Member LoginDividend CushionValue Trap |

Cisco Systems Continues to Recover; Growth Outlook Quite Promising

publication date: Aug 19, 2021

|

author/source: Callum Turcan

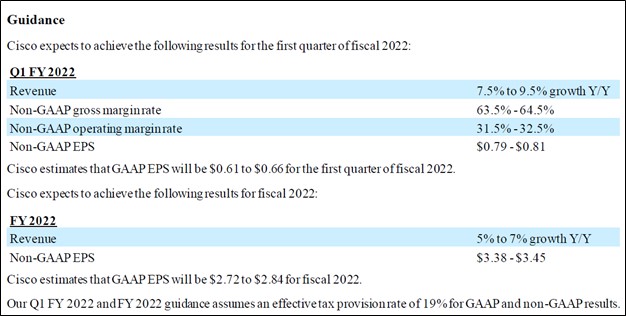

Image Source: Cisco Systems Inc – Fourth Quarter of Fiscal 2021 IR Presentation By Callum Turcan On August 18, Cisco Systems Inc (CSCO) reported fourth quarter earnings for fiscal 2021 (period ended July 31, 2021) that beat consensus top- and bottom-line estimates. Cisco Systems also offered guidance for both the first quarter of fiscal 2022 along with full-year guidance for fiscal 2022, breaking with tradition (usually the company does not offer full fiscal year forecasts). Cisco Systems is included as an idea in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios. We continue to be huge fans of Cisco Systems, and shares of CSCO initially moved significantly higher during the morning trading hours on August 19. Pivot to Recurring Revenues A major part of Cisco Systems’ strategy going forward is a pivot towards recurring revenue streams. In the fiscal fourth quarter, over 80% of the company’s software sales were from subscriptions, and its software revenues represented almost one third of its revenues during this period. Subscription revenue growth of 9% year-over-year outpaced total software sales growth of 6% year-over-year last fiscal year. The same held true for all of fiscal 2021, with Cisco Systems’ total software revenues up 7% year-over-year while its software subscription revenues were up 15% year-over-year during this period. Cisco Systems noted in its latest earnings call that over half of its revenues came from its services and software businesses during fiscal 2021 (the parts of its business that include a large recurring revenue component). Please note that the company’s GAAP revenues only grew by 1% in fiscal 2021 on a year-over-year basis, and that software as a percentage of Cisco Systems’ total revenues grew materially last fiscal year. Looking ahead, the company aims to build on this momentum through the recent launch of Cisco Plus, which includes a suite of solutions-as-a-service that can meet the networking, security, compute, storage, and application needs of its clients. Management recently noted that “while still early days in its launch, Cisco Plus directly aligns with our transformation goals around driving more subscription-based recurring revenue via the cloud” and we are intrigued by the potential upside here. The company’s ‘Security’ subscription revenues grew by 13% year-over-year last fiscal quarter and 18% year-over-year for all of fiscal 2021 as demand for cybersecurity offerings remains quite strong, aided by the momentum its Duo and Umbrella offerings have seen of late according to recent management commentary. Furthermore, management noted that Cisco Systems reported “the strongest product order growth rate in over a decade” last fiscal quarter and the company exited fiscal 2021 with $30.9 billion in remaining performance obligations (‘RPO’). Over half of its RPO “is short term, meaning it will be recognized as revenue in the next 12 months” according to recent management commentary. Growth in Cisco Systems’ recurring revenue streams underpins why the company felt confident in issuing full fiscal year guidance, given the greater visibility of its future financial performance. We are big fans of recurring revenue streams because these types of sales create stronger cash flow profiles. Guidance In the upcoming graphic down below, Cisco Systems lays out its guidance for the current fiscal quarter and for fiscal 2022. For reference, the company generated $3.22 in non-GAAP adjusted EPS in fiscal 2021 (up marginally from fiscal 2020 levels), which is expected to grow by 6% this fiscal year at the midpoint of guidance. Cisco Systems expects to report 5%-7% annual revenue growth in fiscal 2022, and we view its guidance as a sign that the company sees its recovery from the worst of the coronavirus (‘COVID-19’) pandemic having long legs.

Image Shown: An overview of Cisco Systems’ near term guidance. Image Source: Cisco Systems – Fourth Quarter of Fiscal 2021 Earnings Press Release Cisco Systems faced sizable headwinds during the worst of the COVID-19 pandemic as governments and enterprises put off major and minor IT projects for a variety of reasons, including the desire to conserve cash and maintain social distancing practices (in the event corporate and/or government offices were closed or otherwise adjusting to the pandemic in some form). As noted previously, Cisco Systems’ GAAP revenues grew 1% in fiscal 2021 over fiscal 2020 levels. The firm’s GAAP operating income shifted lower 6% during this period, in part due to its rising “core” operating expenses (R&D, SG&A) and in part due to a sizable jump up in its ‘restructuring and other charges’ line-item. During the final quarter of fiscal 2021, Cisco Systems reported its GAAP revenues grew 8% year-over-year and that its GAAP operating income rose 10% year-over-year, aided by the global economy steadily emerging from the worst of the pandemic. Acquisition activity created some noise as management noted during the firm’s latest earnings call that recent deals provided “a positive 210 basis point impact on revenue and no material impact on (its) non-GAAP earnings per share” in the fiscal fourth quarter, though the trajectory remains the same. Geographically speaking, Cisco Systems reported strong year-over-year revenue growth across the board last fiscal quarter. Cisco Systems’ business is on the rebound with room for ample upside as governments and enterprises get ready to resume IT projects delayed by the pandemic. Financial Update The company generated $14.8 billion in free cash flow in fiscal 2021, up modestly over fiscal 2020 levels. Cisco Systems spent $6.2 billion covering its dividend obligations in fiscal 2021 and another $2.9 billion buying back its stock during this period. Management noted during the firm’s latest earnings call that the goal is to “[return] a minimum of 50% of (its) free cash flow to shareholders annually” and that Cisco Systems pushed through its tenth consecutive year of dividend increases last fiscal year, which we really appreciate. Cisco Systems exited fiscal 2021 with $13.0 billion in net cash on hand, inclusive of short-term debt, even after spending $7.0 billion on acquisitions last fiscal year. That included five deals that closed in the final quarter of fiscal 2021 including: Slido (offers interactive applications for hybrid events), Sedonasys Systems (focused on multilayer network control, management, and analytics), Kenna Security (offers cybersecurity services), Involvio (focused on offerings for the education market), and Socio Labs (offers a technology platform that supports virtual and hybrid events). Furthermore, Cisco Systems completed its acquisition of networking intelligence firm ThousandEyes in August 2020 and optical interconnection firm Acacia Communications in March 2021. We appreciate that Cisco Systems has been able to maintain its financial strength while continuing to grow its dividend and repurchase its stock, on top of its acquisitive streak. Cisco Systems is a stellar free cash flow generator with a bright outlook that continues to improve. Management remains committed to rewarding shareholders while investing in the business, and we are intrigued by the potential upside its recent deals could yield. Supply Chain Hurdles Cisco Systems mentioned during its latest earnings call that the market should expect the company to continue contending with supply chain hurdles during the first half of fiscal 2022, hurdles that may continue into the second half of its current fiscal year. The ongoing semiconductor component shortage was cited as a key reason why this is likely to be the case. Here is what management had to say on the issue during Cisco Systems’ latest earnings call (emphasis added): “While we're seeing increasing demand for our technology, we're also continuing to manage through the component shortage challenges that nearly every company is experiencing our world-class supply chain team, as always, is doing an incredible job navigating this complex situation by working with our global suppliers to meet customer demand as quickly as possible. Looking ahead, we expect the supply challenges and cost impacts to continue through at least the first half of our fiscal year and potentially into the second half.” --- Chuck Robbins, Chairman and CEO of Cisco Systems Additionally, management noted that Cisco Systems is turning to other suppliers (those that are not necessarily its main suppliers) to meet its semiconductor component and other needs to keep up with demand, which in turn was weighing negatively on its margin outlook (particularly for the current fiscal quarter). Cisco Systems expects its non-GAAP gross margins will come in at 63.5%-64.5% in the current fiscal quarter, down from 65.6% in the fourth quarter of fiscal 2021 due to “the continuing increase in supply chain costs (it is) incurring as we protect shipments to our customers.” During the company’s latest earnings call, management mentioned that Cisco Systems announced “selective” pricing increases in early August 2021 to offset those additional costs in response to an analyst's question on the issue of the firm’s near term margin outlook. Please note that management mentioned it will take time for the pricing increases to go into effect (the increases are expected to be reflected in Cisco Systems’ financial performance during the upcoming fiscal second and fiscal third quarters). We are not worried as demand for Cisco Systems’ offerings is now quite strong, and eventually the global semiconductor shortage should ease up a bit as supply ramps up-- though things remain in flux due to the pandemic. Future pricing increases are under consideration, and Cisco Systems is closely monitoring the situation, as are we. Concluding Thoughts We are huge fans of Cisco Systems. The company’s supply chain hurdles are significant near-term problems, though we expect these headwinds will abate in the coming quarters, aided by 1) its significant pricing power (with an eye towards recent price increases and the potential for additional price increases down the road), 2) the firm’s growing software business, and 3) strong demand for its offerings (which underpins its pricing power). Shares of CSCO yield ~2.6% as of this writing, and the top end of our fair value estimate range sits at $61 per share of Cisco Systems. Downloads Cisco's 16-page Stock Report (pdf) >> Cisco's Dividend Report (pdf) >> ----- Technology Giants Industry - FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI Tickerized for CSCO, INFN, CIEN, FSLY, ANET, FFIV, COMM, LITE, AVYA, IIVI, JNPR, PLT, ZBRA, GLW, TRMB, ZM, PANW, PLTR, CRWD, OKTA, ZS, FEYE, FTNT, PFPT, SPLK Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO), and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Facebook Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment