Member LoginDividend CushionValue Trap |

Why Don’t They Get It? Process Is More Important Than the Companies You Select

publication date: Jan 20, 2015

|

author/source: Brian Nelson, CFA

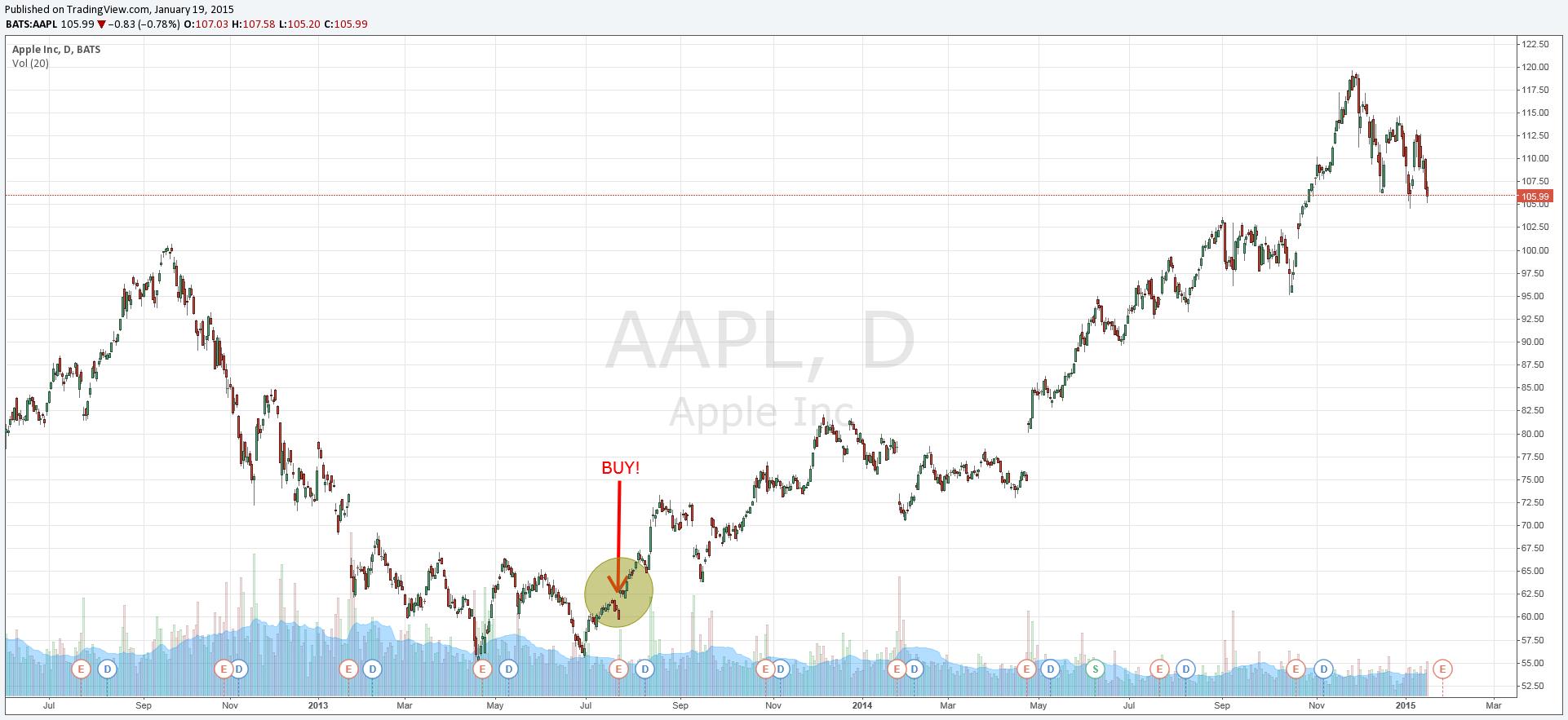

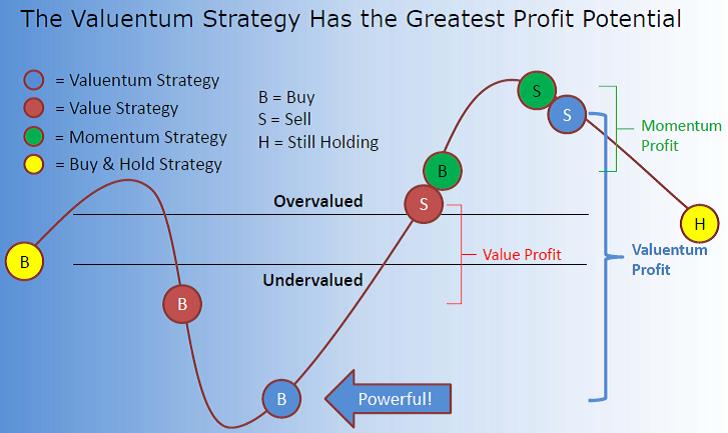

Case Study: Apple (AAPL) July 24, 2013: “We added to our position in Apple. We think the shares are significantly undervalued, and we’re seeing some re-affirming market action following its strong quarterly report… (source).” The chart of Apple and the philosophical illustration below show how using the Valuentum process helped maximize profits in Apple within the newsletter portfolios. While others were still unsure whether Apple would come to reflect its intrinsic value and sat on the sidelines, a powerful technical breakout gave us all the incremental information we needed on this underpriced idea to add more shares to the Best Ideas portfolio. We also opened a new position in the Dividend Growth portfolio at that time. This particular breakout--when a downtrend is broken through--is incredibly powerful. The market, in essence, told us when it was time to buy Apple. Apple has performed wonderfully since then – a homerun, indeed, and textbook execution of the process. The select few firms that make it to the newsletter portfolios also mean that we have a very high batting average – the number of firms added to the newsletter portfolios that are outperforming the market divided by the total number of firms added. Any firm that has been added to the newsletter portfolios is currently in its stock pricing cycle, which is why we may have firms with lower Valuentum Buying Index ratings in the portfolios. It takes time for the “Valuentum” thesis to play out -- just look at Apple below, for example. It has been ~18 months since the 'consider buying' signal. Fabulous and worth waiting for. Stick to the methodology.

|