Why VBI Ratings Change; Capturing the Stock Pricing Cycle

publication date: Mar 24, 2015

Valuentum's Brian Nelson explains the myriad factors that can cause Valuentum Buying Index (VBI) rating changes. The VBI is not a step-function system (e.g. 5 to 4) as it considers DCF valuation, relative valuation, and technical/momentum indicators, a three-factor model (not a single-factor model). Mr. Nelson talks about how Valuentum strives to capture the entire stock pricing cycle with each idea, revealing why some stocks in the newsletter portfolios can have lower VBI ratings than non-portfolio constituents. Just over three minutes of takes from Valuentum's four-part investment education seminar.

Subscribe Now to Gain Access!

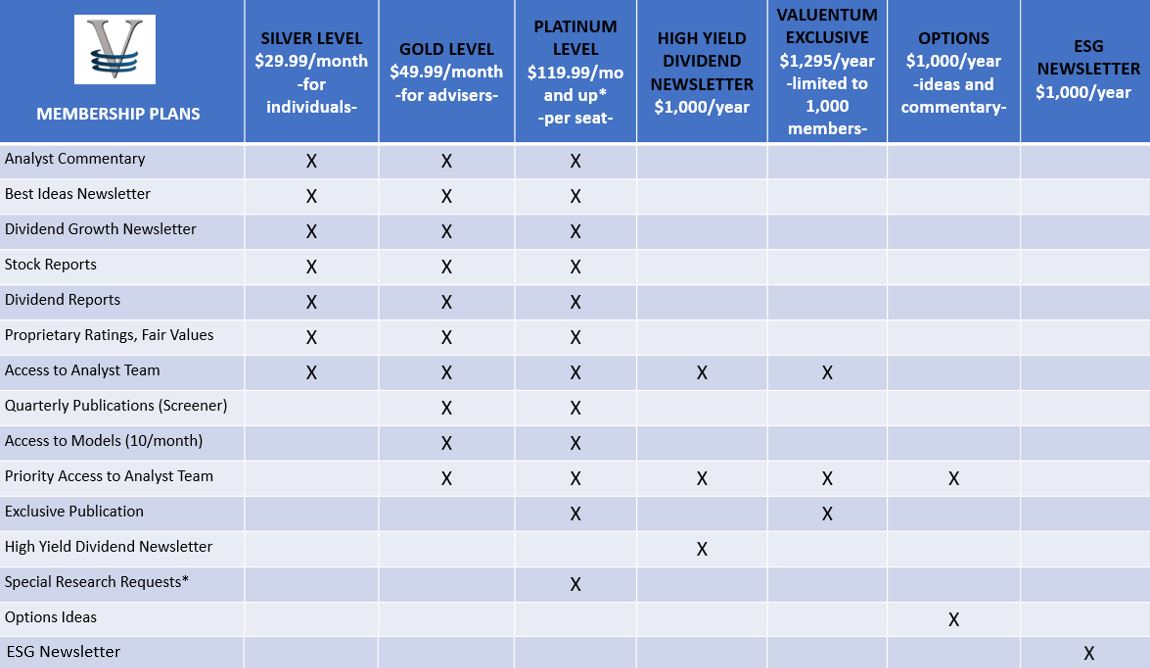

This page is available to subscribers only. To gain access to members only content (including this research piece), click here to subscribe. With a subscription, you'll have access to all of our premium commentary, equity reports, dividend reports and Best Ideas Newsletter and Dividend Growth Newsletter, as well as receive discounts on all of our modeling tools and products. Financial advisers and institutional investors have even more to choose from!

Click to Learn More about Valuentum

If you are already a subscriber, please login.

If you believe you should be able to view this area then please contact us and we will try to rectify this issue as soon as possible.

To gain access to the members only content, click here to subscribe. You will be given immediate access to premium content on the site.