Member LoginDividend CushionValue Trap |

Member Question: Reaves Utility Income Fund

publication date: Nov 10, 2019

|

author/source: Brian Nelson, CFA

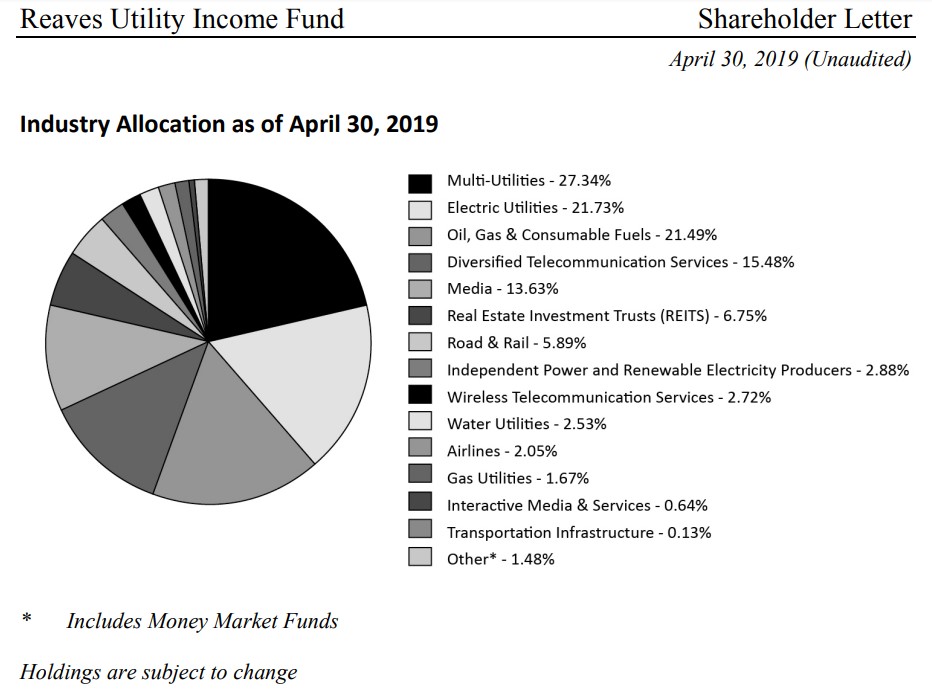

Image Source: Reaves Utility Income Fund, April 30 Question: Have you ever looked at Reaves Utility Income Fund (UTG)? The fund is a utility fund that uses a little bit (20%) of leverage. I have owned them for a long time and have made a good return, but I wonder going forward if I should keep them in my portfolio? Utilities are popular right now, but popularity worries me. Answer: For starters, as is the case for financial publishers such as Valuentum, we can’t provide any personal advice, as we’re not aware of your personal goals and risk tolerances. Please always contact your personal financial advisor regarding any investment decision. With that said, according to Reaves’ website, “the Reaves Utility Income Fund is a closed-end fund. Reaves Asset Management is the Investment Adviser to the Fund. The Fund invests primarily in electric and gas utilities and aims to generate a high level of monthly income for investors.” Here is the stated Investment Objective: The Fund's objective is to provide a high level of after-tax total return consisting primarily of tax-advantaged dividend income and capital appreciation. It intends to invest at least 80% of its total assets in dividend-paying common and preferred stocks and debt instruments of companies within the utility industry. The remaining 20% of its assets may be invested in other securities including stocks, money market instruments and debt instruments, as well as certain derivative instruments in the utility industry or other industries. There are two things that struck us right away in looking at this closed-end fund. First, the closed-end fund increased its leverage facility to 28.8% in October of last year, up from 19.8% previously, so this change is something to be aware of (leverage stood at 26.5% in April 2019). Second, for the fiscal year ended October 2018, interest paid on loans, investment advisory fees, administration fees and other expenses totaled $29.6 million, or about 1.5% of investments, at value, as of the end of October 2018. While 1.5% isn’t too bad of an expense ratio, by our estimates, we’d like to see an expense ratio a bit lower, especially if turnover of this fund is rather low. The top holdings of this closed-end fund, as of September 30, 2019, are Sempre Energy (SRE), DTE Energy (DTE), Verizon Communications (VZ), NextEra Energy (NEE), BCE Inc. (BCE), Union Pacific (UNP), WEC Energy Group (WEC), Charter Communications (CHTR), ONEOK (OKE), and Royal Dutch Shell (RDS.A). Collectively, the top 10 holdings account for ~43% of the portfolio. What a lot of these companies have in common is rather large net debt positions, and many aren’t necessarily attractively priced as many have benefited materially from declining Treasury rates and lower borrowing costs. Though many of the closed-end fund’s top holdings are strong businesses, in the context of the leverage already applied to operate the fund, the Reaves Utility Income Fund becomes one of debt upon debt to eek out a relatively modest net yield. In the fund’s April report, it had outstanding borrowings of $445 million at an interest rate of ~3.5%. This Reeve’s closed-end fund currently pays out about $0.18 per month in dividends ($2.16 per share on a forward annual basis), so that means its gross yield is about 5.9%. After deducting for its expense ratio of ~1.5%, by our estimates, we’re looking at a fairly leveraged closed-end fund on debt-heavy utility equities with a net yield of about 4.5%. There are certainly some interesting attributes of the Reaves Utility Income Fund, including the application of leverage to enhance yield, but most of that yield augmentation is reduced as a result of the expenses of the fund (and of course, the interest paid on the loan to enhance the yield). The closed-end fund offers some diversification across utilities, communications and energy stocks and even, as of April 2019, had exposure to entities such as Delta (DAL), Alphabet (GOOG, GOOGL), Union Pacific, and Annaly Capital (NLY), but we think Valuentum’s High Yield Dividend Newsletter portfolio is much better positioned, and it has a higher yield to boot (without the application of leverage). The Reaves Utility Income Fund has done well in the past (as interest rates have fallen alongside a very strong bull market), but investors are not receiving the full benefit of the leverage that management is applying to already-leveraged entities in the fund. In fact, investors are taking on all the risk. There also doesn’t appear to be too-much of a valuation overlay to the portfolio, which could expose investors to overpriced dividend payers, something that many learned the hard way when venturing into the master limited partnership arena. For those seeking exposure to high-yield dividend considerations with an intrinsic-value-focused overlay, we continue to prefer the High Yield Dividend Newsletter portfolio, which offers a much more diversified basket of high-yield dividend considerations. Subscribe to the High Yield Dividend Newsletter here. ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |