Member LoginDividend CushionValue Trap |

Coherus Biosciences Begins the Process of Bringing a Humira Biosimilar to Market

publication date: May 17, 2017

|

author/source: Alexander J. Poulos

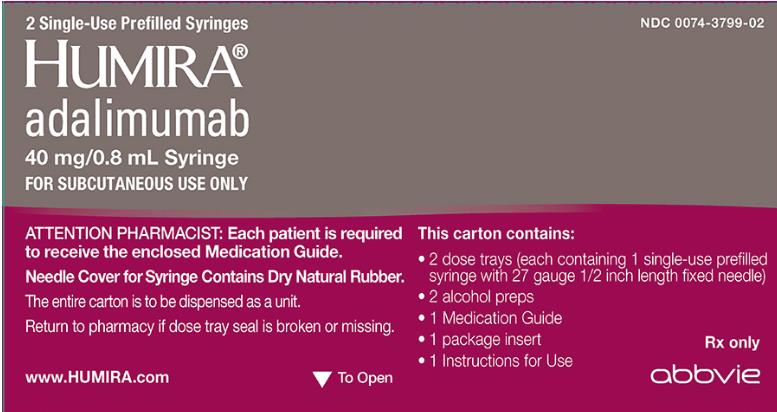

Image Source: Drugs.com The duration and validity of patents that back the intellectual property of drugs in the pharma/biotech industry underpin the group’s revenue stream. Once patent protection is lost, however, revenue from products typically nosedives as multi-source products come to market, undercutting their original price. The patent estate, in essence, bestows monopoly-like pricing power to Big Pharma. Once lost though, it becomes tough to replace. Let’s provide a quick update on the breaking Coherus Biosciences patent win. Alexander J. Poulos Humira Remains the Primary Revenue Driver for Abbvie Shares of Abbvie (ABBV) have come under selling pressure May 17 on the news of a key patent lose to biosimilar upstart Coherus Biosciences (CHRS). AbbVie remains locked in a protracted battle to fend of multiple forays to invalidate the patent estate protecting its crown jewel Humira from a biosimilar challenge. While rigorous patent defenses are the norm in the industry, in light of the enormous revenue generated by Humira, we believe this case may set legal precedent. Humira is a biological product, a key differentiator versus traditional small molecule forms of medication--an example is common household products such as Tylenol. The US has a well-defined system in place where small molecules lose patent exclusivity after a pre-defined period. It is not unusual for a branded product to lose well over 50% of sales three years post a patent expiration. The biological class thus far has remained immune to patent challenges as the US lacked a formal process to approve a biosimilar version of a biological product. With the passing of the Affordable Care Act in 2010, a pathway for a biosimilar emerged as outlined in the Biologics Price Competition and Innovation Act of 2009. In our opinion, the Act will permanently alter the landscape in the biotech/pharma world, opening up an entirely new class of medications to price competition. The biologicals fall under the category of specialized drug spend which continues to advance well above the rate of inflation. With cost containment, the primary focus in healthcare today, the biological class with 80% plus margins is ripe for disruption. In our view, Humira remains the juiciest target for the upstart biosimilar companies such as Coherus. Humira has the enviable crown of the top-selling product in the US with cumulative worldwide sales exceeding $16 billion in 2016. The danger for shareholders of AbbVie is the company’s overreliance on Humira to drive top-line sales (Humira accounted for over 62% of AbbVie’s sales). Though we applaud the management team for attempting to diversify the overall revenue stream, we feel the executive suite will continue to face an uphill battle. Patent Estate AbbVie has invested a considerable sum in building up a patent estate that it believes will hold back a biosimilar challenge for a significant period. We do not share the company’s enthusiasm, however; we feel the estate is very vulnerable since the composition of matter lapsed in December of 2016. These patents and applications, including various patents that expire during the period 2017 to the late 2030s, in aggregate are believed to be of material importance in the operation of AbbVie’s business. However, AbbVie believes that no single patent, license, trademark (or related group of patents, licenses, or trademarks), except for those related to adalimumab (which is sold under the trademark HUMIRA), are material in relation to the company’s business as a whole. The United States composition of matter (that is, compound) patent covering adalimumab expired in December 2016, and the equivalent European Union patent is expected to expire in the majority of European Union countries in October 2018. In the United States, non-composition of matter patents covering adalimumab expire no earlier than 2022. We are not at all surprised with the recent win by Coherus that invalidates AbbVie’s U.S. Patent 8,889,135 (the ‘135 Patent). The patent detailed the use of Humira to treat Rheumatoid Arthritis by injection every 13-15 days. We feel the win underscores the tenuous position Abbvie is now thrust into. We find it fascinating that biotech heavyweight Amgen (AMGN) is embroiled in a legal fight with AbbVie to bring forth Amgen’s version of Humira. The combination of biotech heavyweights plus biosimilar upstarts will more-than-likely eventually overwhelm the defenses AbbVie has put forth. We believe the numerous competitors circling validates our belief that price concessions will be the norm. We do not think pricing will hold and may follow the typical oral dosage forms. We are relatively confident the revenue stream for Humira will continue to grow heading into 2019, but from that point forth, we believe that revenue will decline materially, if not replaced. We feel that, in the European market in particular, Humira will face multiple biosimilar challengers in 2019, which will likely shave a significant amount of revenue from current levels. International sales accounted for over $5 billion of Humira’s overall sales in 2016, for context. Biologic acceptance in Europe is far more advanced than in the US; with the preponderance of national healthcare systems in Europe, we feel aggressive discounting will rule the day. Further complicating matters for Abbvie is a new crop of competitors that come armed with superior head-to-head results versus Humira. We feel Kevzara an interleukin-6 (IL-6) receptor antibody is uniquely positioned to steal market share. The product recently won European approval with FDA approval expected in June. Kevzara is being developed by Regeneron Pharmaceuticals (REGN) and its partner Sanofi (SNY). Thus far, the duo has demonstrated a willingness to price its products to gain share. Regeneron has eschewed the industry dynamics of price hikes well above the rate of inflation to boost sales. We feel a strategy of undercutting Humira’s list price to gain share may be employed, further pressuring Abbvie to make pricing concessions. We initially had high hopes for Baracitinib as detailed in ”How the FDA’s delay impacts Eli Lilly and Incyte,” but the FDA had other plans. Baracitinib is approved in Europe, which will put pressure on Humira sales as the product is an oral dosage form that also has superior head-to-head results. Conclusion The patent win by Coherus underscores the need for product diversity. The overreliance on one product has negative long-term implications once the patent lapses, due to the enormous difficulty in replacing the lost revenue. We feel AbbVie has now been thrust into the unenviable position of having to defend Humira through the legal process at a time when competitors have emerged, armed with superior data ready to steal Humira’s market share. We’ve been expecting some trouble at AbbVie, and we are leaving our fair value estimate unchanged as we reiterate the broad fair value range, underscoring the Humira patent risk. Disclosures: Alexander J. Poulos is long Regeneron Pharmaceuticals and Eli Lilly. Additionally tickerized for the ETFs -- IBB and XLV. |