Member LoginDividend CushionValue Trap |

Financial Analysis 501: Why Value Is Always Based on Future Expectations

publication date: Jul 25, 2014

|

author/source: Brian Nelson, CFA

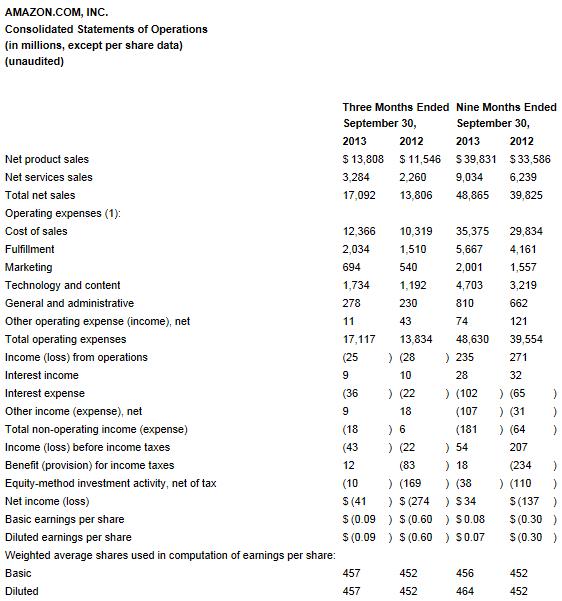

A version of this article appeared on our website October 25, 2013. On October 24, 2013, Amazon (AMZN) reported better-than-expected fiscal third-quarter results. Let’s take a look at the firm’s income statement and cash flow statement to explain why value is always based on future expectations of earnings and free cash flow. The concept of value is not based on a firm’s most recent-quarterly performance or its past performance. Amazon currently sports a market capitalization of $166.3 billion as of the time of this writing. Income Statement << What Is the Income Statement?

Image Source: Amazon For a company that records $17.1 billion in revenue (the third line down called ‘total net sales’), Amazon’s quarterly ‘loss before income taxes’ of $43 million (negative $43 million) is quite unusual. The firm has had more than a decade to effectively and consistently turn the corner with respect to profitability, but generating earnings in the near term is secondary (or maybe even tertiary) to the firm. However, that doesn’t mean the company doesn’t have intrinsic value. The Cash Flow Statement << What Is the Cash Flow Statement?

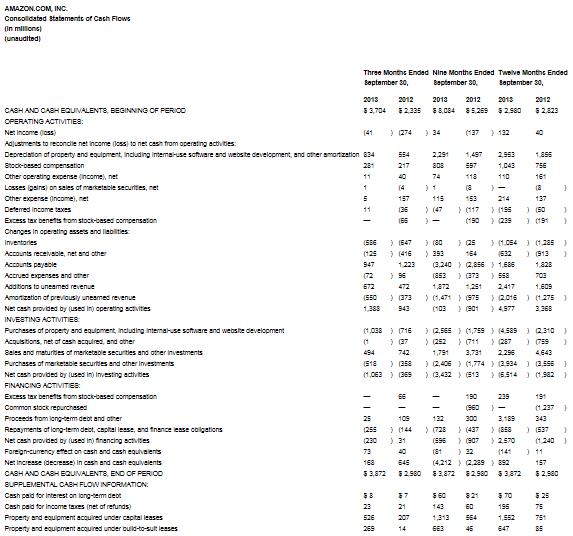

Image Source: Amazon The value that Amazon possesses is its cash-flow generating capacity (not today, but in many years from now). The current metrics aren’t as strong as those of other cash-cows – think software firms or asset light entities – but the firm has generated $4.98 billion in cash flow from operations in the ‘Twelve Months Ended September 30 (second column from the right in image above),’ which compares to $4.59 billion in capital spending, resulting in free cash flow of about $390 million. This free cash flow isn’t a huge number considering Amazon’s size, but it is meaningful given the company’s meager accounting profitability. To help convey the firm’s cash-flow generating potential, let’s look at Amazon's cash-flow generation in previous years (before the expense gushers were turned on).

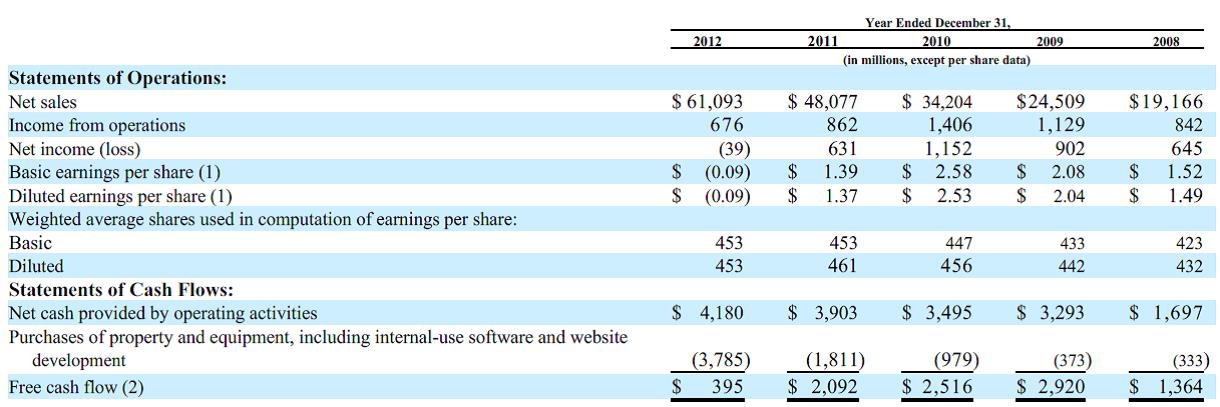

(2) Free cash flow, a non-GAAP financial measure, is defined as net cash provided by operating activities less purchases of property and equipment, including capitalized internal-use software and website development, both of which are resented on our consolidated statements of cash flows. Image Source: Amazon

What the image above tells us is that when or if Amazon starts to focus on profitability, its potential free cash flow profile would be tremendous (the bottom line in the image above). We believe this fact of Amazon’s business model is what many market participants have a difficult time acknowledging with respect to the company’s current share price and market capitalization. Amazon is not trading at such lofty levels because the market is crazy (if one compares its valuation to accounting earnings), but instead, the firm's stock is trading at such lofty levels because the market acknowledges its fantastic cash-flow generating profile in the future (once the expense gushers are turned off). This dynamic is a fact of valuation: a fair value estimate of a company is based on future expected free cash flows, not current earnings or even next year’s earnings.

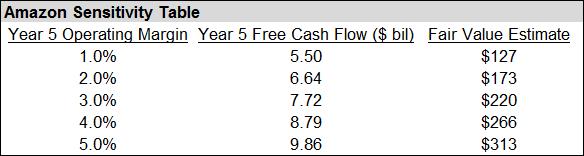

Sensitivity Analysis

Let’s take this one step further and perform a sensitivity analysis on Amazon’s valuation, varying the firm’s expected operating margin in Year 5 of our discounted cash flow model. Said differently, the table below shows what Amazon’s fair value estimate would be for each given operating margin in Year 5 (2017). It should be noted that Amazon’s current operating margin is negligible. The operating margin is one of the biggest drivers behind free cash flow generation (working capital changes and capital outlays are the two others). To put these numbers into real-life perspective, Amazon achieved an operating margin of 4.1% in 2010 ($1,406/$34,204 – in image above) and 4.6% in 2009 ($1,129/$24,509 – in image above).

Image Source: Valuentum

Valuentum’s Take

Sometimes companies with little or even negative accounting earnings can justifiably have hefty valuations. Remember, equity valuations are based on future free cash flows – not on past performance or this year’s or even next year’s accounting earnings.

For us, Amazon doesn’t fit our risk profile to be considered in the portfolio of our Best Ideas Newsletter, but that doesn’t mean its shares don’t have significant intrinsic worth. We’re currently forecasting a mid-cycle (Year 5) operating margin of 4% (just below the levels achieved in 2010 and 2009), which puts our fair value estimate of Amazon at $266 (at the time of this writing), below its current share price. |