Member LoginDividend CushionValue Trap |

BNP Paribas is One of the Stronger Banks in an Overtraded European Landscape

publication date: Aug 14, 2020

|

author/source: Matthew Warren

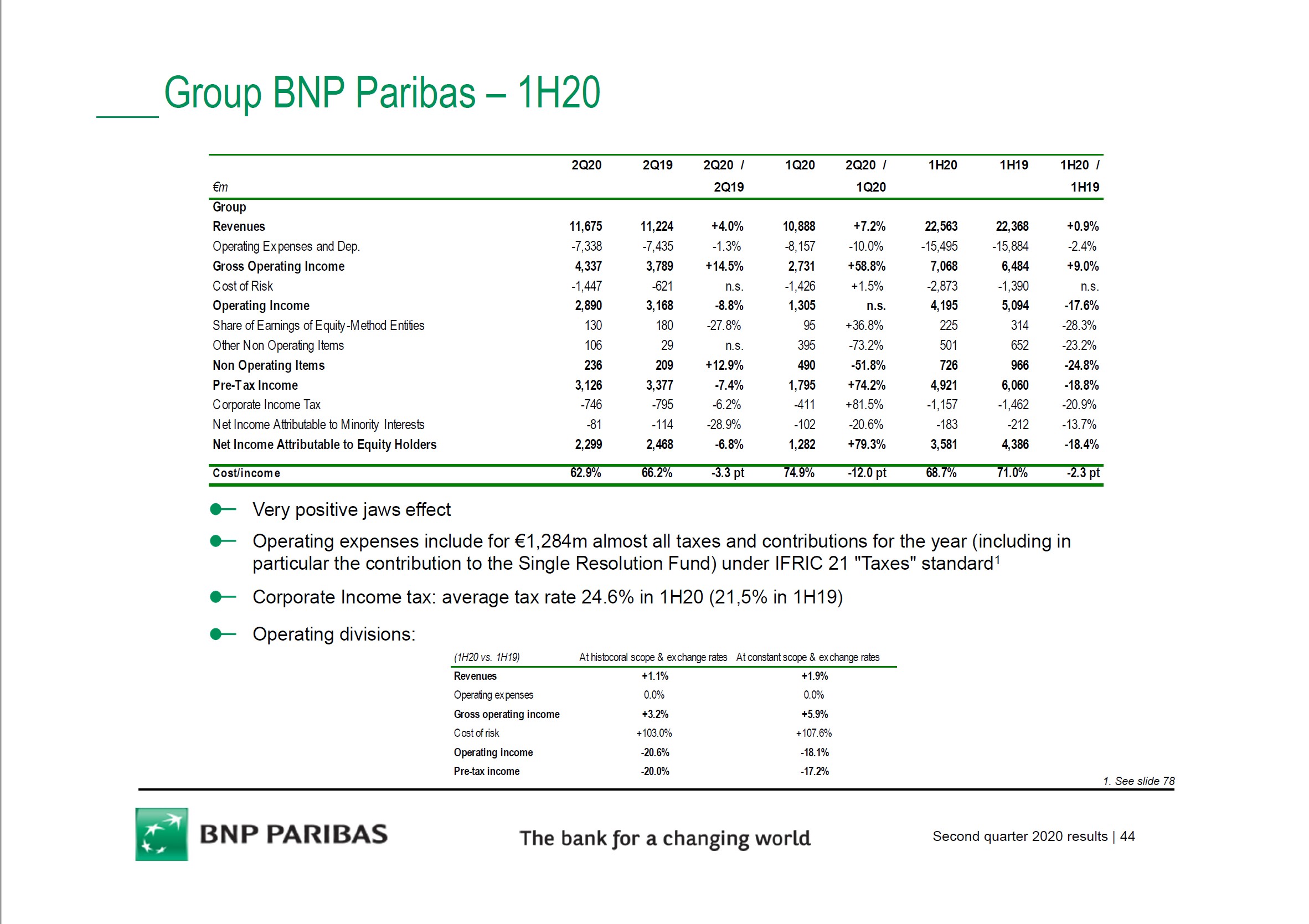

While some of the stronger global banks like BNP Paribas are showing that they can take the economic fallout from COVID-19 on the chin while maintaining some degree of earnings power and protecting strong capital levels, other banks with lesser earnings power and balance sheets are falling prey to this cycle with losses and lower capital levels. From our perspective, it is simply easier to find non-bank operating companies with strong moats, sound balance sheets, and visible free cash flow growth into the future. Be careful investing in banks! By Matthew Warren On July 31, BNP Paribas (BNPQF) put up a reasonable set of results in the second quarter, considering the global pandemic’s substantial impact on the economy. As you can see in the upcoming graphic down below, group revenues were actually up 4%, but net income was down 6.8% due to substantially higher cost of risk (bad loans expected). The bank managed very impressive cost control so far this year, which bodes well for results on the other side of the pandemic.

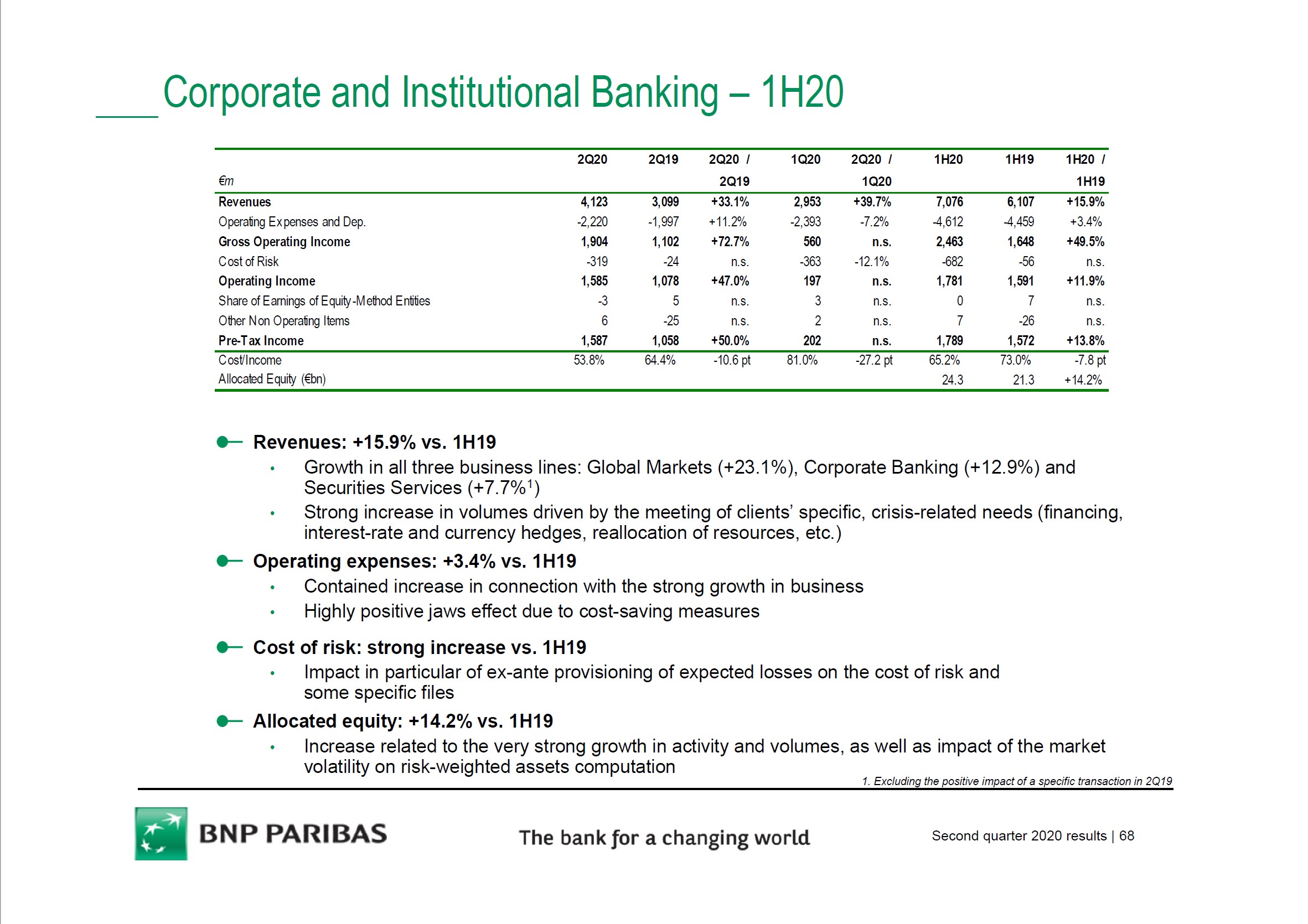

Image Shown: BNP Paribas’s second quarter results held up better than many global bank peers. Image Source: BNP Paribas 2Q2020 Earnings Presentation With a return on tangible equity of about 8% in the quarter, it is clear that BNP Paribas is one of the better banks in Europe in terms of financial metrics. In part, this is due to how global the bank actually is, operating in geographies around the world. It is also important to note that the bank benefitted from a standout performance by its Corporate and Institutional Banking Unit in the quarter, which is expected to (and management guided to) taper off going forward. Essentially, bank customers around the world issued a lot of equity, bonds, and convertibles in the second quarter in order to add liquidity to their balance sheets and term out their debt maturities, so as to reduce risk. This bonanza especially accrued to the stronger global investment banks (IBs), most of which are domiciled in the United States, but BNP is one of the strongest IBs in Europe, which you can see in the upcoming graphic down below. Segment revenues were up 33.1% in the quarter and pre-tax income was up a whopping 50%. As this activity normalizes, BNP and other global banks will count on their loan loss provisioning to come down in order to put up better numbers as we move through the economic cycle.

Image Shown: BNP Paribas Corporate and Institutional Banking had a stellar quarter. Image Source: BNP Paribas 2Q2020 Earnings Presentation

Concluding Thoughts While some of the stronger global banks like BNP Paribas are showing that they can take the economic fallout from COVID-19 on the chin while maintaining some degree of earnings power and protecting strong capital levels, other banks with lesser earnings power and balance sheets are falling prey to this cycle with losses and lower capital levels. Some US banks like Wells Fargo (WFC) and Capital One (COF) have cut dividends and all the largest US banks have cut out share buybacks as a group decision (we think likely influenced by regulators behind closed doors). European banks have cut out all share buybacks and dividends as a result of pressure from the European Central Bank. Aside from pressure on capital returns to shareholders, banks around the world are also being pressured to make government-backed loans to consumers and businesses and offering moratoriums on payments in many cases. Only time will tell how these moratoriums will play out in terms of ultimate migration into bad loans. The reality is that only the highest quality banks are investible, and even then it is hard to double down during a financial crisis, when one doesn’t know how high the flood will ultimately crest. From our perspective, it is simply easier to find non-bank operating companies with strong moats, sound balance sheets, and visible free cash flow growth into the future. Be careful investing in banks! View our latest video on how banks/financials performed during the COVID-19 crisis here. --- Related: SAN, IITOF, DB, ING, CRARF, SCGLF, BBVA, UNCFF, CRZBF, BCS, BKZHY, UNCRY, LYG, EUFN, XLF Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Matthew Warren does not own any of the securities mentioned. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment