Member LoginDividend CushionValue Trap |

AT&T Remains Free Cash Flow King, Though Deleveraging Efforts Are Getting Tougher

publication date: Jul 28, 2020

|

author/source: Callum Turcan

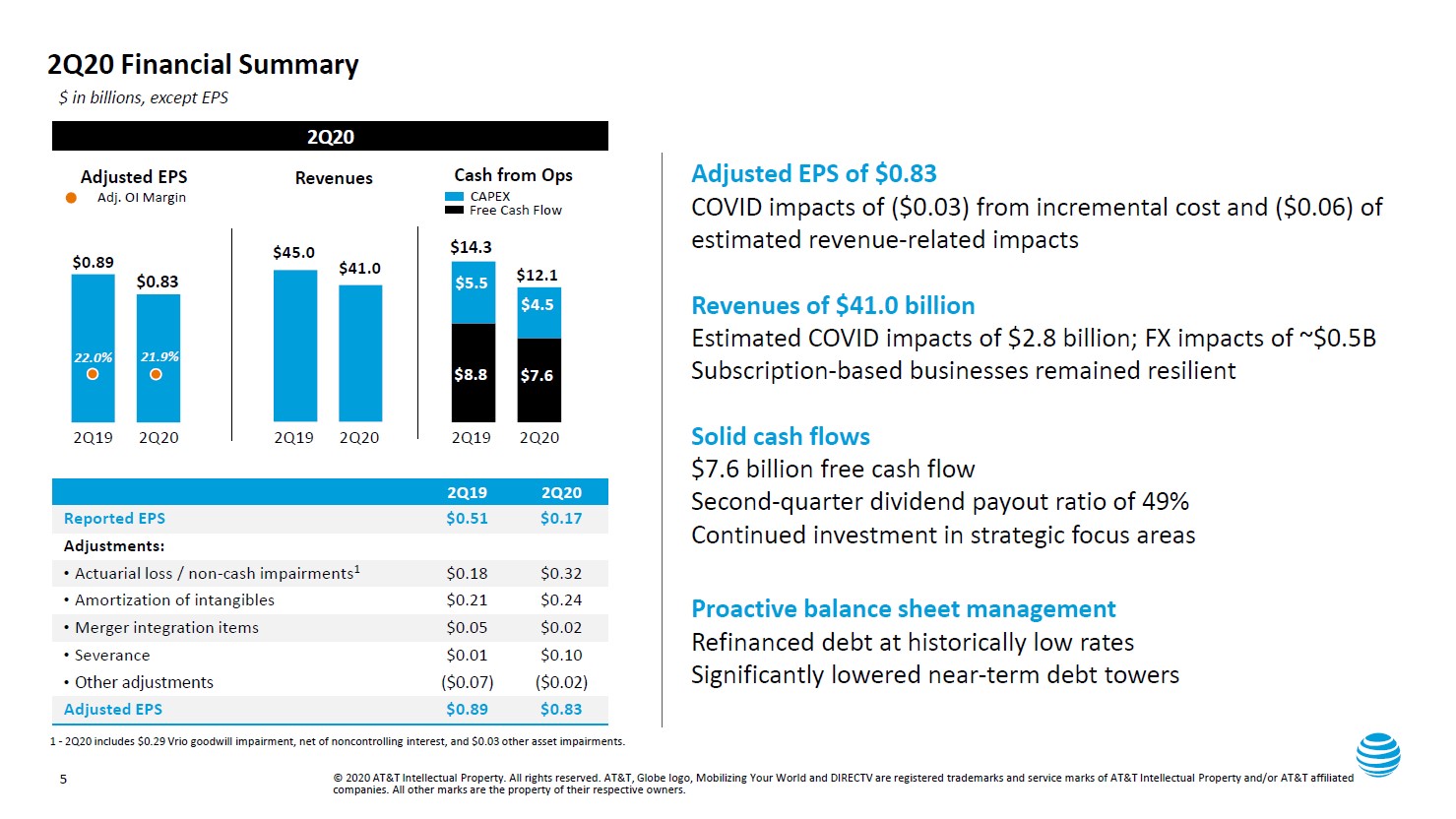

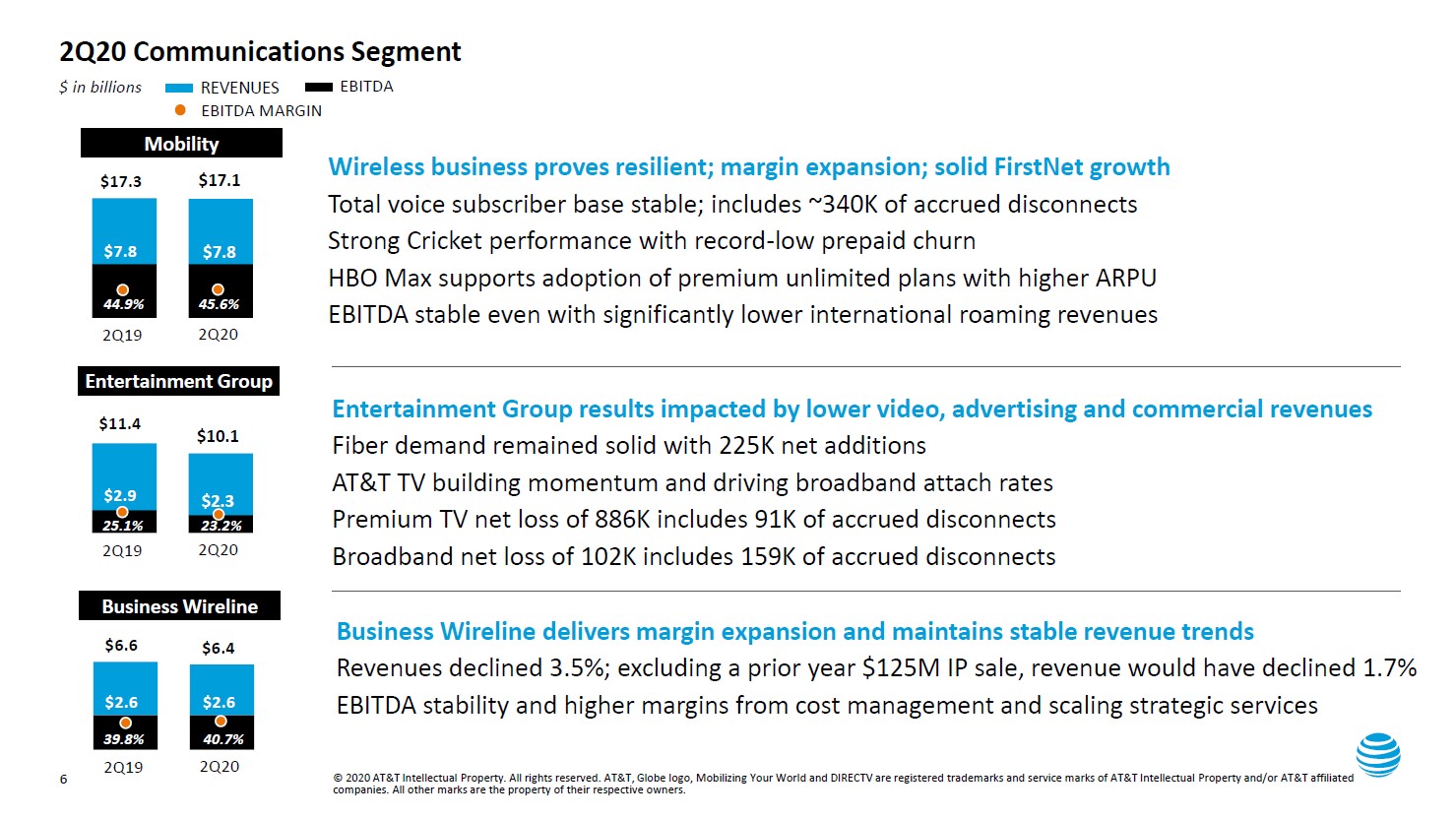

Image Shown: AT&T Inc continued to be a free cash flow cow last quarter, though the ongoing pandemic created headwinds for its various businesses. Image Source: AT&T Inc – Second Quarter of 2020 IR Earnings Presentation By Callum Turcan The ongoing coronavirus (‘COVID-19’) pandemic has created some very serious headwinds for AT&T Inc (T), but that did not stop the telecommunications and entertainment giant from being incredibly free cash flow positive last quarter. On July 23, AT&T reported its second quarter 2020 earnings report and we remain confident in the firm’s ability to keep making good on its dividend obligations going forward. Shares of T yield ~7.1% as of this writing, and we include shares of AT&T in our High Yield Dividend Newsletter portfolio. Quarterly Overview AT&T’s GAAP revenues moved lower by 9% year-over-year in the second quarter of 2020 as the firm dealt with headwinds created by COVID-19. The company also took a $2.3 billion asset abandonment and impairment charge last quarter, which along with headwinds facing its revenues resulted in the firm’s GAAP operating income turning significantly lower on a year-over-year basis. Last quarter, the company’s ‘Communications’ segment (wireless, cable, internet) held up quite well, relatively speaking. AT&T added 225,000 net subscribers to its fiber internet business while it continued to roll out its wireless FirstNet offering. Its wireless subscriber base held fairly steady last quarter, though “accrued disconnects” built up as AT&T was part of the Federal Communication Commission’s (‘FCC’) Keep Americans Connected Pledge. That program involved AT&T keeping subscribers connected through June 30, 2020, during the first part of the pandemic even if those subscribers stopped paying, among other initiatives. Looking at AT&T’s prepaid wireless service, Cricket Wireless, management noted that this offering added 135,000 net subscribers last quarter. At its postpaid wireless service, AT&T would have added 190,000 net subscribers last quarter when excluding the 340,000 subscribers that were counted as disconnects. Please note that this (the 340,000 subscribers) figure includes those that were still on AT&T’s service though had stopped paying (due to the FCC pledge). Subscriber churn was down at both wireless operations which we appreciate (record-low at its prepaid service, down at its postpaid service even when including the disconnect accrual). AT&T’s Communications segment reported that the firm continues to lose premium TV subscribers at its ‘Entertainment’ unit, which were down 886,000 net last quarter (this includes AT&T’s DirecTV business). Strength at AT&T’s ‘Business Wireline’ unit helped offset that weakness as the Business Wireline unit posted margin expansion and a stable revenue profile (especially when factoring out a recent divestment). Cost management initiatives at this unit have started to yield real results, which we appreciate.

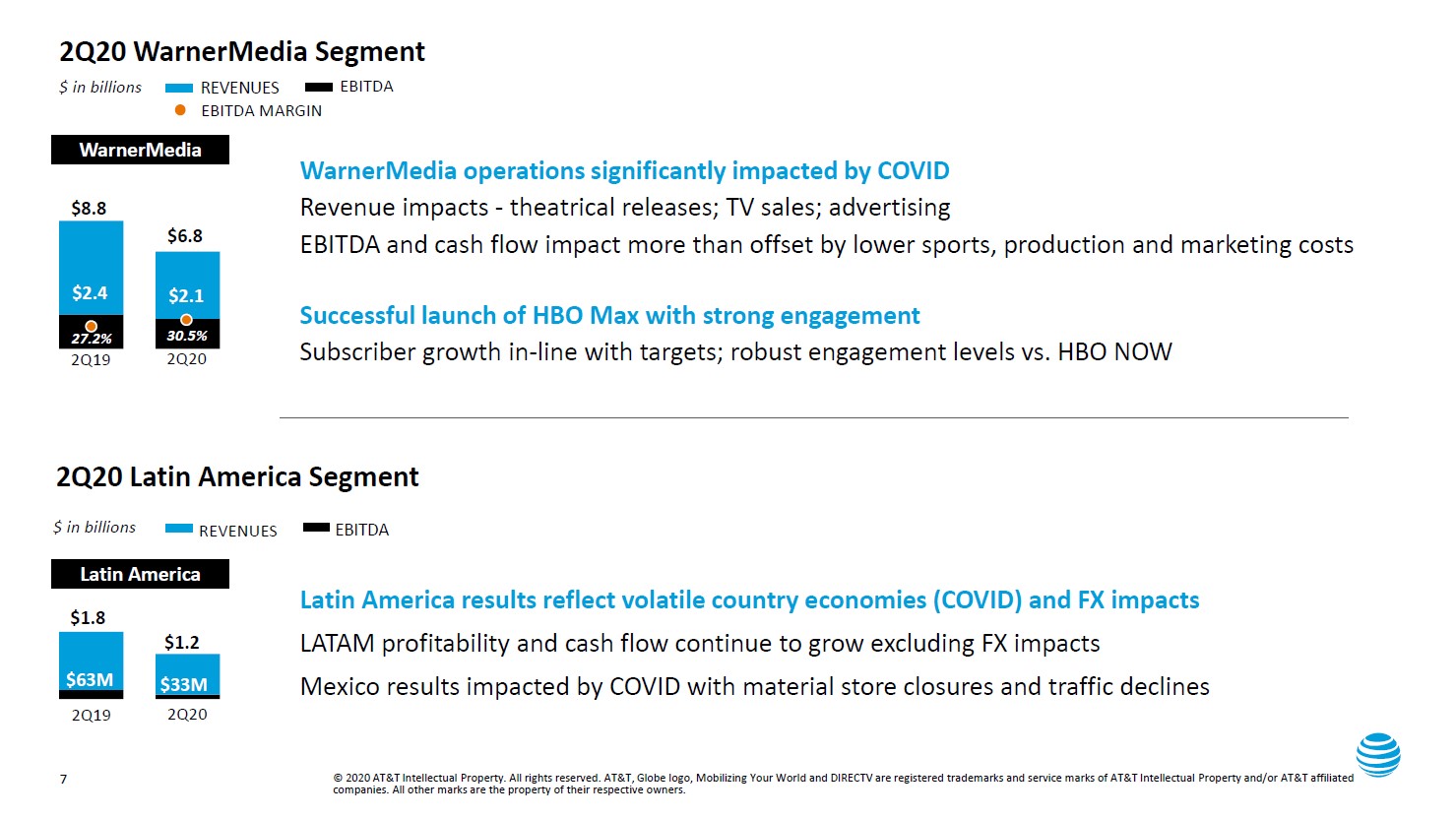

Image Shown: An overview of how AT&T’s Communication segment performed last quarter. Image Source: AT&T – Second Quarter of 2020 IR Earnings Presentation For reference, please note FirstNet is billed as a national wireless communications platform built from the ground up for public safety needs. AT&T built the network with First Responder Network Authority through a public-private partnership. As of December 2019, FirstNet had over one million connections, and management noted the build out of FirstNet was going better than expected during AT&T’s latest earnings call: “The FirstNet build continues to run ahead of plan. We expect additional network benefits as our 5G build is expected to reach nationwide coverage today. The network and the entire FirstNet team has done a great job in building out our 5G network.” Pivoting now to AT&T’s ‘WarnerMedia’ and ‘Latin America’ business segments, those segments both reported a sharp drop in their revenues last quarter due to the pandemic versus the same period a year-ago. For WarnerMedia, the delay of theatrical releases and a sharp drop in advertising were cited as reasons for declining sales. However, the segment’s EBITDA margin grew due to a sharp declining its operating expenses. Regarding AT&T’s Latin American businesses, a decline in foot traffic and foreign currency headwinds were cited as major hurdles. In the upcoming graphic down below, AT&T highlights how its WarnerMedia and Latin American business segments performed during the second quarter of 2020.

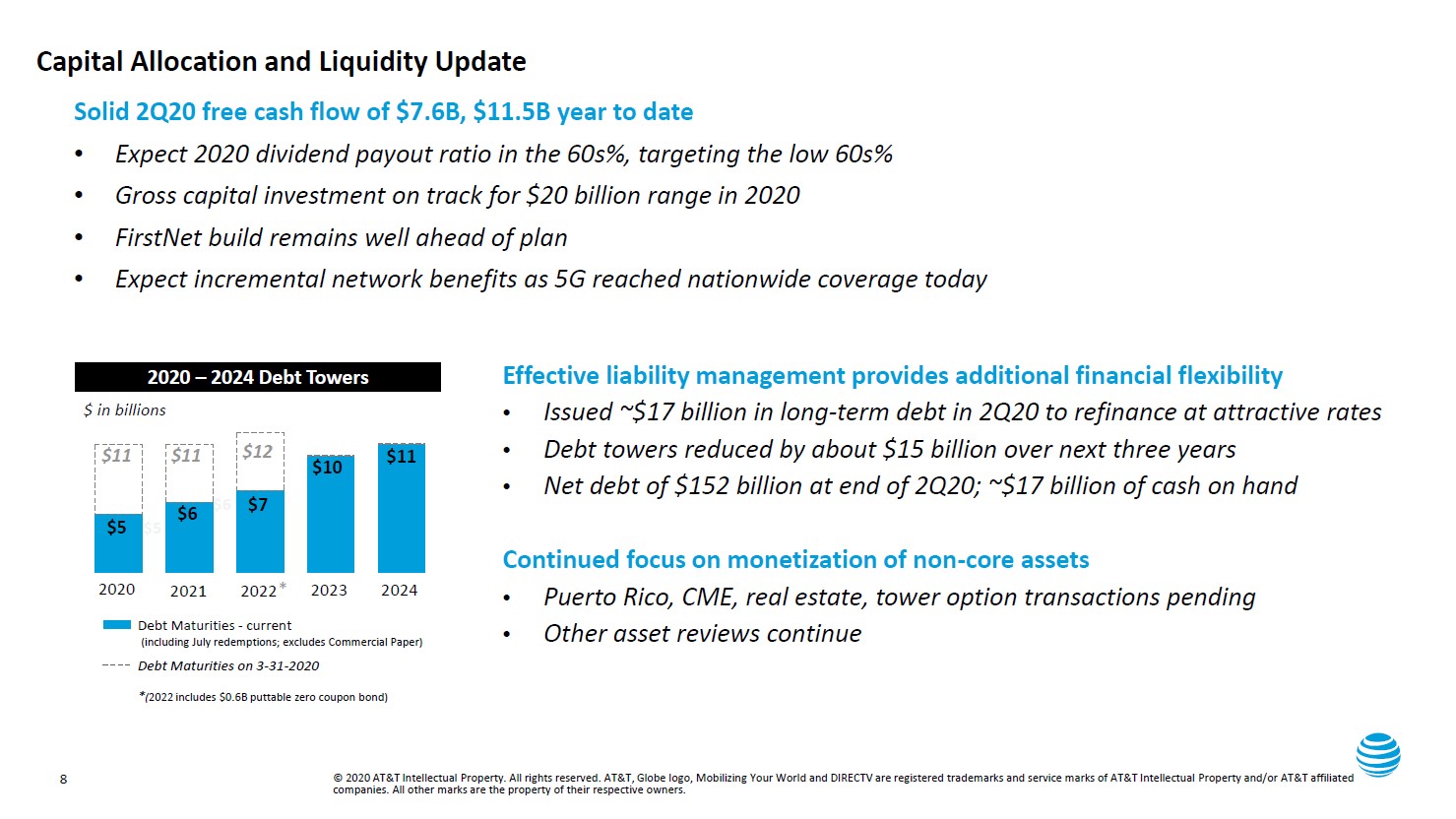

Image Shown: An overview of how AT&T’s WarnerMedia and Latin America segments performed last quarter. Image Source: AT&T – Second Quarter of 2020 IR Earnings Presentation Going forward, WarnerMedia should benefit from the launch of HBO Max in late-May 2020. Initially, AT&T is pricing the video streaming service at $14.99 per month, the same price as its HBO NOW offering. Additionally, HBO Max is being offered for free to many of HBO’s current customers. In the future, AT&T will likely increase the monthly subscription price of HBO Max as it is making billions of dollars in investments in original content for the new streaming service, on top of the additional content HBO Max comes with that HBO Now does not. Management noted that there were potential synergies here as it relates to AT&T’s wireless business and HBO Max, such as offering a free HBO Max subscription to those with an AT&T Unlimited Elite wireless plan (according to AT&T’s website). AT&T noted that HBO Max helped the firm’s internet broadband business by enhancing its ability to grow its subscriber base. We continue to be very excited in the potential for HBO Max to gain a sizable paying subscriber base. At the end of the second quarter, AT&T notes it had 36.3 million HBO and HBO Max subscribers, up from 34.6 million at the end of last year. Management intends on launching an ad-supported version of HBO Max next year. The reoccurring revenue streams generated by video streaming services allows for quality cash flow profiles. Financial Update At the end of June 2020, AT&T had $16.9 billion in cash and cash equivalents on hand versus $15.6 billion in short-term debt and $154.4 billion in long-term debt. Deleveraging remains the long-term goal given AT&T’s large net debt load, though COVID-19 will make that a trickier task in 2020. AT&T’s net debt load grew by ~$1.0 billion from the end of 2019 to the end of June 2020, hitting $152.0 billion at the end of last quarter. The company continued to be a free cash flow cow during the first half of 2020, generating $11.5 billion in free cash flow that fully covered $7.5 billion in dividend obligations, though $5.5 billion in share repurchases during this period were covered in part by its balance sheet. Please note AT&T announced it was suspending its share repurchase program back in March 2020. Management expects AT&T’s dividend payout ratio, defined as its dividend obligations divided by its free cash flows, will be in the low 60s% range this year. During AT&T’s latest quarterly conference call, the company noted that it would consider how to proceed with its capital allocation strategy during an upcoming corporate strategy meeting in September. Management made sure to communicate to investors that it is too early to tell when the company would restart its share buyback program. The company expects to invest ~$20.0 billion in gross capital expenditures this year as it builds out its 5G network in the US. On the plus side, AT&T continues to get paid in a timely manner as its account receivables balance (net of related allowances for credit losses) dropped from $22.6 billion at the end of 2019 to $19.1 billion at the end of June 2020. Its allowance for credit losses grew by $0.4 billion during this period, hitting $1.6 billion at the end of June, which seems reasonable given the economic backdrop. We appreciate that AT&T has been able to continue collecting what it is owed during the pandemic (from most of its customer base), highlighting the resilience of its business model. AT&T retains quality access to credit markets and has tapped debt markets in the recent past to restructure its debt maturity schedule. In the upcoming graphic down below, management provides an overview of AT&T’s recent refinancing efforts. The company is contemplating additional non-core asset divestments to help it pare down its large net debt load, though such activities will have to contend with general uncertainty created by the pandemic.

Image Shown: AT&T’s debt maturity schedule over the next several years is manageable, in our view, after taking recent refinancing efforts into account. Image Source: AT&T – Second Quarter of 2020 IR Earnings Presentation Here are a few choice comments from management that were given out during AT&T’s latest earnings call (emphasis added): “We launched Max with six new originals. All were found in the top 25 viewed series on the platform. By August, we’ll have 21 new original series on Max which we expect to sustain our near term acquisition efforts. Like everyone else in the industry, we’re working on ways to resume production and we hope to see that engine start to fire back up next month… One month after launch, HBO Max had about 3 million retail subscribers and 4.1 million subscribers had activated their Max accounts. Of those, more than 1 million were wholesale subscribers through AT&T. As you might expect, we’re seeing more rapid activation with subscribers who are active users of HBO digital offers, but we still have work to do to educate and motivate the exclusively linear subscriber base and we’ll continue to work with our wholesale partners to drive these activation rates. We’re also bundling HBO Max with some of our premium wireless and fiber plans. We’re seeing a positive pull-through that’s at or better than the wireless unlimited plan step-up assumptions we shared with you in October. You will recall this coupled with the 5G handset upgrade cycle is one of the key drivers to growing wireless service revenues in the latter half of the year. Management stressed that AT&T remains committed to working together with companies like Amazon Inc (AMZN) that have yet to sign a deal covering the distribution of the HBO Max video streaming service. AT&T stated during the earnings call that it has “tried repeatedly to make HBO Max available to all customers using Amazon Fire devices, including those customers that have purchased HBO via Amazon. Unfortunately, Amazon has taken an approach of treating HBO Max and its customers differently than how they’ve chosen to treat other services and their customers” and so far, no deal between AT&T and Amazon covering HBO Max has been signed. AT&T has a deal covering the distribution of HBO Max with firms like Apple Inc (AAPL) and Alphabet Inc (GOOG) (GOOGL), among many others. Should AT&T and Amazon reach a deal, that would significantly improve the subscription growth outlook for HBO Max. Concluding Thoughts Given the company’s strong cash flow profile, we have confidence that AT&T should be able to keep making good on its dividend obligations going forward, though we caution that the pandemic has weighed negatively on its near-term outlook given its hefty net debt load. We would like the company to stick with its deleveraging efforts, which management aims to achieve in part through non-core asset sales. Back in October 2019, AT&T announced it was selling its Puerto Rican and US Virgin Islands wireless business for just under $2.0 billion in cash. AT&T also announced it had $2.0 billion in pending sales covering other assets including real estate and towers in the works. Additionally, management aims to generate meaningful cost savings and other operational synergies in the coming years which will enhance AT&T’s outlook given the potential for meaningful cost structure improvements (which could generate ~$6.0 billion in savings over the next three years). Please note that we recently trimmed AT&T's weighting in the High Yield Dividend Newsletter portfolio, which we announced via email (link here), due to the headwinds created by COVID-19. The company needs to retain access to capital markets at attractive rates to refinance its debt obligations going forward, which has been the case so far during the pandemic. ----- Computer Hardware Industry – AAPL BB HPQ IBM TDC Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM Internet Content & Services Industry – GOOG GOOGL BIDU FB JD TCEHY TWTR Internet Content and Catalog Retail Industry – BABA AMZN BKNG EBAY EXPE GRPN IAC OSTK QRTEA STMP Telecom Services – BCE CTL EQIX FTR S T TMUS VZ VOD Media Entertainment Industry – CNK DIS IMAX ISCA LYV MSG NFLX NWSA SIRI Media (CATV) Industry – AMCX CMCSA DISCA DISH VIAC Related: IEME, PBS, XLC ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Microsoft Corporation (MSFT), and Oracle Corporation (ORCL) are all included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Apple Inc, Facebook Inc (FB), Microsoft Corporation, and The Walt Disney Company (DIS) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. AT&T Inc (T) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Both the simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios include a SPDR S&P 500 ETF Trust (SPY) put option holding with a $295 per share strike price that expire on August 21, 2020. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment