Member LoginDividend CushionValue Trap |

Chipotle, Domino's Continue to Deliver for Shareholders

publication date: Jan 19, 2021

|

author/source: Callum Turcan

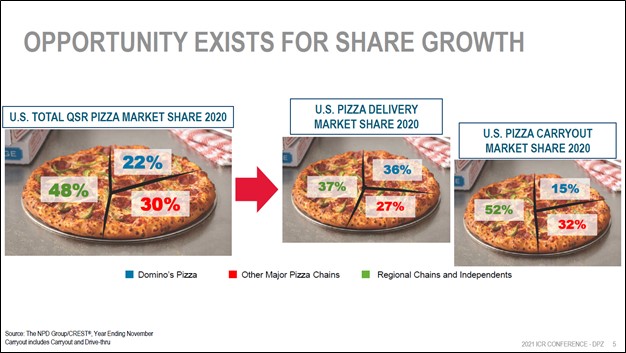

Image Shown: Domino’s Pizza Inc aims to grow its market share in the US by leaning heavily on its delivery and digital operations, a realm the firm has significant competitive advantages in, as compared to leaning on carryout operations at physical stores. Image Source: Domino’s Pizza Inc – January 2021 IR Presentation By Callum Turcan In the restaurant industry, one thing the coronavirus (‘COVID-19’) pandemic has made clear is that having drive thru operations, a strong online presence and efficient delivery services will be key to meeting consumer demand going forward. Physical restaurant locations that rely on indoor dinning will become relevant once again when the pandemic is contained, something the ongoing distribution of COVID-19 vaccines should help accomplish, but the use of food/beverage delivery services in a post-pandemic world will likely be greater than that in the pre-pandemic world (both in terms of number of households and the number of times households that use such services in any given period). Two Top Tier Fast-Causal Restaurants Omni-channel selling capabilities are essential not just for the retail space but for restaurants as well, particularly fast-causal operations. Placing a greater emphasis on digital marketing campaigns will be essential, too, given the highly targeted nature of these offerings and the wide reach such campaigns generally have. With that in mind, Chipotle Mexican Grill Inc (CMG) and Domino’s Pizza Inc (DPZ) are two restaurants with stellar omni-channel selling capabilities that have made considerable upgrades to their digital operations during the past few years. Domino's digital technologies are among the best in the fast-casual space, in our view, and Chipotle's delivery service revenue has surged in recent quarters thanks to recent investments across the channel (e.g. its app, website, and additions of "Chipotlane" drive-thru's). Image Shown: Chipotle's delivery service revenue has expanded considerably as it has successfully adapted to changing consumer preferences as a result of the COVID-19 pandemic (e.g. installing "Chipotlane" drive-thru's and the like). We expect delivery service revenue to become an ever-more important part of the fast-casual landscape relative to pre-COVID-19 in the years to come, with Chipotle remaining one of the most successful operators in this area. Image Source: Chipotle, Delivery Service Revenue.

During the pandemic, Chipotle and Domino’s have been able to lean on their food delivery capabilities to continue meeting consumer demand as social distancing measures forced households to stay indoors and unfortunately, many restaurants (especially smaller businesses) to close. Having digital platforms that are engaging, straightforward and easy-to-use also played a big role in enabling these firms to maintain their sales growth trajectories. For many households, the convenience of home delivery services is a big part of the value proposition. Asset-light delivery operations also translate into an improved ROIC, RONIC (return on new invested capital) situation. This is why we continue to be big fans of both Chipotle and Domino’s and view each firm having ample capital appreciation upside (based on the high end of our fair value estimate ranges, especially Domino's). We had highlighted these two ideas near the bottom of the March meltdown as top COVID-19 picks (see here). On January 12, we added Chipotle and Domino’s to the Best Ideas Newsletter portfolio (link here). In that piece we noted that “these two were clearly the stand-out performers across the restaurant space in 2020, and we want exposure to this arena as the economy continues to recover and then expand.” Looking ahead, both companies are well-positioned to capitalize on a global economic rebound and expectations for additional fiscal stimulus measures in the US. Chipotle's Financials Chipotle’s GAAP revenues grew by 6% year-over-year during the first nine months of 2020, with digital sales representing almost half of its total sales during the third quarter of 2020. The restaurant’s digital sales more than tripled versus year-ago levels in the third quarter and overall, Chipotle’s comparable restaurant sales were up 8.3% year-over-year during this period. However, the company’s GAAP operating income faced headwinds during the first nine months of 2020 due to pandemic-related expenditures. We forecast that Chipotle’s financial performance will rebound sharply going forward as its sales growth trajectory continues. The resumption of in-store dining activities along with sustained gains on the digital front underpins our optimistic take on Chipotle, as does the eventual end of most of its pandemic-related expenses. At the end of September 2020, Chipotle had $1.0 billion in cash, cash equivalents and short-term investments (not including restricted cash) along with an additional $0.1 billion in long-term investments on hand. Please note Chipotle did not have any debt on the books, though it did have $3.1 billion in short- and long-term operating lease liabilities combined at the end of this period to be aware of. During the first nine months of 2020, Chipotle generated $0.3 billion in free cash flow and spent ~$0.05 billion buying back its stock (the firm does not pay out a common dividend at this time). Domino’s Financials During the first three quarters of fiscal 2020, Domino’s posted 12% year-over-year growth in its GAAP revenues while its GAAP operating income climbed higher by 13% year-over-year. In the US, the company’s same-store sales growth clocked in at 17.5% in the fiscal third quarter while its international same-store sales growth came in at a decent 6.2% during this period, both on a year-over-year basis. We expect Domino’s will maintain its impressive financial and operational strength going forward. Domino’s had $3.8 billion in net debt (inclusive of short-term debt, not including restricted cash) at the end of the third quarter of fiscal 2020 (period ended September 6, 2020), and we view that burden as manageable given its stellar cash flow profile and modest dividend obligations. At the end of the fiscal third quarter, Domino’s had $0.2 billion in short- and long-term operating lease liabilities on the books, a relatively modest figure given the company’s franchise-oriented business model. Domino’s generated $0.3 billion in free cash flow during the first nine months of fiscal 2020 and spent $0.1 billion on its share purchases and dividend obligations combined during this period.

Image Shown: An overview of Domino’s asset base and financial performance. Image Source: Domino’s Pizza – January 2021 IR Presentation ROIC and RONIC Discussion As digital and related delivery service revenue becomes a greater part of the quick-service and fast-casual space of the restaurant industry, the implications on restaurants' ROIC and RONIC will be considerable, as operations generally move to more asset-light models. Many believe that "ghost kitchens," delivery-only restaurants, will become a growing part of the restaurant landscape in the future, and we would not be surprised to see a number of new publicly-traded issues seek to capitalize on this trend. Domino's, which runs mostly-franchised operations (its business model is to sell the technical know-how to and market for franchisees, rather than take on operating risk), has generated substantial ROICs due to its asset light nature, but operated restaurants that specialize in "ghost kitchens" may end up posting the highest ROICs among operators (non-franchise business models) in the years ahead. We expect a trend toward "ghost kitchens" to become a growing theme across the space, and we may see a number of new restaurant IPOs along these lines in coming years.

Image Shown: Domino's generates substantial ROICs, a key reason why we added the company to the Best Ideas Newsletter portfolio. The restaurant generates a "Highest Rated" Economic Castle rating, too. Concluding Thoughts We're impressed with the pace that several safe and viable COVID-19 vaccines were discovered by a consortium of private companies, research institutions and government entities. It appears that global health authorities will be able to put an end of the pandemic sooner than expected, supporting the outlook for the global economy going forward. Expectations that the US will pass additional fiscal stimulus measures in the near-term (after just recently passing ~$0.9 trillion in additional emergency fiscal spending measures, which we covered here) further supports the outlook for the global economy, though rising federal debt is an unavoidable long-term problem. In 2020, both Chipotle and Domino’s continued to grow their total store count (operated and franchised locations) even in the face of serious exogenous headwinds. Looking ahead, we see ample room for further expansion, supported by the operational prowess and financial firepower of both firms. The outlook for both Chipotle and Domino’s is bright, and we like having exposure to them in the Best Ideas Newsletter portfolio. ----- Discretionary Spending Industry – ATVI, BBY, CBRL, CMG, DIS, DG, DLTR, DPZ, DNKN, EL, F, GM, HAS, HD, LOW, MCD, NFLX, NKE, SBUX, TSLA, YUM, DKS, TJX, ROST, WHR, KMX, AZO, RL Related restaurant stocks: DRI, EAT, JACK, MCD, SBUX, WING, TXRH, YUM, QSR, FAT, SHAK, NDLS, RRGB, ARCO, DENN, JAX, KRUS. Related food delivery stocks: DASH, WTRH, GRUB, APRN, TKAYF, HLFFF ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Chipotle Mexican Grill Inc (CMG), Dollar General Corporation (DG), Domino’s Pizza Inc (DPZ) and The Walt Disney Company (DIS) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Dick’s Sporting Goods Inc (DKS) and Home Depot Inc (HD) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment