Member LoginDividend CushionValue Trap |

DocuSign Has All the Makings of a Long-Term Winning Enterprise

publication date: Dec 4, 2020

|

author/source: Brian Nelson, CFA

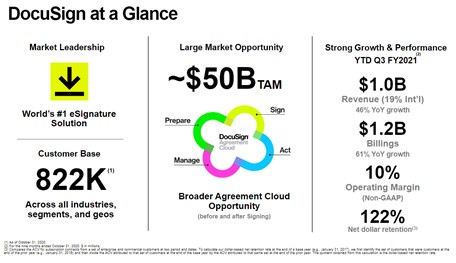

Image Source: DocuSign Investor Presentation Winter 2020. By Brian Nelson, CFA On December 3, cloud software provider DocuSign (DOCU)--best known for its electronic signature (eSignature)--reported fantastic third quarter fiscal 2021 results. We expect to raise our fair value estimate for shares upon its next update and point to the high end of our existing fair value estimate range of $295 per share for those investors taking an optimistic bent on this disruptive innovator. The company continues to revolutionize the traditional way people conduct business through contracts, offer letters and other agreements, and the outbreak of COVID-19 has only accelerated trends toward virtual business processes. DocuSign is tapping into a very large market opportunity, estimated at ~$50 billion, and the company’s existing customers (~822,000)--including heavy hitters such as Apple, Visa, Microsoft, Netflix, Abbott and beyond--account for just 1% of available enterprises and businesses around the world. DocuSign’s primary rival is Adobe’s (ADBE) EchoSign, but we think DocuSign competes favorably against the competition. For one, DocuSign’s cloud software spans the entire contract/agreement process, and its first-mover advantage, particularly with eSignature, helps to drive adoption via familiarity. Having a customer list of some of the most well-known enterprises also helps during the billing process. Businesses have come to trust DocuSign, and it is showing up in the numbers. During DocuSign’s third quarter fiscal 2021 (three months ended October 31, 2020), it experienced a 53% year-over-year increase in revenue thanks to strong subscription (~95% of total sales) and professional services revenue expansion. Billings during the period came in at $440 million, a leap of 63% on a year-over-year basis (and up 8% on a sequential quarterly basis). The company continues to invest heavily across its product suite, adding a number of new capabilities (e.g. AI-powered advanced contract analytics) to help enterprises complete remote business easier (it plans to roll out an electric notary feature soon, too). DocuSign’s outlook for the fourth quarter of fiscal 2021 (the current quarter ending January 31, 2021) showed that business momentum is accelerating. For the current quarter, management expects billings to come in the range of $512-$522 million (up ~42% on a year-over-year basis and nearly 19% on a sequential quarterly basis), with total billings for fiscal 2021 anticipated in the range of $1.7-$1.71 billion, up over 55% from the $1.1 billion it posted during fiscal 2020 (its billings in fiscal 2019 and fiscal 2018 were $801 million and $599 million, respectively). The company’s total revenue for fiscal 2021 is expected in the range of $1.426-$1.43 billion (better than our current estimate of $1.385 billion), with non-GAAP gross margin guided to the range of 78%-80%, consistent with its expectations for the current quarter. DocuSign’s business model has decent visibility into future sales, too, with its average contract length per customer at ~17 months and nearly one third of its business on contracts longer than a year. International opportunities also look robust. Here’s what management had to say on the fiscal third-quarter conference call: “…Q3 was another exceptional quarter for us. We saw results significantly outperform this quarter with billings growth of 63% year-over-year and revenue growth of 53% year-over-year leading to record levels of profitability. Our international business also showed substantial strength with revenue up 77% year-over-year, now representing fully 20% of total revenue. We landed 73,000 new customers bringing our total to nearly 822,000 worldwide and our customers expanded their use of DocuSign at the highest levels we’ve seen today yielding a net revenue retention rate of 122%.” Through the nine months ended October 31, 2020 (fiscal year-to-date), DocuSign has generated non-GAAP operating income of ~$106 million, operating cash flow of ~$235 million, and free cash flow of ~$171 million (~17% free cash flow margin). Though GAAP operating losses are currently a bit frightening (~$149 million during the first nine months of the current fiscal year), its asset-light subscription-based business model is built to facilitate tremendous earnings leverage as revenue continues to expand. The company ended the fiscal third quarter with cash, cash equivalents and investments of $675.6 million and $486.1 million in convertible senior notes. Concluding Thoughts DocuSign is executing well on its strategy to transform the foundation of doing business. The company’s large and under-penetrated market opportunity, essential cloud product suite that lines up favorably against the competition, accelerated billings expansion, and growing customer base with well-known brand names (which add credibility to its product offering) represent a number of key positives to the investment thesis. Though GAAP losses continue to pile up, DocuSign is free cash flow positive and sports an asset-light business model with considerable earnings leverage (as sales continue to expand at a rapid clip). DocuSign’s largely subscription-based business model offers a nice degree of visibility into future revenue trends, and its balance sheet is relatively healthy with a decent net cash position. DocuSign has all the makings of a long-term winning enterprise, as long as it avoids any security/execution miscues that could tarnish its brand and/or derail trust among its customers, impairing future growth. We expect to raise our fair value estimate of DocuSign upon its next report update and point to the high end of our existing fair value estimate range of $295 per share for bullish investors. DocuSign's 16-page stock report (pdf) >> --- Related: WFH Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Brian Nelson owns shares in SPY, SCHG, DIA, VOT, and QQQ. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment