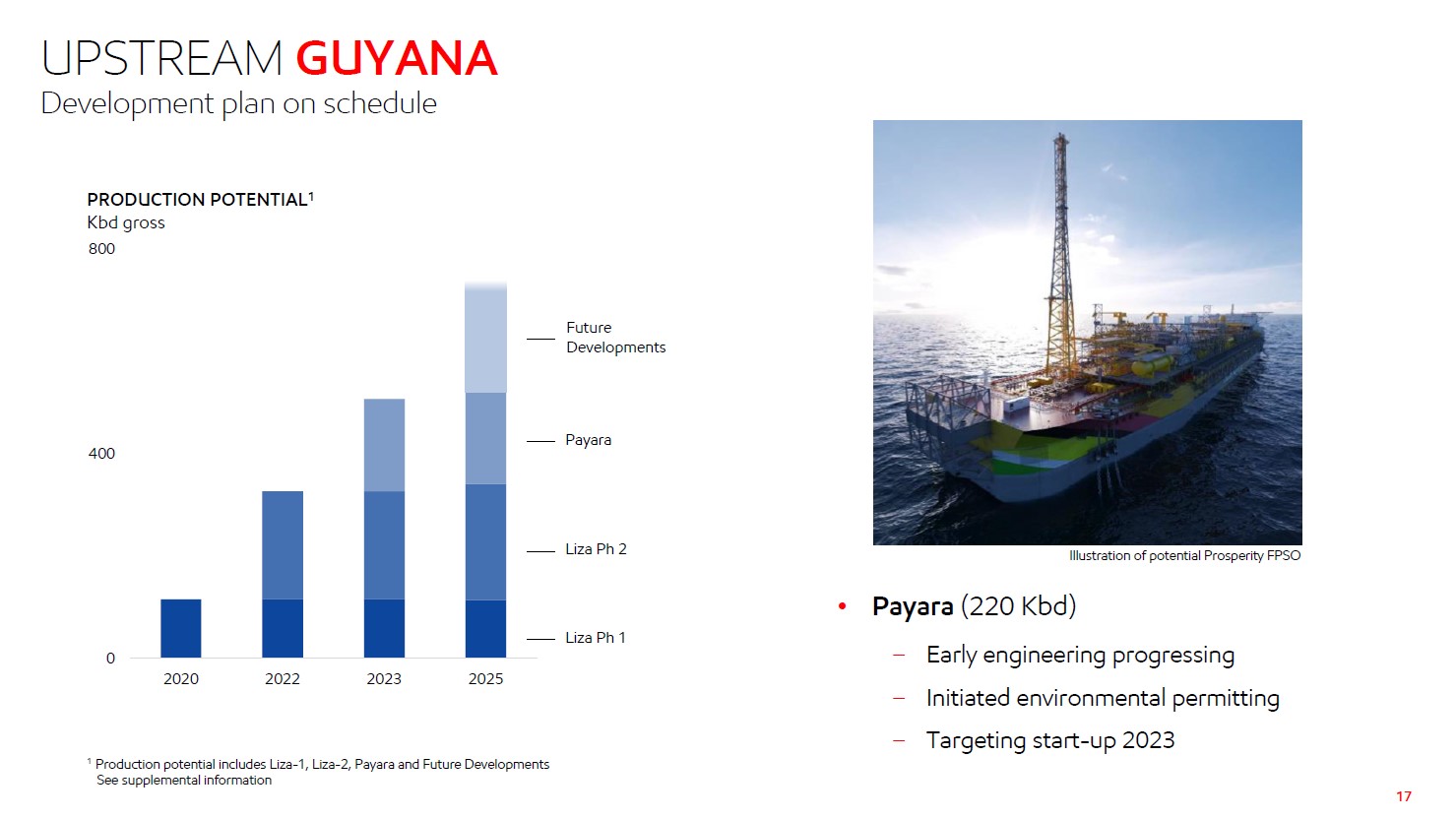

Back in April 2020, Exxon Mobil announced it was reducing its 2020 capital expenditure expectations by 30%, bringing its budget down to ~$23.0 billion. Exxon Mobil is also targeting a 15% reduction in its cash operating costs. However, management remained committed to Exxon Mobil’s world class upstream operations in Guyana, which are high quality upstream oil-rich endeavors. Within a few years, Guyana will produce several hundred thousand barrels of crude oil per day and Exxon Mobil will be leading the charge to make that happen. Exxon Mobil is developing Guyana’s offshore Stabroek block through a consortium that includes Hess Corporation (HES) and CNOOC Ltd (CEO), and first-oil was achieved last year (i.e. the first upstream asset started production). Exxon Mobil acts as operator of the consortium and owns a 45% interest in the venture.

Image Source: Exxon Mobil – November 2019 Guyana IR Presentation

Concluding Thoughts

Exxon Mobil arguably was in a stronger financial position than Royal Dutch Shell plc (RDS.A) (RDS.B) when the Anglo-Dutch oil giant cut its dividend in April 2020, but how long Exxon Mobil and its peers that have yet to cut their dividend in the face of COVID-19 will be able to hold out depends on factors outside of their control. As a price taker and not a price maker, there is only so much Exxon Mobil can do before exogenous forces tips its hand. The cuts in its capital expenditures and cash operating costs will go a long way in improving its cost structure and cash flow profile.

BP plc (BP) remains our favorite oil major, and has maintained its dividend policy during the COVID-19 induced downturn in energy markets by cutting capital expenditures, capitalizing on expected reduced annual legal payouts (relating to the Macondo disaster), leaning on its balance sheet and selling off some non-core assets. The terms of BP’s divestment of its Alaskan business to privately-held Hilcorp Energy Co. were adjusted to meet recent changes in energy market dynamics (though the payment structure now appears to be more staggered), but that $5.6 billion all-cash deal is still expected to go through and get completed in 2020.

—–

Oil & Gas (Majors Industry) – BP CVX COP XOM RDS.A RDS.B TOT

Independent Oil & Gas Industry – APA COG CLR DVN EOG MRO OXY PXD

Industrial Minerals – ARLP, CCJ, CNX, HCR, NRP

Refining Industry – HES HFC MPC PSX VLO

Oil & Gas Pipeline Industry – ENB ET EPD KMI MMP

Energy Equipment & Services (Large) Industry – BKR HAL NBR NOV SLB FTI SI

Related: USO, BNO, UNG, ARMCO, XLE, XOP, VDE, AMLP, AMZA, HYG, JNK, LQD, CHK, WLL, KRE, KBE, PBR, EQNR, FM, GULF, EWW, NORW, EWC, SPY, KSA, ERUS, UAE, EWZ, CVE, OIH, CRAK, MCO, SPGI

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Kinder Morgan Inc (KMI) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. BP plc (BP), Enterprise Products Partners L.P. (EPD), Magellan Midstream Partners L.P. (MMP), and the ProShares Short High Yield ETF (SJB) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.