By Brian Nelson, CFA

Dividend growth may never go out of style. For one, there are tremendous compounding benefits to investing in dividend growers over the long haul, “3 Substantial Benefits of Dividend Growth Investing.” A focus on traditional cash-based sources of intrinsic value and dividend health is therefore essential to avoid tragic dividend cuts in your portfolio (see our walk-through of the cash-based sources of intrinsic value and how to find them in our article/video about Apple here).

Three dividend growers that we do not include in the Dividend Growth Newsletter portfolio but that have recently-reported calendar first-quarter 2021 earnings and may be worth considering in a diversified equity portfolio are Kellogg (K), Colgate-Palmolive (CL) and Clorox (CLX). These three entities are household names and have long dividend growth track records. Though each has a net debt position, all three generate sufficient traditional free cash flow coverage of the payout to keep the dividend growing.

Kellogg’s Net Debt Is Large But Free Cash Flow Is Strong

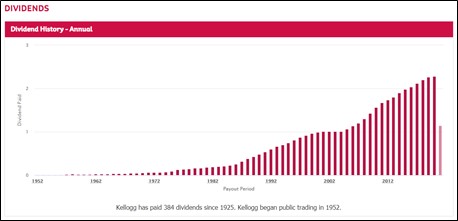

Image: Kellogg has raised its dividend payout each year since 2005. Image Source: Kellogg.

On April 30, Kellogg announced that it had declared a quarterly dividend of $0.58 per share, marking a 2% increase in the payout and the 386th dividend the company has paid to shareholders since 1925. Kellogg has grown its dividend each year since 2005, and it’s hard not to like the business model resiliency of this consumer staples powerhouse that sells under the brands of Pringles, Cheez-It, Special K, Frosted Flakes, Pop-Tarts, Rice-Krispies, and the list goes on and on.

Kellogg’s Dividend Cushion ratio is weighed down by its large net debt position (~$7.3 billion), relative to forecasted free cash flow. This relationship helps explain why its dividend ratings aren’t as strong as other companies in our coverage. However, we expect Kellogg to keep growing its dividend, albeit modestly, based on its traditional free cash flow coverage of the payout. For example, during the past three fiscal years, Kellogg has generated average annual free cash flow of ~$1 billion, while annual cash dividends paid have averaged ~$750-$800 million over the same time period.

The company also noted that it generated better-than-expected free cash flow in the first quarter of 2021 when it reported results May 6. We don’t expect big yearly dividend increases at Kellogg, which is why we don’t include it in the Dividend Growth Newsletter portfolio, but it’s hard not to like the company. Shares of Kellogg yield ~3.7% at the time of this writing, which could offer a decent risk-reward consideration for investors not too worried about its bloated net debt position.

Colgate-Palmolive Has Paid Uninterrupted Dividends Since 1895

On March 11, Colgate-Palmolive increased its quarterly cash dividend to $0.45 per share, marking a 2.3% increase versus the prior payout. Impressively, Colgate-Palmolive has been returning cash to shareholders in the form of a dividend payout since Grover Cleveland was President of the United States in 1895. Colgate-Palmolive has also raised its dividend each year for the past 55+ years. Now that is one mighty impressive track record!

Colgate’s fundamentals are supportedby its “dominant position in the oral care business, led by products sold under its namesake Colgate brand. Colgate is also a big player in the personal care market though its Palmolive, Softsoap, Speed Stick, and Sanex brands. Increasingly, Colgate is becoming a bigger player in the pet nutrition space through its Hill’s brand. The company’s growth trajectory is also underpinned by a growing global middle class, which is expected to increase significantly in size in coming years.”

Unlike Kellogg, Colgate-Palmolive’s net debt position isn’t as large relative to our expectations of its future free cash flow generation, providing greater support to the dividend payout and a healthier Dividend Cushion ratio. Where Kellogg’s dividend payout as a percentage of traditional free cash flow has been ~75%, Colgate-Palmolive’s is much better. For example, Colgate-Palmolive has averaged ~$2.9 billion in annual free cash flow generation during the past three fiscal years, while its annual cash dividends paid have averaged about ~$1.62 billion.

This reflects an average annual dividend payout of ~55% of traditional free cash flow, offering much more excess cash to grow the dividend, buy back stock, or otherwise invest in other areas than Kellogg. Colgate-Palmolive ended the March quarter with a net debt position of $6.8 billion, which also is smaller than Kellogg’s $7.3 billion tally. Shares of Colgate-Palmolive yield ~2.2% at the time of this writing, and while the yield isn’t as enticing as Kellogg’s, Colgate-Palmolive’s financials are in much better shape on a comparative basis.

Clorox Is a Great Example of Why Fair Value Estimate Ranges Matter

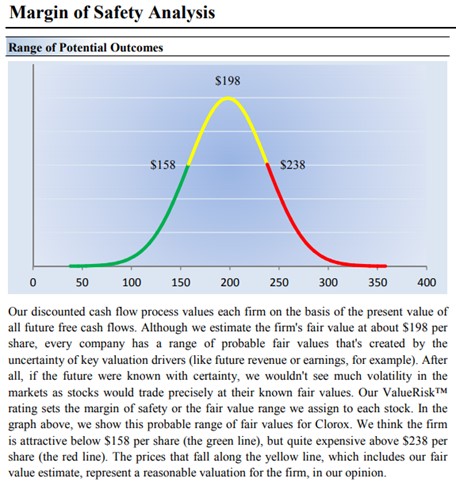

Image Shown: Our fair value estimate range for Clorox. Image Source: Valuentum

Clorox is a Dividend Aristocrat and has raised its dividend each year since 1977. The company’s “portfolio of brands are giants of industry, including its namesake, Pine-Sol, Fresh Step cat litter, Kingsford, Hidden Valley, KC Masterpiece, and the list goes on; ~80% of its sales are generated from brands with a #1 or #2 share position. Clorox estimates that nine out of every ten US homes contain at least one of its products. The company aims to generate annual free cash flows of 11%-13% of its sales, aided by its cost savings program which has yielded meaningful results so far.”

During the height of the coronavirus (“COVID-19”) pandemic, Clorox’s shares were trading at euphoric levels thanks to pantry-stuffing driven demand and hit a 52-week high of $236 per share in July 2020. Our fair value estimate range, as shown in the image above, offers context for what we think would be a fair price to pay for shares, using the sensitivity of future fundamental forecasts within our discounted cash-flow valuation models as guidance. Through most of 2020, we thought Clorox’s shares were pricey, and they now have fallen to a more reasonable price of ~$185. Our current fair value estimate stands at ~$198.

As with Kellogg and Colgate-Palmolive, Clorox has a net debt position, but more similar to Colgate-Palmolive, its net debt position is more manageable than Kellogg’s relative to future expected free cash flow generation. At the end of fiscal 2020, Clorox held a net debt position of ~$1.9 billion, as it averaged traditional free cash flow generation of ~$950 million during the past three fiscal years, a measure heavily influenced by its robust ~$1.29 billion in free cash flow generation in fiscal 2020 (ending June 30, 2020).

Over the same three fiscal years, cash dividends paid averaged just ~$490 million. This relationship means that Clorox’s dividend payout as a percentage of its traditional free cash flow generation was in the low 50% range during the past three fiscal years, just a bit better than Colgate-Palmolive’s but much better than Kellogg’s. During fiscal 2020, however, Clorox’s dividend payout as a percentage of free cash flow was an impressive ~34%–or said another way, traditional free cash flow covered cash dividends paid 2.9x in fiscal 2020.

Clorox’s more manageable net debt position and our forecasts for strong free cash flow relative to expected cash dividends paid to continue is why, in part, the company has a better Dividend Cushion ratio than that of Colgate-Palmolive and a much better Dividend Cushion ratio than that of Kellogg. Our future expected free cash flow forecasts help inform the fair value estimate range as shown in the image above, while they help rank dividend health as in these examples of Kellogg, Colgate-Palmolive and Clorox. Clorox’s shares yield ~2.4% at the time of this writing.

Concluding Thoughts

Kellogg, Colgate-Palmolive, and Clorox offer investors solid exposure to the consumer staples space, while showcasing impressive track records with respect to dividend growth. Each has a net debt position, but all three generate traditional free cash flow in excess of cash dividends paid, meaning growth in each of their payouts should be expected.

Clorox has the highest Dividend Cushion ratio of 1.6 at this time (Kellogg’s is 0.1, while Colgate-Palmolive’s is 1.4), and as one might expect, Clorox’s dividend growth prospects are the strongest out of this bunch. For example, Clorox raised its annual payout more than 7% during fiscal 2020, while both Kellogg and Colgate-Palmolive have had more modest dividend increases in recent years.

Evaluating the cash-based sources of intrinsic value (see the example of Apple here) helps one derive a fair value estimate range, as in the example of Clorox, while it helps rank dividend health and dividend growth, as shown in this group’s respective Dividend Cushion ratios. All things considered, Kellogg, Colgate-Palmolive, and Clorox could be valuable additions to a diversified dividend growth portfolio. Our Dividend Growth Newsletter portfolio can be found here.

Tickerized for holdings in the XLP.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, and IWM. Brian Nelson’s household owns shares in HON, DIS, HAS. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.