Member LoginDividend CushionValue Trap |

Best Idea Alphabet on the Move!

publication date: Jun 16, 2021

|

author/source: Callum Turcan

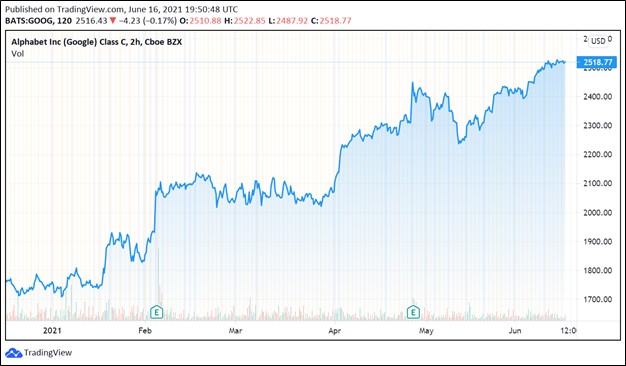

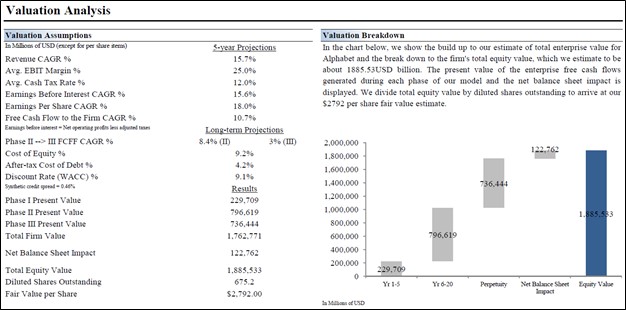

Image Shown: Shares of Alphabet Inc Class C have been on a nice upward climb over the past several months with ample room for additional capital appreciation upside, in our view. We include shares of GOOG as a top-weighted idea in the Best Ideas Newsletter portfolio. By Callum Turcan Companies with real pricing power are well-positioned to navigate headwinds arising from inflation pressures as cost increases can be passed along to the consumer and then some (i.e. price increases above inflation). Many large cap tech firms fit this bill including one of our favorite ideas Alphabet Inc (GOOG) (GOOGL), with an eye towards the pricing strength seen at its enormous digital advertising business. We include shares of Alphabet Class C (ticker: GOOG) as a top-weighted idea in the Best Ideas Newsletter portfolio. In this article, we will highlight why we view Alphabet’s growth outlook and capital appreciation potential quite favorably in the face of major hurdles. Preparing for Big Changes The digital advertising landscape is changing in the wake of Apple Inc (AAPL) updating its app tracking transparency framework. Among other things, Apple recently changed the default setting on its popular hardware regarding identifier for advertisers (‘IDFA’) from on to off, meaning users must now opt-in to having their digital activity tracked online. Effectively, tracking individual user activity online on iPhones and other Apple hardware across apps and websites is no longer a viable option for digital advertisers. Furthermore, Apple is revamping its Apple Mail offering to limit the amount of data that email senders can gather about the receivers of those emails, such as whether the mail was opened and what location the receiver is located. Generally speaking, Apple’s installed hardware base tend to be represented by households in the higher income brackets in their respective regions and major targets for advertising campaigns. When Apple changes its business practices, the impact can quickly reverberate across the entire economy. As an aside, we include shares of Apple as an idea in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios and continue to be huge fans of the name (here is a link to a video we created at Valuentum that covers why Apple is a stellar enterprise). Alphabet is also changing its business practices by phasing out third-party cookies and making it harder to track individual online user activity, among other changes. The company will still allow first-party data targeting, and Alphabet will still provide its customers with conversion tracking data so its customers can gauge the performance of their digital advertising campaigns. Furthermore, Alphabet will still target ads across its own properties including Gmail and YouTube. In our view, Alphabet is incredibly well-positioned to navigate the changing digital advertising landscape, aided by the immense popularity of its own digital properties and the ability to continue offering highly targeted advertising campaign services to its customer base. The company will still be able to offer its customer base advertising offerings that generate a high return on investment (‘ROI’), in our view, underpinning future demand for Alphabet’s services. Regulatory Headwinds and Intrinsic Values Big tech companies are facing growing regulatory headwinds in the US and elsewhere, though for Alphabet it appears one of the biggest risks is that future M&A activity will become significantly harder to pursue. In 2006, Alphabet (then Google) acquired YouTube for about $1.65 billion. Legislators on both sides of the isle in the US have recently proposed bills that would make M&A activity for large tech firms significantly more difficult if not impossible to pursue (I, II). While that could prevent a firm like Alphabet from making an acquisition that could generate sizable shareholder value, please note that this proposed legislation, even if enacted, would not have a material negative impact on Alphabet’s intrinsic value as things stand today. Our fair value estimate for shares of Alphabet Class C (ticker: GOOG) sits at $2,792 under our “base case” scenario, well above where GOOG is trading at as of this writing. This intrinsic value is derived through our enterprise cash flow analysis process built on forecasting the firm’s future free cash flows into perpetuity and discounting those forecasted free cash flows at the appropriate rate. The top end of our fair value estimate range sits at $3,490 per share of GOOG under our “bull case” scenario. Here, we would like to stress that these forecasted future free cash flows are based on Alphabet’s existing businesses as things stand today. Unless legislation is passed that prevents Alphabet operating its core businesses as it currently does (as a hyperbolic example, banning digital advertising outright), its future forecasted free cash flows would not change simply because potential future M&A activities will become more difficult to pursue in certain jurisdictions. The upcoming graphic down below highlights the key valuation assumptions used in the “base case” scenario regarding Alphabet’s enterprise cash flow model. Alphabet’s strong forecasted free cash flow growth during the mid-cycle (Year 6-Year 20) and perpetuity (Year 21+) phases of the business period underpins its fair value estimate, aided by its net cash position. Proposed legislation in the US and elsewhere would need to be extremely onerous and punishing that it changes that forecasted dynamic, something that would be very difficult to do given that Alphabet’s future financial performance is supported by secular growth tailwinds. For instance, digital advertising is becoming more dominant, aided by the proliferation of e-commerce, while cloud computing operations are now the backbone of modern IT infrastructure at enterprises and governments. These are dynamics that are not going to go away for the foreseeable future.

Image Shown: The key valuation assumptions used in our “base case” scenario in the cash flow models covering Alphabet are highlighted in the above graphic. Shares of Alphabet Class C, ticker GOOG, appear to be significantly undervalued as of this writing. Potential regulatory headwinds aside, ongoing structural changes in the global economy provide an immense amount of support to the firm’s growth trajectory, and thus make it difficult to believe that Alphabet would not be able to significantly grow its free cash flows at a brisk pace for a sustained period going forward. Beyond digital advertising, Alphabet’s cloud computing unit Google Cloud is showing some real promise and has been growing at a brisk pace of late (revenues at this segment were up 46% year-over-year in the first quarter of 2021, while the company’s digital advertising-related revenues were up 32% year-over-year during this period). Alphabet’s free cash flow generating abilities are stellar and its enormous net cash position provides the firm with ample financial firepower, as we covered in our April 2021 article Best Idea Alphabet Flying Higher (link here). If M&A activities are off the table, Alphabet can use its immense net cash position to repurchase its stock at a faster pace than it currently is, or initiative a dividend program, or both. If Alphabet were forced to break up into smaller separate companies, an idea that was been floated around before, though one we view as incredibly unlikely to materialize for the foreseeable future, that would not significantly alter the free cash flow generating abilities of those enterprises. That said, combined with the changing digital advertising landscape, there could be some turbulence if this unlikely event materializes, though not at levels that would fundamentally ruin the impressive financial performance of Alphabet’s core businesses. Given that Alphabet is trading at a meaningful discount to its fair value estimate as of this writing, such a move may counterintuitively see shares of GOOG climb higher. The reason this could occur comes down to the market evaluating the different pieces of the broken up firm on a sum of the parts basis (which, in theory, would ultimately lead to the market recognizing that the various pieces of Alphabet are undervalued relative to their intrinsic value on the basis of their forecasted future discounted free cash flows). Considering shares of GOOG are on a nice upward trend of late, it appears the market is warming up to Alphabet’s promising growth outlook and that investors are largely shrugging off concerns regarding the changing digital advertising and regulatory landscape. That is not to imply that these concerns are not very real and significant to Alphabet’s future financial performance; they very much are, but we want to highlight that Alphabet’s business model is so rock-solid that it is difficult for any entity (governments, enterprises, political groups, etc.) to stymie the company’s promising long-term growth outlook. On a final note, though Amazon Inc’s (AMZN) digital advertising business has grown at an impressive pace over the past few years, we see room for multiple winners in the digital advertising business due to the secular growth tailwinds supporting the industry. We are not worried that Amazon will “eat Alphabet’s lunch” on this front given Alphabet’s dominant position in the space. Concluding Thoughts We are closely monitoring the changing digital advertising landscape and regulatory environment, specifically as it concerns big tech names. Alphabet is a tremendous business and there is not much that can derail its impressive growth trajectory, in our view. With that in mind, we continue to like Alphabet Class C shares as a top-weighted idea in the Best Ideas Newsletter portfolio. Alphabet and its peer Facebook Inc (FB), which is another top-weighted idea in the Best Ideas Newsletter portfolio, represent tremendous capital appreciation opportunities. We covered Facebook’s first quarter earnings report and why we are big fans of the firm in our April 2021 article Best Idea Facebook Posts Blowout Earnings Report that can be viewed here. ----- Technology Giants Industry - FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI Tickerized for GOOG, GOOGL, FB, AMZN, AAPL Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Facebook Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment