“Dividends are a transfer of cash to the shareholders that the shareholders owned anyway.” — Brian Nelson, CFA

By Brian Nelson, CFA

Many investors use the strategy of dividend growth investing as a means to generate increasing income in their retirement portfolios to stay ahead of inflation, or as a means to grow an income stream in the decades before retirement. Though we think such a strategy has merit, we think it’s important for readers to understand how a cash dividend payment impacts the valuation (intrinsic worth) of a company.

In this article and for analytical purposes, we use the terms ‘dividend’ and ‘distribution’ interchangeably, even though the tax implications for investors are different. Let’s address the important concept of how dividends impact valuation from a variety of different angles. First, however, let’s examine a cash dividend payment within the context of an enterprise free cash flow valuation model.

This article is for educational purposes so it does not reflect our current opinions of companies used as examples.

How Dividends Impact Valuation (Intrinsic Worth)

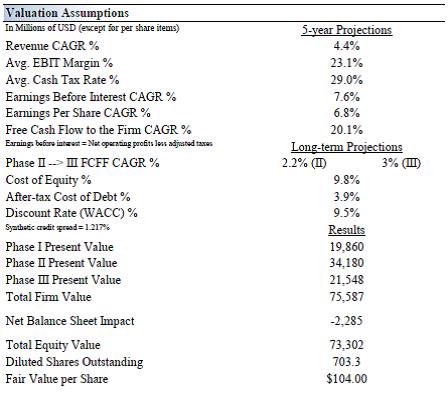

Let’s walk through the valuation adjustments we perform when a company pays a dividend. Let’s use Dividend Aristocrat 3M (MMM) in this example. Below, please find the company’s valuation breakdown, as of its report dated December 25, 2013.

Image Source: Valuentum

There are two items that we’d like you to focus on in this example (image above): 1) The line item ‘Net Balance Sheet Impact’, which is -$2.285 billion (negative $2.285 billion), and 2) the line item ‘Diluted Shares Outstanding,’ which is 703.3 million shares.

Step I: Identifying the Company’s Shares Outstanding and Net Balance Sheet Impact

One of these figures can be found in 3M’s 2012 annual report Form 10-K while the other figure has to be calculated (to download 3M’s 2012 annual report Form 10-K, click here, see pages 47 and 48). The Form 10-K is a large document so it may take some time to show up on your screen. On page 47 of that document, you’ll see the denominator we use in valuation, ‘Diluted Shares Outstanding’: 703.3 (million). It can be found near the bottom of the income statement.

On page 48, you’ll see how we arrive at the ‘Net Balance Sheet Impact’: cash and cash equivalents ($2.883 billion) + marketable securities ($1.648 billion) less long-term debt ($4.916 billion) less short-term borrowings ($1.085) and less two additional items we adjust for: capital lease obligations ($71 million) and the underfundedness of the company’s pension ($744 million) or our estimate of its current funding status (the pension was more than $1.9 billion underfunded at the end of 2012, page 79).

Net Balance Sheet Impact = $2.883 + $1.648 – $4.916 – $1.085 – $0.071 – $0.744 = -$2.285

Step II: Calculating How Much Cash Is Removed from the Balance Sheet Upon the Dividend Payment

On December 17, 2013, 3M significantly increased its quarterly dividend to $0.855 per share from $0.635 previously (see press release here). The same day, 3M issued another press release, “3M Affirms Long-Term Sales and Earnings Growth Objectives, Addresses 2014 Outlook,” where it reaffirmed its long-term sales and earnings growth objectives and issued a 2014 outlook of $7.30-$7.55 per share, bounding the consensus estimate of $7.40 per shars. Assuming that there will be 703.3 million shares outstanding at the time the company goes ex-dividend (2/12/14), the cash transfer from the company to the shareholders when it pays its quarterly dividend would be ~$601.3 million, ~703.3 million x $0.855.

Therefore, the new intrinsic (enterprise) value estimate of 3M, using the balance sheet as the adjustment factor (since dividends are paid from cash on the balance sheet), would be ratcheted down by a total of ~$601.3 million. The ‘Net Balance Sheet Impact’ becomes a larger ‘negative’ and the equity value of 3M would go from $73.3 billion to $72.7 billion, and the new fair value estimate would be $103.145 per share. You’ll notice that the per-share valuation adjustment is precisely the amount that the company pays to shareholders in cash dividends. Perhaps counter to what one might think, and all else equal, a cash dividend payment reduces the intrinsic value of a company, much like your paying a personal “dividend” in the form of, let’s say, a vacation for yourself reduces your net worth.

3M can increase our estimate of its fair value is if it drives better-than-expected earnings and free cash flow (relative to our forecasts in the future), which would increase the discounted value over our three-stage model and bolster total firm (enterprise) value. However, “taking money out of the company” to pay it to its owners (shareholders), as in the case of a cash dividend payment, reduces the intrinsic value estimate of the company, all else equal. Dividends should be viewed as a transfer of cash/wealth to the shareholders that the shareholders owned anyway, as by definition, shareholders already have a claim on the company’s assets. Increasing a dividend is not an economic-value-creating endeavor. It is simply an income or wealth transfer, a movement of funds from one place to another. That said, paying a dividend can be ‘value-preserving’ if the management team would have otherwise destroyed value by overpaying for an acquisition or buying back expensive stock with the cash it instead used to pay the dividend.

Income Transfer versus Value Creation

“The value of a dividend-paying firm is not in the income distributed to shareholders, per se, but in the actions the dividend-paying firm takes to replenish that income stream such that it is sustainable long into the future.” — Brian Nelson, CFA

Let’s imagine for a minute that you gave $1,000 to your co-worker for a piece of paper, and the co-worker said that in exchange he or she would pay you a $1 per year and increase the payment 5% each year into perpetuity until the $1,000 ran out (was completely transferred back to you). At any time during the arrangement, you could give the paper back, and your co-worker would return the remaining money left (less cumulative dividends already paid) to you in full.

Let’s ask two questions. Absent the time value of money (i.e. the discount mechanism that links the value of tomorrow to today), what is the value of this hypothetical relationship to you? And when he or she pays you more and more each year, should you grow more and more excited about the payment?

The answer to the first question is that the relationship to you isn’t really worth anything. You could have your $1,000 in sum back right now by returning the paper or your co-worker would eventually over time provide you with an annual income stream until you finally receive $1,000 in its entirety in the future. Absent the time value of money, these two scenarios are equal.

Raising the payout to you each and every year shouldn’t make you more or less excited in this example.

The only value of such a relationship would occur if your co-worker grows the $1,000 you gave him for your benefit. If instead, for example, the co-worker would replace all payments that are given to you with his or her own personal earnings such that at any time he or she would have $1,000 to give to you in exchange for the paper (even though he or she keeps paying you a growing dividend). That would be fantastic deal!

The value of this relationship to you, instead of being net-neutral ($0) in the scenario where the co-worker did not replace the dividends paid to you, would be a growing perpetuity function: [$1 * (1.05)]/0.05 = $21. Essentially, the co-worker is creating $21 in value for you because he or she is generating earnings for you (replacing the dividends paid to you), assuming a 10% discount rate (for illustrative purposes).

The value of a relationship where one party pays an income stream to another is not in the income stream itself, but in the actions one party takes to replenish that income stream such that it can continue to be paid in the future. Said differently and perhaps in more relevant terms, the value of a dividend-paying firm is not in the income itself, but in the actions the dividend-paying firm takes to replenish that income stream such that it is sustainable.

On the operations of the business that generates free cash flows to replace cash dividends paid, the focus should be–not on the dividend itself.

Now A Real-life Example

Let’s say you bought 1,000 shares of Southern Company (SO), and while its price has changed since we first published this article, let’s assume it still would cost you about $45,100 at today’s prices, excluding commissions. At the time of the publishing of this article, the company paid out $2.10 per share in annual dividends, so each year you would receive about $2,100 plus the growth in the payout.

Assuming the utility grows its dividend at a 2% annual clip, it would take about 20 years for you to receive all of your money back from dividends ($45,100/$2,100). If Southern Company does not generate earnings or free cash flow to replenish the dividends it has paid to you, the firm has simply transferred the money you invested in it back to you over this time period; no value has been created.

The value accruing to you as a shareholder of Southern Company through Year 20 is not in the cash dividends paid to you, but in the earnings and free cash flows generated by the firm to replace the money it has paid out as dividends to you over the years. That value would be reflected in Year 20 in its stock price, which will continue to be based on future expectations of earnings and free cash flows at any time.

Said differently, what Southern Company pays as dividends to you is not a source of value, but a symptom of value. The company in many ways is simply paying the money you’ve “invested” (2) in it back to you. The concept of value creation, instead, is defined by the earnings and free cash flow that replace the income stream that Southern Company provides to you. The transfer or the structuring of income from one party to another can in many cases be best described as a source of convenience, but it is not a source of value to you.

As opposed to only focusing on the dividend itself, investors instead should focus on a company’s capacity to replenish the dividends that it pays to investors via earnings and free cash flow. A dividend will always be a symptom (an output) of strong free cash flow generation, not a driver of it, and therefore, dividend payments are not a driver of the intrinsic value of companies.

(2) In this example, Southern Company does not receive the money you invest in it by your buying shares in the secondary market, but the example illustrates the point conceptually from the income investor’s standpoint.