Member LoginDividend CushionValue Trap |

CVS Health at the Crossroads, Too Much Debt

publication date: Dec 12, 2017

|

author/source: Alexander J. Poulos

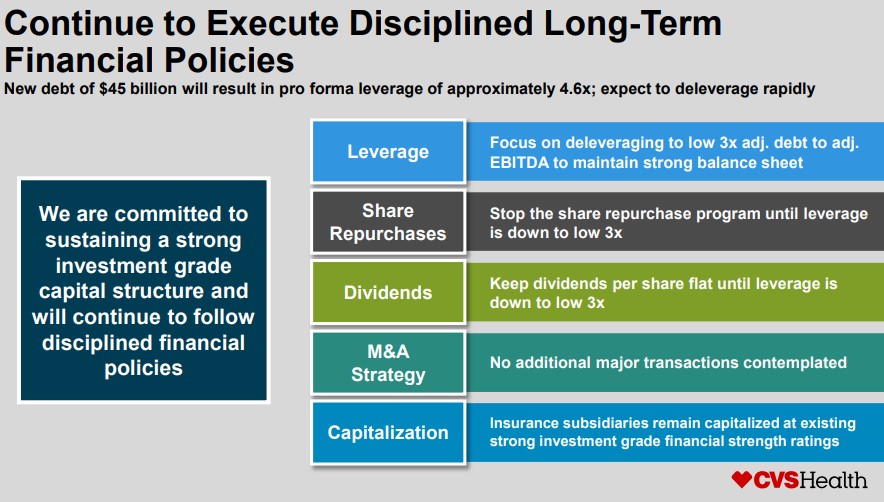

We have been disappointed with the lack progress displayed by CVS Health thus far in 2017. We knew the business was entering into an earnings trough as a result of key contract losses, but recent events have unfolded that, in our view, have lessened the attractiveness of its business model, to a meaningful degree. Let’s talk more about what’s happening at CVS Health, the changing PBM market, Amazon’s threat, and too much leverage. We’re not overreacting, but we’re not happy either. By Alexander J. Poulos “CVS Health hasn’t performed as we would have hoped during 2017, and frankly, it has been hit by a storm of negativity, not the least of which has been caused by the disruptive threat of Amazon. Though we can point to some huge winners in the Dividend Growth Newsletter portfolio this year, brand new ideas like Boeing, for example, it always gets to us when we are blindsided by abruptly-changing business fundamentals. We almost want to scream foul! In business as in life, however, things change, and that’s just how it is. We’re not happy about recent developments at CVS Health, especially its plans to balloon its balance sheet (and the implications on dividend health), but we’re not going to hide our concerns under the rug either. Let’s talk it through.” – Brian Nelson, CFA Background on the PBM Business The pharmacy benefits management (PBM) business remains the crown jewel of CVS Health as the unit continues to post year over year growth. However, in recent months, the PBM business may have entered a critical inflection point with negative implications for the integrated model of CVS and the pure play model of Express Scripts (ESRX). We’re not overreacting, but we think you should be aware of potential structural shifts. The trend of outsourcing prescription benefits management to outside vendors has come under fire with Anthem (ANTM) publicly claiming that Express Scripts has systematically overcharged them over the course of the contract post the acquisition of Anthem’s PBM unit by Express Scripts. We had anticipated Anthem would move its considerable PBM business over to a competitor once the contract lapses in January of 2020, but we’re now surprised Anthem decided to form its own PBM named IngenioRX. Fortunately for CVS, it was “lucky” enough to gain a contract to help manage the PBM upon launch. However, we feel once the contract lapses in 2024, Anthem may convert to a 100% in-house operation, thus further narrowing the field of potential clients that CVS can service. Also, it is important to keep in mind that United Healthcare (UNH), the largest managed care company in the US, showed incredible vision by setting up its own internal PBM dubbed OptumRx, which has directly aided in the stellar profit growth displayed by United Healthcare over the past five years. The size of United coupled with the growth of Optum is a dual edge sword for CVS as it deprives them of a large potential customer base while further narrowing the pool of possible covered lives thus restricted likely new growth of the PBM business. We were initially optimistic that Anthem would migrate its business over to CVS Health, but the move to form IngenioRX, in our view, places considerable doubt as to the ability of the PBM market as a whole to grow—and this is before we account for the disruptive threat that is Amazon (AMZN). In our opinion piece "Opinion: Is Amazon Prepared to Tackle the Pharmacy Market?” we discussed the probability of Amazon entering into the PBM business. With over 300,000 employees and a commanding lead in cloud computing, a credible case can then be made for Amazon to build its own internal PBM. As a result, we feel it may be a bit premature to anticipate Amazon will enter the PBM market outside its internal needs, at least at this time. Quote Attributed to Alexander J. Poulos Let’s review the PBM angle for a moment. Amazon is one of the top ten employers in the US, which in our view, nearly ensures that Amazon will set up an internal PBM in a similar vein as Anthem to service its employee healthcare needs. CVS on a recent conference call signaled it is willing to partner with Amazon. The best case scenario, in our view, is a short-term contract similar to the IngenioRX deal to aid in implementation. However, once the contract lapses, Amazon will retain full control of the division, thus maximizing the savings. It seems the independent PBM business model may be ripe for disruption with the nation’s largest healthcare insurers looking to develop in-house solutions in an effort to rein in costs. It’s growing likely that perhaps a few key defections may pressure profits of PBM’s, especially if, for example, large corporations such as General Electric (GE) and IBM (IBM) decide to accept the in-house PBM’s offered by United Healthcare and Anthem. The comprehensive package that can be provided could prove to be more cost effective, and if so, this could potentially start a negative chain of events for the independent PBMs. Let us be clear, however—we think there will always be a place in the market for a PBM, but with the new evidence presented, the in-house versions are the latest trend that could severely hamper future profitability of Express Scripts and the Caremark division of CVS Health. Drug Distribution CVS’ pharmacy network continues to feel the strain of contract losses coupled with reimbursement pressures. The loss of a few key contracts has had an outsize impact on the company as the pharmacy business remains burdened with high fixed costs, meaning the last few Rx’s filled are the most profitable (it is a case study of a volume based business-->an increase in volume leads to an increase in profitability due to higher incremental margins). Thus far, the pharmacy network has not revealed the strain of being associated with the PBM unit as competitors have not excluded CVS Pharmacy in no small degree from its network of providers. We suspect the likelihood of this dynamic changing is high, especially if Amazon enters the brick-and-mortar pharmacy space. In our opinion piece, “Opinion: Is Amazon Prepared to Tackle the Pharmacy Market?,” we discussed the implications of Amazon entering into the retail pharmacy business. If Amazon were to begin contracting with other corporations to provide PBM services, Express Scripts with its lack of local pharmacies remains highly exposed. The Caremark division would also suffer, even as the pharmacy field evolves toward a point-of-care service in addition to dispensing medications. For Amazon to fully hamper CVS, it would need to build out a cluster of stores, which it has resisted thus far. The Amazon Go supermarket concept, however, could be considered the first shot across the bow, as it is Amazon’s attempt to break into the grocery store market. If Amazon were to proceed with a roll-out of the Amazon GO concept, a credible case could be made the entire Drug Delivery Model could be at risk assuming Amazon equips its supermarket concept with a pharmacy department. Amazon is also now opening brick-and-mortar bookstores, a headache for Barnes & Noble (BKS), but nonetheless, more evidence that Amazon continues to evolve. Quote Attributed to Alexander J. Poulos The fall in Rx volume during CVS Health’s third quarter continues to pressure front-end sales, which posted a drop of 2.8% for the recently completed period. We feel the front end with its traditional assortment of products ranging from hair and oral care to convenience store staples such as beer, soda, and candy may be exposed to the potential for continued declines. The footprint of the traditional CVS store has a tremendous amount of space dedicated to these products, which are often priced at convenience store rates if not on sale. On a recent conference call, CEO Larry J. Merlo attributed some of the decline in front-end sales to a more nuanced pricing strategy. We’re reading this as the company has abandoned utilizing high turnover products such as soda sold at a loss to drive front-end sales. While we agree the focus of the stores should not be on becoming another retailer, it begs the question—is the store's physical footprint way to large for the current evolution of the business? This could become tremendously problematic over the long haul, as we’ve seen across the retail space, especially those of the big box variety. CVS Bringing On Too Much Debt with Aetna Deal Though we understand why CVS Health may want to act quickly in response to changing industry dynamics, we haven’t been pleased with the pending acquisition by CVS Health of Aetna (AET). There are other reasons for the transaction, of course, but we feel the overture is a defensive move enacted from a position of weakness that if consummated will blow a massive hole in the combined entity’s balance sheet. Here’s what we said more recently in our October piece, “CVS Health Under Review…:” We probably were least-of-all pleased with having learned about the acquisitive nature of CVS Health in its bid for Aetna for no small sum, reportedly over $200 per share ($66 billion). Having also talked to Anthem and United Health, CVS Health is clearly on the defensive following Amazon’s foray into the pharmacy space. However, launching a huge acquisition such as one with Aetna, one that might bury the company in debt while its operations could be squeezed on the margin, makes for a rather ominous scenario, at the very least with respect to the long-term health of the dividend. – October 31, 2017 Aetna’s current market cap of ~$60 billion is somewhat in-line with the ~$73 billion dollar market cap of CVS Health (both figures at the time of this writing). For CVS Health to fund the acquisition, it would assume an enormous amount of debt right at the time when the core business is being disrupted. From Aetna’s perspective, the acquisition would catapult the combined entity to be on par with United Healthcare's offerings, as CVS-Aetna would gain a world-class PBM coupled with an extensive pharmacy network which the entity could, in theory, transform into point of care service centers. If we assume the deal comes to fruition, we might advocate for a broad, but costly transformation of the store base, whereas the front end would be shrunk at minimum to half its size with the remaining sales floor converted to a full-service medical clinic with onsight lab testing in addition to a physician on staff to treat the community. Aetna could leverage its extensive customer network by offering incentives via lower co-payments, if members utilize the clinical services available at the newly formulated CVS, which are conveniently located in high traffic areas. There are a few challenges to this theory, the primary one being the expansive footprint that is CVS. We feel a re-imaging of a portion of the store base would be adequate to drive the gains needed for Aetna which leaves the question: what do you do with eh remaining store base? Would it not be more cost effective to partner with Walgreens (WBA) whose footprint is just as vast with a similar set-up while avoiding the debt taken on from such a deal? The overriding question posed by such a transformative transaction is: when can we expect the deal to become accretive to earnings or accretive to value-generation? We feel such a combo would require a long lead time, possibly over two years with a broad assumption of potential synergy targets that may not manifest themselves. The sell-off in shares of CVS post the rumor of such an ambitious deal may unfortunately be the correct knee-jerk response, as the transaction may transform the CVS “story” into one where debt service management becomes more the norm than dividend expansion. Terms of the CVS-Aetna Deal On December 3, CVS Health entered into a definitive agreement to purchase Aetna. The terms of the deal are very favorable to Aetna shareholders, as CVS is willing to pay $145 in cash in addition to 0.8378 shares of CVS Health equity for each outstanding share of Aetna. The significant cash outlay may be necessary to gain Aetna shareholder approval as the equity portion of CVS may feel the impact of the enormous debt load placed on the balance sheet in order to close the deal. CVS is funding the $69 billion transaction via the combination of $4.1 billion in cash on hand, the issuance of an additional $21 billion in equity, and a whopping $44.8 billion in new debt. We are not at all happy with CVS blowing up its balance sheet to make such an audacious purchase. The new debt on the books will balloon the Newco’s debt/EBITDA ratio to 4.6x versus the prior 2.1x debt/EBITDA thus in our view transforming the company from a cash-rich entity to a highly leveraged play on the potential transformation of the US healthcare system.

Image Source: CVS Health Conference Call Slide Deck on December 4 From an income investor’s perspective, the deal could likely be considered a disaster as the debt load may severely curtail the capital returns offered to shareholders. The abundant free cash flow that we were initially attracted to may face pressure, too, as CVS’ new priority--in addition to radically reshaping the US Healthcare system (a daunting task)—will be to deleverage. One of the main appeals of CVS Health had been the rapidly-growing dividend coupled with a low payout ratio—an excellent combination that bodes well for continued well above the rate of inflation dividend hikes. However, the debt burden that would be placed on the balance sheet, if the proposed deal would come to fruition, has effectively torpedoed one of CVS Health's main draws. David Denton, the CFO of CVS Health, mentioned on the conference call his expectation of lowering leverage into the mid-three range by year two which we interpret to mean limited dividend hikes or share repurchases (or none at all) for roughly three years as CVS Health attempts to work off the debt. We’re not happy at all. Synergies of the Transaction One of the most overused (dare we say abused term on modern finance) “synergies” was trotted out at on the conference call. Unfortunately, we also weren’t very happy with the seeming lack of meaningful potential synergies as the proposed $750 million in “synergies,” if achieved, would kick in year two after the approval of the deal. We are looking at a mid-2020 event assuming the deal closes in mid-2018 as projected. Denton further clarified the synergy expectations in the following quote On the $750 million synergies, there's virtually no revenue synergies tied to this. This is mostly cost and a little bit of, I'll say, care management synergies as we think about getting -- or helping consumers get the lowest-cost site of care for the most part. So I wouldn't think about this as revenue synergies at this moment. I do think longer term, there are opportunities to grow revenues as we think about the enterprise and all the capabilities that we'll have here. As it relates to the permanent financing and the cost of that debt, it will depend a bit about the tenor in which we place our portfolio. But you would think about it probably in the 4% ZIP code is our current thinking. That could wiggle a bit based on the amount of short- versus long-term debt that we ultimately place at the end of the day. Quote Source: CVS Health We weren’t impressed with this explanation, as we feel CVS has to work to fend off a potential Amazon challenge, and bulking up to try to defend its turf as Amazon may make the most sense (not cutting back). We get the distinct impression that CVS fears the lucrative PBM business may get much smaller as the two largest managed care organizations (MCO) in United Healthcare and Anthem are now insourcing the PBM business with others looking to emulate the model. We continue to believe the Amazon threat is real, but not the primary reason for the merger. In short, CVS is attempting to remain relevant in the PBM space by acquiring an MCO it feels will allow the company to perhaps emulate the United Healthcare model. Integrated Health Care Model

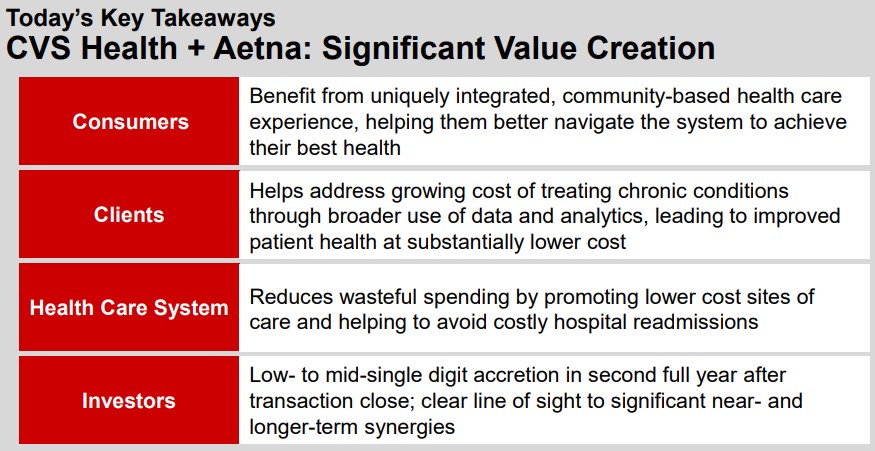

Image Source: CVS Health Conference Call Slide Deck on December 4 Let's examine, in depth, a bit more each of the four potential points of significant value creation. First, CVS is proposing consumers will benefit from an easier-to-navigate health system via this merger. We find the statement as highly speculative as other integrated models have failed miserably. We cite the acquisition of Health Care Partners by Davita (DVA) as the prime example of a recent colossal integrated healthcare system failure. Davita runs an excellent dialysis business, but the adroit management team has met its match via the acquisition of Healthcare Partners. The original goal had been to create a seamless patient experience for Davita’s critically ill patient population. The results for Davita have been somewhat embarrassing as the acquisition remains an unmitigated disaster. Still, Davita shares have sprung to life on a report it is looking to exit the business and focus exclusively on being the dialysis provider of choice. We are highly skeptical the diverse patient population that is covered by Aetna will seamlessly blend into this integrated care model. We were also perplexed by the commentary of lowering the cost of chronic conditions as the data in question is already at the fingertips of both companies. When a claim for a medication is adjudicated to the third party (in this case Aetna), an electronic record is created which is issued to pay for the medication—hence, Rx billing is immediate versus care at the physician's office, which may take weeks before a bill for service is provided. CVS, via its extensive database, already has this information, as does Aetna, via the collection of data each time an Rx is filled. We doubt additional meaningful insights will be gleaned outside of perhaps data from patients that are covered by a competing plan. We are intrigued by the potential for the repositioning of the physical CVS store footprint away from its current format as a pseudo-convenience store into a more healthcare-centric outfit. We can easily envision a shrinking of the sales floor to free up space to construct offices for healthcare workers such as physician assistants, nurse practitioners, a lab in addition to the traditional doctor. We do believe it may help defray some costs, but the goal of reducing hospital admissions, in our view, will remain elusive under the current healthcare rules. Due to lack of readily accessible urgent care centers, many have utilized the emergency room as a primary care center which is easily the most expensive care available. We feel the clinics that may be built in the CVS stores will not be staffed on a 24-hour basis. Thus, it may eliminate some yet far from enough of these non-emergency visits to the emergency room. Conclusion As you can probably gather by now, we are not fans of CVS’ proposed merger of Aetna (even as we say the deal is great for Aetna shareholders looking to cash out). The audacious goal of purchasing Aetna diminishes a significant portion of the once-attractive idea that was CVS Health. The lack of a substantial capital return potential, plus the enormous debt load is taken on by CVS Health, has us looking for the exit. If the merger had not been announced, CVS had the potential to ride the recent wave of good fortune in retail higher, especially given November 2017 comparable store trends at Costco (COST), for example. We’re watching the chart (the technicals) to see if we can find an exit point that still might make CVS a winner. Long term, however, we won’t be sticking around. Tickerized for healthcare/biotech ETFs. |