Image Source: Campbell Soup Company – Third Quarter of Fiscal 2020 Earnings IR Presentation

By Callum Turcan

On June 3, 2020, Campbell Soup Company (CPB) reported third quarter earnings for fiscal 2020 (period ended April 26, 2020) and raised guidance for the full fiscal year to reflect the surge in demand for consumer staples goods due to the ongoing coronavirus (‘COVID-19’) pandemic. The firm beat consensus bottom-line estimates but missed consensus top-line estimates. Campbell’s net organic sales (a non-GAAP figure) jumped up by 17% year-over-year (GAAP revenues were up by 15%) and its adjusted diluted EPS (a non-GAAP figure) climbed higher by 57% year-over-year (GAAP diluted EPS was up 34%).

Quarterly Update

Sales of its ‘meals and beverages’ products rose by 20% while sales of its ‘snack’ products rose by 9% year-over-year last fiscal quarter. Campbell’s GAAP operating income rose by 11% year-over-year last fiscal quarter, though after making some adjustments (largely relating to ‘investment losses’ and ‘pension settlements’), on a non-GAAP basis the firm’s adjusted operating income climbed higher by 31%.

Campbell appeared to benefit from market share gains as well, with the firm’s CEO noting in the earnings press release that “Campbell’s products were purchased by millions of new households, with total company household penetration increasing over 6 percentage points in the quarter compared to the third quarter of fiscal 2019,” which highlights the recent shift towards big brand names and away from what some refer to as “insurgent” brands (generally speaking, the insurgent brands are more expensive and marketed as healthier products).

Due to its extraordinarily strong performance in the fiscal third quarter, Campbell raised its full year guidance for fiscal 2020. Net sales and organic net sales are now both expected to grow by 5.5%-6.5% (up from -1% – +1% previously), adjusted operating income is expected to grow by 12%-14% (up from 2%-4% growth previously), and adjusted EPS is expected to grow by 25%-27% (up from 11%-13% growth previously) versus fiscal 2019 levels. However, shares of CPB still sold off during normal trading hours on June 3, likely due to this performance and improving outlook already being priced into its stock (and then some).

Please note this guidance excludes the favorable impact from an additional week in fiscal 2020 (the 53rd week) and the sale of Campbell’s European Chips Business, which closed in October 2019. Also, please note some of those modest proceeds (less than $0.1 billion in USD terms) were used to pay down debt.

Our fair value estimate for shares of Campbell sits at $42 per share, with the upper end of our fair value estimate range sitting at $52 per share. As CPB was trading near the upper end of our fair value estimate range at the start of trading on June 3, the selloff in its share price appears justified. Stocks trade on forward-looking assumptions, not historical performance, and Campbell communicated that the recent surge in sales was unlikely to last (growth rates going forward will be significantly lower). While management noted Campbell was well-positioned to capitalize on changing consumer needs in light of COVID-19 during the firm’s latest quarterly conference call, management also noted that some of these recent changes will be “episodic” in nature.

Deleveraging Drive

Campbell generated $0.9 billion in free cash flow last fiscal quarter and spent $0.3 billion on its dividend obligations. The company did not repurchase a meaningful amount of its stock last fiscal quarter, in part due to the debt taken on after acquiring Snyder’s-Lance Inc in an all-cash deal worth $6.1 billion by enterprise value (that deal closed in March 2018).

At the end of its fiscal third quarter, Campbell had a net debt position of $5.5 billion, and please note the firm’s $1.2 billion in cash and cash equivalents on hand fell short of its $1.5 billion in short-term debt. A combination of refinancing activities, cash on hand, and future free cash flows will be used to roll that burden over or pay down those upcoming maturities. Here’s what management had to say on the issue of Campbell’s debt position during the firm’s latest quarterly conference call (emphasis added):

“As we updated you last quarter, we had made significant progress to de-lever our balance sheet. Ending net debt of $5.5 billion as of the third quarter declined by approximately $2.9 billion in the first nine months of fiscal 2020 as proceeds from completed divestitures, along with positive cash flow generated by the business, were used to reduce our debt.

In April, we raised $1 billion through the issuance of 10- and 30-year bonds. In early May we repaid the $300 million which was outstanding on our revolver and while we currently have an increased cash balance, we plan to utilize these proceeds to reduce a portion of our outstanding debt. We are comfortable with our overall liquidity position, in light of the increased cash balance combined with the highly cash generative nature of our business. Our leverage ratio, which represents net debt to a trailing 12-month adjusted EBITDA from continuing operations is now at 3.2 times.” — Mick Beekhuizen, CFO of Campbell Soup

We like Campbell’s deleveraging drive, though a lot more work needs to be done on this front. Campbell’s Dividend Cushion ratio sits at -0.7 (negative 0.7) highlighting the immense burden the firm’s net debt load is placing on the strength (or lack thereof) of its dividend coverage on a forward-looking basis. While the situation is improving, Campbell must stay the course and continue deleveraging.

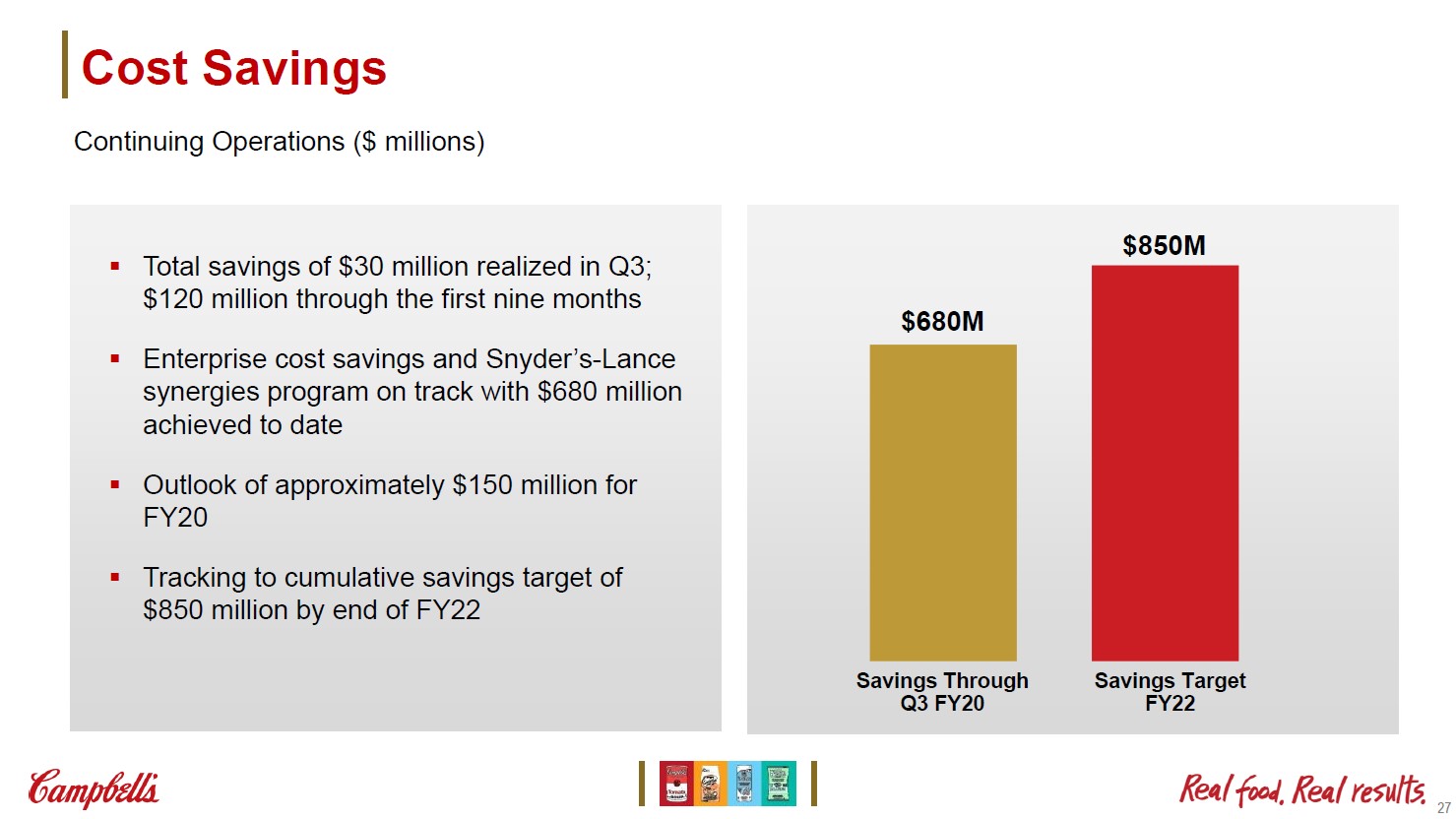

Cost savings and synergies from the Snyder’s-Lance deal are expected to materially improve Campbell’s cost structure in the coming years as one can see in the upcoming graphic down below. That will make deleveraging activities a bit easier due to potential improvements in Campbell’s cash flow profile on a forward-looking basis, keeping in mind the firm has already secured meaningful cost savings.

Image Shown: Campbell’s is targeting additional cost savings over the coming years on top of the savings already realized in the wake of its Snyder’s-Lance deal. Image Source: Campbell– Third Quarter of Fiscal 2020 Earnings IR Presentation

Concluding Thoughts

Campbell’s near-term outlook remains quite strong, and the firm appears to be gaining meaningful market share. However, a lot of that upside (and then some) was already priced into Campbell’s stock going into its latest earnings report, which is likely why shares of CPB sold off on June 3, in our view. We appreciate management sticking with Campbell’s deleveraging efforts during these challenging times.

—-

Dollar Store and Department Store Industries – KSS M JWN BIG DG DLTR PSMT

Food Products (Small/Mid-Cap): CALM FLO FDP HAIN HRL JJSF LANC MKC SJM THS TSN

Food Products (Large/Mid-Cap): ADM BG CPB CAG GIS HSY K KHC MDLZ NSRGY UL UN

Food Retailing Industry – CASY COST CVS KR SYY TGT WBA WMT

Related: AMZN, VDC, WHGRF

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Dollar General Corporation (DG) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. The Vanguard Consumer Staples ETF (VDC) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.