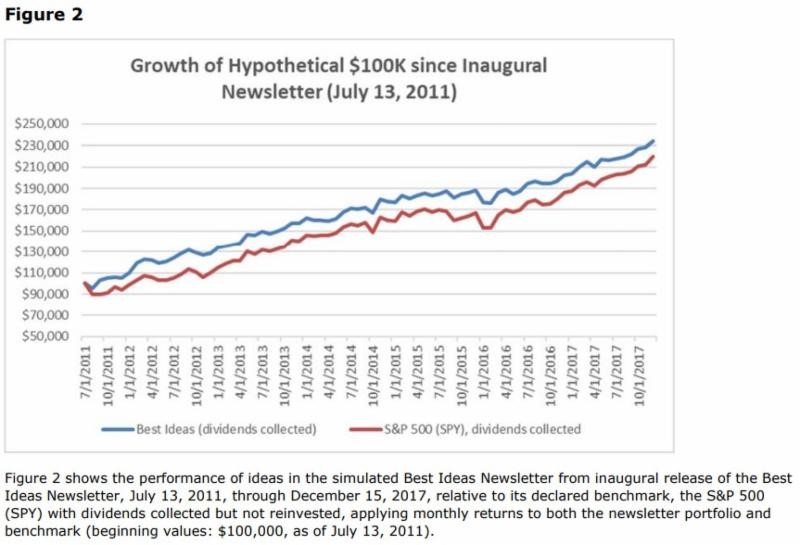

Image shown: The performance of Valuentum’s simulated Best Ideas Newsletter since the inaugural edition of the newsletter, July 13, 2011. We migrated to a weighting range format for the Best Ideas Newsletter portfolio ideas beginning in 2018. At that time, Visa (V) was the top weighting by far at 8.6%. Shares of Visa have soared since, and other ideas haven’t been too shabby either! Source.

Valuentum’s Best Ideas Newsletter portfolio is in a class by itself. Did you know that ~90% of active fund managers are underperforming their benchmarks over prolonged periods of time? The lack of volatility of the simulated Best Ideas Newsletter portfolio had been driven by its massive average cash “weighting” of 25% during its history, something we moved to 0% at almost the precise near-term bottom December 26, 2018.

This article was sent to members via email March 17.

By Brian Nelson, CFA

I wanted to share an excerpt of what I think to be among the most troubling trends in investing today — the backtest! From my perspective, backtests can often be extremely misleading. Here’s what I wrote in Value Trap: Theory of Universal Valuation:

Today, according to a study by the Index Industry Association, there are now more than 70 times as many stock indexes as there are stocks, and many of these stock indexes have been created by somewhat suspect methods and backtests. Hypothetically speaking, an index can be created with the best performing stocks in history, showcasing significant outperformance relative to any benchmark or peer group, but what does pre-selected past performance imply with respect to the future performance of the index? Not much, if you ask me. “There’s never a backtest a researcher didn’t like,” some industry veterans might say. Unlike walk-forward studies, where a methodology is tested in real-world conditions (not just in other historical out-of-sample data sets), some indexes today seem to be backfilled from scratch. When these stock indexes are converted to products such as ETFs and go live, future actual performance may be far different than the substance of the in-sample backtest used to originally support the product.

The proliferation of backtests in attracting investment capital makes it extremely challenging for independent newsletter publishers like us. I want you to know this. For example, our Best Ideas Newsletter portfolio is a walk-forward study on the basis of simulated trading over the past many years. That is vastly different than a backtest that practically identifies the “best-performing stocks” and solves for the most optimal combination, all in the past. This is happening out there, and I don’t like it one bit. Quite simply, there’s no way that Valuentum can compete with an optimized backtest. The backtester already knows what has happened and can best-fit the model any way that he or she would like to drive outperformance. This is very troubling to me.

No matter how we measured the Best Ideas Newsletter portfolio though, whether it was based on new ideas originating from Seeking Alpha when we started publishing there, or when we published our first newsletter July 2011, with or without reinvested dividends, the newsletter portfolio outperformed its benchmark, the S&P 500 (SPY). Not only this but when we migrated to providing weighting ranges for ideas at the end of 2017 to augment the membership offerings (and lessen the burden of these monthly calculations on our staff), Visa (V) was listed as an 8.6% “weighting,” significantly higher than any other newsletter portfolio constituent! Visa has simply been on fire, outperforming the S&P 500 by ~30 percentage points since then.

But it gets better. We achieved all of this with an average cash “weighting” in the Best Ideas Newsletter of about ~25% throughout the newsletter’s history. So not only did the Best Ideas Newsletter portfolio outperform on this simulated walk-forward basis, but the outsize cash position effectively muted its volatility creating risk-adjusted performance that was even better. Since the latest in-depth measurement update of the Best Ideas Newsletter portfolio on December 15, 2017, we called the near-term market bottom December 26, 2018 (a huge move to generate even more alpha), and we made savvy adds like Chipotle (CMG), while letting big winners run like PayPal (PYPL)–all of this backed up by intrinsic value analysis and every move explained in detail. The newsletter continues to be amazing. Meanwhile, the active money management business, itself, seems to be failing, with ~90% of active managers trailing the S&P 500 over a prolonged period of time, according to a recent S&P study.

I’m not hear to brag or to try to toot our own horn. Most definitely not! I’m sending this email because I want you to stick with us. You know very well that the Best Ideas Newsletter is just one newsletter of two in part of a regular premium membership, and you have access to our fair value estimates (updated four times a year), the Valuentum Buying Index rating, the Dividend Cushion ratio and more. Here’s the deal though: I want you to have access not only to great research and analysis, but also great judgment. The latter is what I think separates us from almost everybody else out there. Please don’t punish us because others are good at backtests or pitching index funds!

Tickerized for ideas in the simulated Best Ideas Newsletter portfolio.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.