Member LoginDividend CushionValue Trap |

5 Steps to Understand Why Apple Is Cheap; Shares Continue to Be Unfairly Weighed Down By ‘Palm Pilot’, “Moto Razr” and “Blackberry’ Memories

publication date: Jan 27, 2014

|

author/source: Brian Nelson, CFA

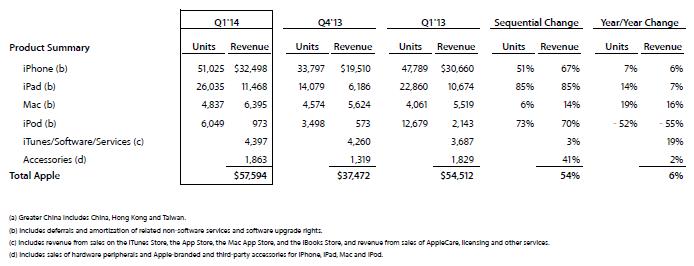

Executive Summary: For Apple to be fairly valued at its after-hours price, normalized earnings per share would have to be assumed to be about $20 per annum, half of Apple’s current annual earnings of $40+ per share. We think normalized earnings at the iPad maker are much higher than what the market is giving it credit for, especially considering the promising ideas in its product pipeline. We’ve raised our fair value estimate of Apple to $680 per share thanks to the time value associated with rolling our model one year forward, offset in part by a slightly lower growth trajectory following fiscal 2014 first quarter results (ending December 28, 2013). We continue to like shares, which are currently trading at just over $500 each (at the time of this writing). Before we dig into Apple’s (AAPL) fiscal first quarter results (ending December 28, 2013), let’s first establish a basis in five steps for how undervalued shares of Apple truly are. You may hear pundits dismissing Apple’s valuation, but the reality is that valuation can never be dismissed. The process at Valuentum, the Valuentum Buying Index, attempts to optimize entry and exit points, but valuation will always be a relevant consideration. Here’s how we know Apple is cheap. 1) Apple has a $141.8 billion net cash hoard ($158.84 billion in cash equivalents less $16.96 billion in long-term debt) at the end of the calendar year, which amounts to $157 per diluted share (Apple ended the year with 901 million shares outstanding on a diluted basis). 2) In after-hours trading, Apple’s market capitalization (its total equity value) is $456 billion or $506 per share. 3) Adjusted for its net cash position, Apple’s equity value (independent of the excess cash on its balance sheet) is $314 billion. 4) Using the assumption that blue-chip, mature equities should trade at roughly 15 times earnings, to justify Apple’s after-hours price, the firm’s long-term annual earnings-per-share stream would have to be at least $20.9 billion (divide its net-cash adjusted market capitalization by 15, or $314 billion divided by 15 = $20.9 billion). 5) Dividing $20.9 billion by the 901 million shares outstanding on a diluted basis approximates $20 in annual earnings per share (rounded down from $23). Our estimates are for Apple to earn more than $40 per share in fiscal 2014. This simple five-step process may bring up a few questions. For one, many investors care about where Apple’s cash is domiciled, but we don’t. Business is global, and Apple will be able to apply cash in areas of need or issue relevant debt to repatriate cash (as in this example). We believe this impact is negligible to our valuation, especially with interest rates where they currently stand. In Apple’s fiscal first-quarter results, released today, the company posted a quarterly profit of $13.1 billion. That quarterly number already amounts to more than half of what the company would need to achieve on an annual normalized basis for the current after-hours price to make any real sense. With mobile payment opportunities, Apple TV, and other wearable ideas in its pipeline, it’s difficult to make the case that Apple's normalized earnings are half of what they currently are today. After rolling our model forward (accounting for the cash Apple generated since the last update), we’ve actually increased our fair value estimate. Shares are underpriced. As for fiscal first-quarter results, we weren't disappointed in Apple’s performance: 51 million iPhone units sold; 26 million units of the iPad sold, 4.8 million Macs sold and 6 million iPods sold. Except for the now-dated iPod, all of these unit sales numbers increased on a year-over-year basis (see image below)!

Image Source: Apple We think the only thing holding Apple’s shares back is a psychological barrier that the following three pictures may create: the Palm Pilot, the Moto Razr, and the Blackberry (BBRY). Each one of the devices shown below was at one time the “next big thing,” but each fell from grace and ultimately faded (or is fading) into obscurity. The Palm Pilot

Image Source: Wikipedia Moto Razr

Image Source: Wikipedia The Original Blackberry

Image Source: Crackberry This simple psychological barrier and perception of an ‘inevitable’ product cycle is what many believe Apple, as a company (not just one of its products), will eventually succumb to. We don’t think this is an appropriate way to think about the tech giant. The difference between Apple and the examples above rests on the idea that Apple currently has four lines of innovation—the iPhone, the iPad, the Mac, and the iPod—and an "ecosystem," not just one area of technological dominance. Further, any successful foray by Apple into other areas—mobile payments, TV, or wearable devices (watches)—would diversify the tech giant even more. Valuentum’s Take We don’t think a ‘psychological barrier’ or ‘product cycle discount’ is warranted. Apple’s mid-cycle, normalized earnings are far greater than $20 per share, in our view, implying significant upside to its market price. We’re not sure how long it will take for the market to recognize the uniqueness of Apple’s fundamentals, but we’re confident the market will. The company will eventually put up a long-term track record that the market will be unable to deny, and this will warrant a reset of its valuation. We continue to hold the iPad maker in both the Best Ideas portfolio and Dividend Growth portfolio and maintain our view that Apple’s shares are cheap. Our updated fair value estimate is $680 per share. Correction: This article originally noted normalized earnings at $19.9 billion. The calculation has subsequently been corrected to $20.9 billion. |