Image Source: The U.S. Department of Commerce

By The Valuentum Team

The global economic environment continues to reel from heightened inflation, which is pressuring consumer discretionary spending, but geopolitical uncertainty remains at a fever pitch. Russia’s invasion of Ukraine has unsettled investors, but the back-and-forth between the U.S. and China has chipmakers in the crosshairs. On October 7, 2022, the U.S. Department of Commerce released the following report aimed to restrict China’s ability to attain advanced computer chip technology:

The Department of Commerce’s Bureau of Industry and Security (BIS) is implementing a series of targeted updates to its export controls as part of BIS’s ongoing efforts to protect U.S. national security and foreign policy interests. These updates will restrict the People’s Republic of China’s (PRC’s) ability to both purchase and manufacture certain high-end chips used in military applications and build on prior policies, company-specific actions, and less public regulatory, legal, and enforcement actions taken by BIS.

The export controls announced in the two rules today restrict the PRC’s ability to obtain advanced computing chips, develop and maintain supercomputers, and manufacture advanced semiconductors. These items and capabilities are used by the PRC to produce advanced military systems including weapons of mass destruction; improve the speed and accuracy of its military decision making, planning, and logistics, as well as of its autonomous military systems; and commit human rights abuses. Finally, these rules make clear that foreign government actions that prevent BIS from making compliance determinations will impact a company’s access to U.S. technology through addition to the Entity List.

We’re viewing this as a material event for chip stocks as it may impair several chip giants from expanding rapidly in China. Fitch Ratings recently noted that it expects “the new rules to adversely affect revenue generation at the leading chipmaking equipment producers, such as ASML Holding N.V. (ASML), KLA Corp (KLAC) and Lam Research (LRCX).” Fitch estimates that as much as 13%-31% of some of the leading equipment producers’ revenue could be impacted. By their estimates, Lam Research and KLA Corp generate between 30%-35% in revenue from China, while ASML generates 15%-20%.

Clearly, the geopolitical tensions between the U.S. and China continue to rise, and the chip investing landscape has become much more complicated than even a few months ago. The impact from the new export restrictions across the chip-making landscape will be mixed, in our view, depending on how companies may be able to “work around” the export controls, and we continue to emphasize our fair value estimate ranges for chip stocks. Our team’s favorite chip names remain Qualcomm (QCOM), which is included in the simulated Dividend Growth Newsletter portfolio, and ASML Holding.

We expect a downward revision to our fair value estimates across the chip space, but many of their refreshed fair value estimates will remain within their existing fair value estimate ranges. Qualcomm will report fourth-quarter results November 2, 2022, and we’ll have more to say after the report. We recently dove into ASML’s quarterly report for the period ending October 3, which wasn’t too bad (which we’ll discuss in depth below). Of note, ASML indicated that the export restrictions won’t be as punitive for them as many believe given its headquarters in the Netherlands.

Though our newsletter portfolio “exposure” to the chip space is small, we’ll be watching fundamental performance across the group closely.

ASML Holding Is a Best in Breed Chip Stock

Image Source: ASML Holding NV – Third Quarter of Fiscal 2022 IR Earnings Presentation

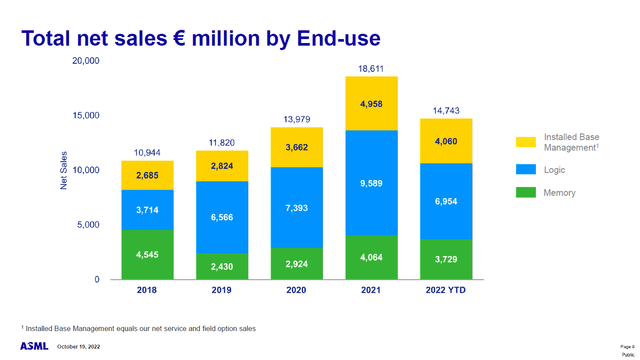

On October 19, ASML Holding NV (ASML) reported third quarter earnings for fiscal 2022 (period ended October 3, 2022) that beat consensus top-line estimates while its earnings remained robust. The Netherlands-based company produces photolithography systems used to make semiconductor components, and at the high-end of this market it operates a virtual monopoly. As ASML Holding faces limited to no competition, the firm possesses ample pricing power and its outlook is supported by a vast backlog.

Earnings Update

In the fiscal third quarter, ASML Holding’s GAAP revenues rose by 10% year-over-year to reach EUR€5.8 billion. The company’s net system sales were up 3% year-over-year and its net service and field option sales grew by 35% last fiscal quarter. As ASML Holding’s installed equipment base grows, so too does its ability to generate services revenues. In the fiscal third quarter, ASML Holding sold 86 photolithography systems, up from 79 in the same period last fiscal year. ASML Holding secured EUR€8.9 billion in net bookings for its photolithography systems in the fiscal third quarter.

ASML Holding’s pricing power continues to impress and has gone a long way in offsetting major inflationary pressures seen of late as it concerns maintaining its gross margins. Last fiscal quarter, ASML Holding reported a GAAP gross margin of 51.8%, up ~10 basis points on a year-over-year basis. However, sharp increases in its R&D and SG&A expenses saw the company’s GAAP operating income grow by just 1% year-over-year to reach EUR€1.9 billion in the fiscal third quarter, as its GAAP operating margin declined by ~310 basis points to reach 33.5%. While its GAAP net income declined 2% year-over-year last fiscal quarter, the firm’s GAAP diluted rose by 1% to hit $4.29 due to a meaningful reduction in its outstanding diluted share count.

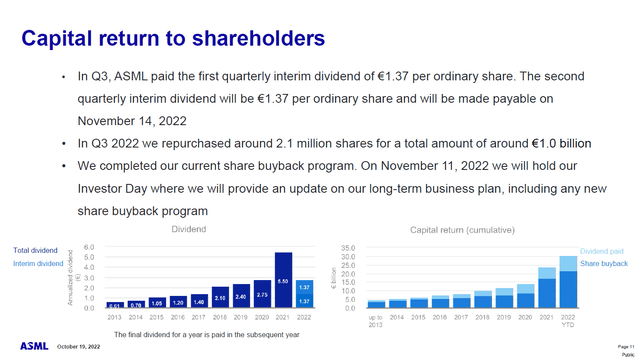

The company exited the fiscal third quarter with EUR€3.4 billion in cash, cash equivalents, and short-term investments on hand versus EUR€3.5 billion in long-term debt on the books (ASML Holding did not break down the components in its current liabilities line-up). ASML Holding’s net cash position at the end of fiscal 2021 flipped to a marginal net debt position at the end of the third quarter of fiscal 2022 as the company has been aggressively buying back its stock of late while ramping up its dividend payouts. Its balance sheet health remains rock-solid given its ample liquidity on hand.

Image Shown: ASML Holding has been returning substantial amounts of cash back to investors in the form of dividend increases and share repurchases in recent fiscal years. Image Source: ASML Holding – Third Quarter of Fiscal 2022 IR Earnings Presentation

During the first three quarters of fiscal 2022, ASML Holding generated EUR€2.3 billion in free cash flow and spent EUR€2.0 billion covering its dividend obligations along with another EUR€4.3 billion buying back its stock. For reference, ASML Holding’s annual free cash flows averaged ~EUR€5.3 billion from fiscal 2019-2021. ASML Holding recently shifted to a quarterly dividend program, and its payout is in euro terms, meaning there are foreign currency movement considerations to be aware of.

Guidance Update

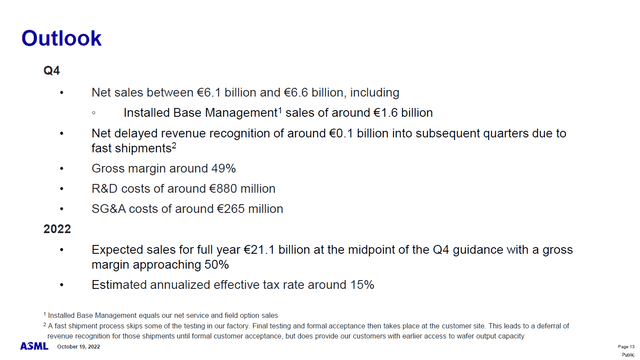

Looking ahead, ASML Holding expects to report solid performance in the fiscal fourth quarter. The company is guiding for EUR€6.1-€6.6 billion in net sales in the current fiscal quarter, which at the midpoint represents 27% year-over-year growth. ASML Holding also forecasts that its gross margin will come in around 49% this fiscal quarter, down from 54.2% in the same period last year as inflationary pressures are beginning to take a heavy toll that pricing increases alone can’t offset.

Image Shown: ASML Holding is guiding for robust revenue growth in the current fiscal quarter on a year-over-year basis, though its gross margin is expected to shift materially lower as inflationary pressures begin to take a toll. Image Source: ASML Holding – Third Quarter of Fiscal 2022 IR Earnings Presentation

During prepared remarks covering the firm’s latest earnings update, ASML Holding’s management team had this to say regarding US technology export controls to Chinese enterprises and how rising US-China geopolitical tensions were impacting the firm’s business (emphasis added):

“Finally, with regards to the announcement earlier this month from the US government around export control restrictions, we have performed our initial assessment and expect the direct impact on ASML’s overall shipment plan for 2023 to be limited. However, there could be an indirect impact due to the inability of other equipment suppliers to ship their systems.

Our current expectation of such an indirect impact would be around 5 percent of our backlog.This percentage is based on the share in our backlog of purchase orders from Chinese fabs that in our current assessment are seen as meeting the technology criteria as indicated in the updated US export controls restrictions. We will continue to refine our assessment as the situation evolves.

While ASML is of course fully committed to comply with all applicable regulations, the new regulations do not directly change U.S. export controls on lithography equipment. As a European based company with limited US technology in our systems, ASML can continue to ship all non-EUV lithography systems to China out of the Netherlands.

Additionally, we can ship most U.S. origin spare parts to most customers in China that are working on mature nodes without a U.S. export license. The new export control rules are directed at advanced nodes, while our business in China is predominantly directed at mature nodes. Lastly, if for export control related reasons we cannot ship to more advanced fabs in China, we have more than sufficient demand for these systems elsewhere globally, as demand continues to exceed supply.” — Peter Wennink, President and CEO of ASML Holding

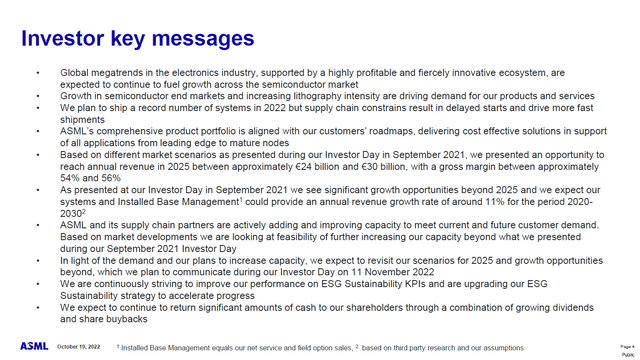

Shares of ASML popped higher initially after its latest earnings update was published, likely in part due to management reassuring investors that the company’s longer-term goals remained intact. By (likely fiscal) 2025, ASML Holding aims to generate EUR€24-€30 billion in revenue with a gross margin of 54%-56%. For reference, ASML Holding generated EUR€18.1 billion in GAAP net sales with a GAAP gross margin of 52.7%.

Image Shown: ASML Holding is targeting substantial revenue growth and gross margin expansion over the next several fiscal years, which should drive significant operating cash flow growth and ultimately free cash flow growth. Image Source: ASML Holding – Third Quarter of Fiscal 2022 IR Earnings Presentation

Concluding Thoughts

ASML Holding is a stellar enterprise and the company is doing its best to ride out inflationary pressures and US-China geopolitical tensions with its growth runway intact. Management is incredibly shareholder friendly, and shares of ASML yield ~1.7% as of this writing. Though its near term may be rocky given news regarding export restrictions, we remain optimistic on ASML Holding’s longer term growth outlook and view its capital appreciation upside favorably. We’ll have more to say about Qualcomm when it reports November 2, 2022.

—–

Technology Giants Industry – META, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI

Tickerized for holdings in the SMH.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, META, GOOG, VRTX, and XLE. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Korn Ferry (KFY), and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. ASML Holding NV (ASML), Oracle, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.